D

Dowser

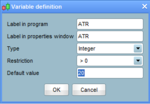

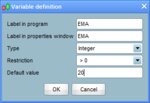

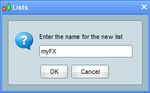

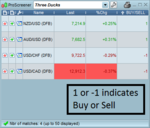

I thought I would start a thread about coding in ProRealTime. I know it's a popular platform, especially in the UK and I wanted to share what I've learnt so far. I should stress that I'm in no way an expert or a professional in this area and that this is aimed at people who have little or no coding experience. First off, I will show how to code an indicator. I was surprised that PRT didn't have a Keltner Channel indicator that is based on exponential averages - so this seems like a good place to start.

Last edited by a moderator: