ForexChaser

Newbie

- Messages

- 4

- Likes

- 0

Bank Of Canada Raises To 1%

The Bank of Canada decided to increase the Overnight Rate by another 0.25%, up to 1%. This is the third consecutive interest rate hike that the BoC operates in a time span of a little more than 3 months.

The Bank’s official statement has remained broadly unchanged from July’s rate hike: the global economy is recovering helped by the emerging economies, while the U.S. economy is advancing at a standstill pace. Turning to the Canadian economy, the BoC notes:

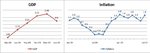

This is quite important, because it suggests that the Bank of Canada might take a pause for the moment. In normal times, central banks raise rates to cool down the economy and to fight inflation. Neither one is the case right here, since Canada’s GDP was only 0.5% in Q2, while the CPI is currently standing at 1.8%, in line with the bank’s target. (click to enlarge)

The only reason way the BoC decided to lift rates so early was to avoid running an ultra-expansionary monetary policy for too long in an economy that has been somehow shielded from the credit crisis. Some of the side effects of having interest rate too low include: liquidity trap (think Japan), creating another bubble due to cheap money (think the U.S. housing bubble), or simply very high levels of inflation. It is expected that other central banks will take similar actions, but more likely, the Fed and the ECB will be among the last ones.

The interest rate announcement had quite a remarkable reaction in the currency market, with the Usd/Cad sliding approximately 100 pips in just a matter of minutes. Among the major currencies, the Canadian dollar posted the biggest intra-day gain against the U.S. dollar, of approximately 1%. Closely following was the Australian dollar, which gained 0.90% in Wednesday’s trade.

The Bank of Canada decided to increase the Overnight Rate by another 0.25%, up to 1%. This is the third consecutive interest rate hike that the BoC operates in a time span of a little more than 3 months.

The Bank’s official statement has remained broadly unchanged from July’s rate hike: the global economy is recovering helped by the emerging economies, while the U.S. economy is advancing at a standstill pace. Turning to the Canadian economy, the BoC notes:

The Bank now expects the economic recovery in Canada to be slightly more gradual than it had projected in its July Monetary Policy Report (MPR), largely reflecting a weaker profile for U.S. activity

This is quite important, because it suggests that the Bank of Canada might take a pause for the moment. In normal times, central banks raise rates to cool down the economy and to fight inflation. Neither one is the case right here, since Canada’s GDP was only 0.5% in Q2, while the CPI is currently standing at 1.8%, in line with the bank’s target. (click to enlarge)

The only reason way the BoC decided to lift rates so early was to avoid running an ultra-expansionary monetary policy for too long in an economy that has been somehow shielded from the credit crisis. Some of the side effects of having interest rate too low include: liquidity trap (think Japan), creating another bubble due to cheap money (think the U.S. housing bubble), or simply very high levels of inflation. It is expected that other central banks will take similar actions, but more likely, the Fed and the ECB will be among the last ones.

The interest rate announcement had quite a remarkable reaction in the currency market, with the Usd/Cad sliding approximately 100 pips in just a matter of minutes. Among the major currencies, the Canadian dollar posted the biggest intra-day gain against the U.S. dollar, of approximately 1%. Closely following was the Australian dollar, which gained 0.90% in Wednesday’s trade.