whenwilljack

Junior member

- Messages

- 15

- Likes

- 0

Hi all,

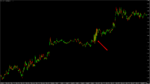

Last Friday morning I had an unusual situation occur. I was watching the oil markets and noticed volatility increase. I wasn’t aware of why this was happening but noticed that, while price movements were volatile and jumpy, they were fairly consistent and repetitive. I've attached a chart to show what I'm talking about. This presented me with a viable strategy of selling towards the top of the range and buying towards the bottom, which is what I went on to do. Over the next hour or so I made just under £18k doing this.

Now of course it seemed unusual to me (my hourly rate is a little less than this normally!), but I was surprised when my broker froze the markets for a while. This was quickly followed by an email from them to say they had cancelled the trades and taken away all associated profits. Their reason for this is that they are claiming a data error and that they are entitled to cancel the trades under the 'manifest error' of their T&Cs. I don't have any evidence that prices were wrong - as you can see the prices being quoted didn't differ widely from preceding price action - but assume the broker wouldn't lie about it. I don't want to name the broker at this stage as I'm not trying to unduly muddy their name but they are a large UK based firm.

I wondered if anyone had a similar experience at all, or any knowledge of this 'manifest error'? I genuinely don't know what the correct outcome should be here which is why I'm asking for advice. My gut feeling is that they probably have covered their backs in the endless T&Cs, but I can't get away from the feeling that this is their mistake but I am the one bearing the cost. I also think about when a shop offers a price wrong they honour it, except when price is so obviously wrong it has to be a mistake. I think (hope!) the manifest error should be there to cover this type of scenario (e.g. their systems offering gold at $1.4 instead of $1,400 which would bankrupt them), rather than oil merely being priced a few cents incorrectly. What do you guys think?

The other thing is that I was assuming risk on each of the trades. Had the market moved against me on the first trade giving me a loss would the broker have been emailing me to say they were refunding me? I doubt it. I'd love to know how many other trades, particularly losers, were cancelled in oil during this time period. To think i undertook this risk for nothing leaves a bitter taste in my mouth.

Few final points:

- they offered me £25 (rising to £50 when I told them it was insulting) goodwill gesture. Does anyone else find this insulting?! It had the feeling to me of give the guy some loose change in the hope he'll go away. Maybe I'm wrong and it was a genuine goodwill gesture but acted more like a kick in the balls after they took £18k from me. They also removed the gesture entirely when I told them (politely) it was insulting which I thought was petty

- I've had their final response (basically 'screw you') and submitted a claim to the UK financial ombudsman. Don't hold much hope but no harm in trying

- I can post the email conversation i had with them if people are interested

- I'm gonna post this in a few places so apologies if you see it elsewhere

Any opinions/ experiences welcomed?

Thanks,

WWJ

Last Friday morning I had an unusual situation occur. I was watching the oil markets and noticed volatility increase. I wasn’t aware of why this was happening but noticed that, while price movements were volatile and jumpy, they were fairly consistent and repetitive. I've attached a chart to show what I'm talking about. This presented me with a viable strategy of selling towards the top of the range and buying towards the bottom, which is what I went on to do. Over the next hour or so I made just under £18k doing this.

Now of course it seemed unusual to me (my hourly rate is a little less than this normally!), but I was surprised when my broker froze the markets for a while. This was quickly followed by an email from them to say they had cancelled the trades and taken away all associated profits. Their reason for this is that they are claiming a data error and that they are entitled to cancel the trades under the 'manifest error' of their T&Cs. I don't have any evidence that prices were wrong - as you can see the prices being quoted didn't differ widely from preceding price action - but assume the broker wouldn't lie about it. I don't want to name the broker at this stage as I'm not trying to unduly muddy their name but they are a large UK based firm.

I wondered if anyone had a similar experience at all, or any knowledge of this 'manifest error'? I genuinely don't know what the correct outcome should be here which is why I'm asking for advice. My gut feeling is that they probably have covered their backs in the endless T&Cs, but I can't get away from the feeling that this is their mistake but I am the one bearing the cost. I also think about when a shop offers a price wrong they honour it, except when price is so obviously wrong it has to be a mistake. I think (hope!) the manifest error should be there to cover this type of scenario (e.g. their systems offering gold at $1.4 instead of $1,400 which would bankrupt them), rather than oil merely being priced a few cents incorrectly. What do you guys think?

The other thing is that I was assuming risk on each of the trades. Had the market moved against me on the first trade giving me a loss would the broker have been emailing me to say they were refunding me? I doubt it. I'd love to know how many other trades, particularly losers, were cancelled in oil during this time period. To think i undertook this risk for nothing leaves a bitter taste in my mouth.

Few final points:

- they offered me £25 (rising to £50 when I told them it was insulting) goodwill gesture. Does anyone else find this insulting?! It had the feeling to me of give the guy some loose change in the hope he'll go away. Maybe I'm wrong and it was a genuine goodwill gesture but acted more like a kick in the balls after they took £18k from me. They also removed the gesture entirely when I told them (politely) it was insulting which I thought was petty

- I've had their final response (basically 'screw you') and submitted a claim to the UK financial ombudsman. Don't hold much hope but no harm in trying

- I can post the email conversation i had with them if people are interested

- I'm gonna post this in a few places so apologies if you see it elsewhere

Any opinions/ experiences welcomed?

Thanks,

WWJ