Hi I just would like to copy paste quckly some things I wrote in another forum. It is about the entropy indicators.Briefly I just would like to point that the entropy indicator is not calculating actually the entropy.

It is the not the entropy but a computation of the probability of up movement and down movement based on the entropy mathematics.

And that is why it is intepreted as an oscillator.

Here are the real links.

http://www.johncon.com/john/correspo...935.21840.html

http://www.johncon.com/john/correspo...563.22218.html

Have a look at this. //by the way the numbers in our mt4 code do not seem right/

The indicator gives us (g) and not the entropy. And g is

"average multiplicative gain per iteration of the game, i.e., after t many iterations, the gambler's capital would have increased by a factor of g^t."

If g goes up uou bet to buy. Ig g goes down you bet to sell.

If there is a low reading of (g) the probabilities are low.

I made a trial to calculate p instead of g. I hope I did right.

And p is The Shannon Probability

Subject: Quantitative Analysis of Non-Linear High Entropy Economic Systems I

If you want the best 101 on entropy go to Noxa analitics register and download their entropy indicators tutorial.

just tried to use the available code in order to compute the entropy function.

Of course consider it just as a trial.

But we need such an indicator.

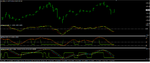

I just drop a shot showing how you can use it. It is fairly simple provided the indicator is correct.

We look for a drop in the entropy function. The drop would confirm a technical break - out. The logic is the same as with the fractal break - out. This time we have an entropy break - out. Well the mathematics are a little complex but the technical use is fairly simple. I just missed that indicator and tried to do something. I am sure that in that way I could attract some coder attention for futher improvements.

Subject: Stock Market

H(p) is the entropy function, H(p) = -[p log p + (1 - p) log (1 -

p)].

This is the formula of the binary entropy function

Binary entropy function - Wikipedia, the free encyclopedia

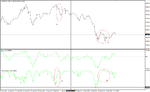

As in the previous indicator the p was computed. I used this formula even if as far as I know the classic formula is different.

Information theory - Wikipedia, the free encyclopedia

It was just one line of code.

I hope this is correct.

So I will update and make the two versions. Comments are welcome.

The binary (entropy function.mt4) should be correct but the other is not because the implementation of formula is not correct.I need a help with the Sigma. However I have the surprise I = -log (p(x)).

Here I add the indicator.