sjrider2397

Junior member

- Messages

- 22

- Likes

- 2

I am hopeing to share and toss around some winning strategies for trading the emini russell. I have been trading it for over a year now profitably. I have developed my strategy based on combinig what I felt were good ideas from other traders. It has not been easy to do..but it is definetly worth it.

I hesitate in starting this thread, there are plenty of people hear that seem to bash everything that you say. I hope that does not happen hear.

I hope that others will share there strategies so that we can all learn to be better traders. I know first hand how you get "tunnel vission" while you are trading. I would like to improve my strategy...and possibly help out some new traders along the way.

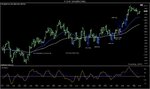

I trade on the 1 minute chart and the 175 volume bar chart...latley I prefer the 1 minute. I have two ema's a 50 and a 21. I prefer to trade the direction they are trending. I use a macd, settings are 4,5,13. I turn the histogram off...I do not use it.

I have a few setups that I look for.

my main setup: I wait for the price to breakout and start trending. I then let it pullback and I enter long on a reversal bar. I go for 2 points (200.00) if you trade with one lot. I set my stop to the bottom of the reversal bar. I then trail my stop under each consecutive bar.

I hesitate in starting this thread, there are plenty of people hear that seem to bash everything that you say. I hope that does not happen hear.

I hope that others will share there strategies so that we can all learn to be better traders. I know first hand how you get "tunnel vission" while you are trading. I would like to improve my strategy...and possibly help out some new traders along the way.

I trade on the 1 minute chart and the 175 volume bar chart...latley I prefer the 1 minute. I have two ema's a 50 and a 21. I prefer to trade the direction they are trending. I use a macd, settings are 4,5,13. I turn the histogram off...I do not use it.

I have a few setups that I look for.

my main setup: I wait for the price to breakout and start trending. I then let it pullback and I enter long on a reversal bar. I go for 2 points (200.00) if you trade with one lot. I set my stop to the bottom of the reversal bar. I then trail my stop under each consecutive bar.