hamatrader

Newbie

- Messages

- 8

- Likes

- 0

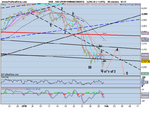

DAX technicals

Hi Everyone

I normally SB trade the DAX. Like many traders I know that I still have much to learn. Apologies if this has already been brought up in the thread before but it would be great to get some opinions from the experienced and the experts here.

Looking at the posts above and having missed the initial sell off for this year starting last week I am now trying to get an entry point for a positional trade on the assumption that we are in a downward trend for a while. The DAX has been down now continuously for quite a few days. I having been looking for an oversold position and thus a pullback so that I could get an entry point. I did think that today was a possibility until bad news from Deutsch Bank, Siemens and others brought the market down further. Darn!

Does anyone here have any ideas on a pullback and hence where a technically good point of reentry would be?

Of course I may be completely wrong in having a bearish outlook on the coming weeks or months and the market may rally higher very soon. However going on earlier posts in this thread - it seems that the DOW and S&P are headed south to at least retest the November lows and possibly then further down toward the 6000s and maybe even ultimately towards the 5000 mark for the DOW later in the year!

Based on this the DAX would be headed towards testing the 4000 mark again. And if the DOW and S&P were headed further lower what are the technical marks below 4000 that the DAX would to be heading towards and testing?

Any views here would be great.

H

Hi Everyone

I normally SB trade the DAX. Like many traders I know that I still have much to learn. Apologies if this has already been brought up in the thread before but it would be great to get some opinions from the experienced and the experts here.

Looking at the posts above and having missed the initial sell off for this year starting last week I am now trying to get an entry point for a positional trade on the assumption that we are in a downward trend for a while. The DAX has been down now continuously for quite a few days. I having been looking for an oversold position and thus a pullback so that I could get an entry point. I did think that today was a possibility until bad news from Deutsch Bank, Siemens and others brought the market down further. Darn!

Does anyone here have any ideas on a pullback and hence where a technically good point of reentry would be?

Of course I may be completely wrong in having a bearish outlook on the coming weeks or months and the market may rally higher very soon. However going on earlier posts in this thread - it seems that the DOW and S&P are headed south to at least retest the November lows and possibly then further down toward the 6000s and maybe even ultimately towards the 5000 mark for the DOW later in the year!

Based on this the DAX would be headed towards testing the 4000 mark again. And if the DOW and S&P were headed further lower what are the technical marks below 4000 that the DAX would to be heading towards and testing?

Any views here would be great.

H