You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

A

aussietrader

Hi,

I am not exactly sure as to your question. All the cfd operators I know of offer trades in multiple markets. However, if you are asking about who trades in the minnow end of the aussie market I would suggest that no reliable operator would touch it. Liquidity too narrow. If they take your action then you will probably get the pointy end of the pineapple trying to get out ;-)

AT

P.S For you non antipodeans, the pointy end of the pineapple is rather unpleasant - or so I am told ;-). Good Trading

I am not exactly sure as to your question. All the cfd operators I know of offer trades in multiple markets. However, if you are asking about who trades in the minnow end of the aussie market I would suggest that no reliable operator would touch it. Liquidity too narrow. If they take your action then you will probably get the pointy end of the pineapple trying to get out ;-)

AT

P.S For you non antipodeans, the pointy end of the pineapple is rather unpleasant - or so I am told ;-). Good Trading

boy trader

Newbie

- Messages

- 3

- Likes

- 0

man are a joke

ps its not worth any of these providers providing CFDs on illiquid volatile stocks if they cant hedge their exposure to it

ps its not worth any of these providers providing CFDs on illiquid volatile stocks if they cant hedge their exposure to it

I have noticed that a new CFD provider has started in New Zealand.

Tricom tried to enter from Australia but with Oz shares only.

The new one offers a DMA on only the top 10 shares which is all the market could stand.

The problem is they want $189/month just to operate which is stupid. Why would anyone do so.

Note also that DMA prevents the use of guaranteed stops and even standard stops with these illiquid shares are a bit of a hurdle.

I will stay with UK/US and QD in the meantime.even though I have never asked for a guaranteed stop.

Minicfds seem to be fun and as there is no initial hurdle other than the 100 share minimum , they are quite good for learning with.

Tricom tried to enter from Australia but with Oz shares only.

The new one offers a DMA on only the top 10 shares which is all the market could stand.

The problem is they want $189/month just to operate which is stupid. Why would anyone do so.

Note also that DMA prevents the use of guaranteed stops and even standard stops with these illiquid shares are a bit of a hurdle.

I will stay with UK/US and QD in the meantime.even though I have never asked for a guaranteed stop.

Minicfds seem to be fun and as there is no initial hurdle other than the 100 share minimum , they are quite good for learning with.

Hi, I trade Index on CMC in Australia and recently, after about two months of good results I'm finding them harder to trade.

examples: previously there was no minimum to stop levels. now there is about a 1.5 point on on the russ2000. Sure this is a tight stop but sometimes I reverse and it seems like they are ripping me off. I work full tiem and I need sleep. Not being able to place decent stop/reserve strats is really annoying.

and lately i've found the response to cancellation of limit orders and order processing to be VERY slow. IE. i cancel my stop to reposition and it takes a good minute for them to go. It's not my connection speed because i have a 12MB link. ..These have not been hit yet but I can see it happening! time will tell. Also buying and selling at market on the index is slow. it used to be fast. It lucky I don't trade on frames < 30 mins.

Anyway, has anyone had a similar experience with them or is it just me? Maybe they don't like it anymore and are turning the tables. Just like the casino might do! Grrr. any suggestions for a decent index platform?? Do i have to look at esignal etc?

examples: previously there was no minimum to stop levels. now there is about a 1.5 point on on the russ2000. Sure this is a tight stop but sometimes I reverse and it seems like they are ripping me off. I work full tiem and I need sleep. Not being able to place decent stop/reserve strats is really annoying.

and lately i've found the response to cancellation of limit orders and order processing to be VERY slow. IE. i cancel my stop to reposition and it takes a good minute for them to go. It's not my connection speed because i have a 12MB link. ..These have not been hit yet but I can see it happening! time will tell. Also buying and selling at market on the index is slow. it used to be fast. It lucky I don't trade on frames < 30 mins.

Anyway, has anyone had a similar experience with them or is it just me? Maybe they don't like it anymore and are turning the tables. Just like the casino might do! Grrr. any suggestions for a decent index platform?? Do i have to look at esignal etc?

I must add I have been happy with most other parts of their service. Apart from the memory leaks their platform sometimes develops, they seem to fix them though. All of this is just going on last nights trading but it's very hard to put up with. Plus they have stopped decreasing the spreads during the local market times. It only reduces about an hour into the local sessions. 😱

Oh and I only find out about these changes when i trade it. They know I trade certain markets...they send me a daily statement! why do i have to find out for myself?

Oh and their charts are pretty good.

Oh and I only find out about these changes when i trade it. They know I trade certain markets...they send me a daily statement! why do i have to find out for myself?

Oh and their charts are pretty good.

Last edited:

Why are trading CFDs in the first place?

For indices you would be much better off using a direct access broker such as www.interactivebrokers.com

That way the spreads are less, the costs less, the market fair and you can put a stop anywhere you want.

JonnyT

For indices you would be much better off using a direct access broker such as www.interactivebrokers.com

That way the spreads are less, the costs less, the market fair and you can put a stop anywhere you want.

JonnyT

JonnyT said:Why are trading CFDs in the first place?

For indices you would be much better off using a direct access broker such as www.interactivebrokers.com

That way the spreads are less, the costs less, the market fair and you can put a stop anywhere you want.

JonnyT

CMC introduced me to the whole scene and I've since moved to a different FX broker I'll now look to change Indexes.

thank you.

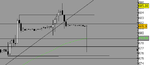

Well I was starting to calm down after my discovery that CMC are no longer interested in tight stops/reverses when I saw this on the Russell2000 in no market hours.

I sent a message to them asking if a long would have been stopped out and they didn't reply. This bothers me because I was long last night and could have been long today... lucky i guess, but I'm thinking I would have been stopped.

I've seen this kind of thing once or twice in the year and not paid much notice because I rarely held o/night but it really makes me wonder what I'm doing with them lately.

While some might say I get what i deserve trading indices with them then as much as i want to change I can't at the moment. Short of selling my much loved car 😢

BEWARE CMC WANABES

I sent a message to them asking if a long would have been stopped out and they didn't reply. This bothers me because I was long last night and could have been long today... lucky i guess, but I'm thinking I would have been stopped.

I've seen this kind of thing once or twice in the year and not paid much notice because I rarely held o/night but it really makes me wonder what I'm doing with them lately.

While some might say I get what i deserve trading indices with them then as much as i want to change I can't at the moment. Short of selling my much loved car 😢

BEWARE CMC WANABES

Attachments

Last edited:

I recently started to trade CFD and found it pretty good because it enables you to trade stock indices, Commodities and metals as well on a single platform. Earlier I had a good experience with forex but now days I am trying to learn as much as I can about the CFD tradings.

Wish me Luck..

Cheers

Wish me Luck..

Cheers

Similar threads

- Replies

- 5

- Views

- 8K

- Replies

- 0

- Views

- 3K