One of the great joys of having invented an analytical technique such as Bollinger Bands (see desc. below) is seeing what other people do with it. While there are many ways to use Bollinger Bands, following are a few rules that serve as a good beginning point.

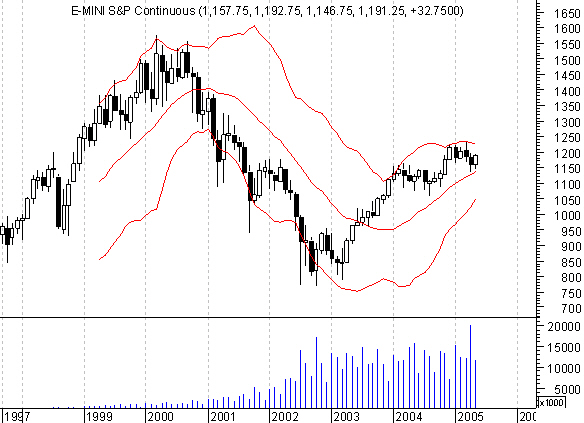

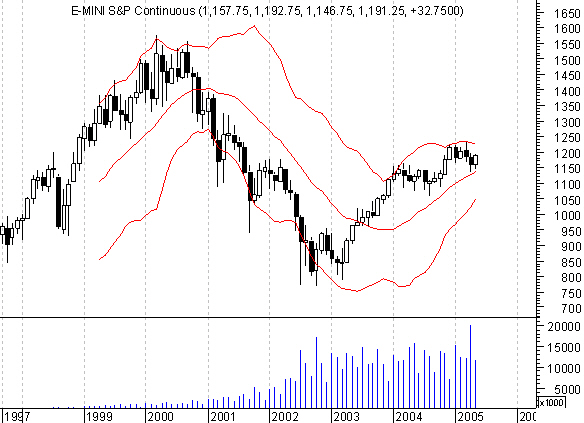

Editor's Note: Bollinger Bands are a fairly ubiquitous study in modern technical analysis. Their creator, John Bollinger, offers his advice for their application above. For those new to the Bands, they can be thought of as a volatility adaptive moving average envelope or channel. Notice in the chart below how the Bands widen or narrow based on the market's volatility (in this case monthly S&P e-mini prices).

The central line of the Bollinger Band plot is a simple moving average. The upper Band is plotted a number of standard deviations above the average, and the lower Band is drawn the same distance below. The standard deviation is calculated on the same data as the moving average. The default setting of many charting systems is 20 periods for the average and 2 standard deviations for the Band plot.

- Bollinger Bands provide a relative definition of high and low.

- </span />That relative definition can be used to compare price action and indicator action to arrive at rigorous buy and sell decisions.

- Appropriate indicators can be derived from momentum, volume, sentiment, open interest, inter-market data, etc.

- Volatility and trend have already been deployed in the construction of Bollinger Bands, so their use for confirmation of price action is not recommended.

- The indicators used should not be directly related to one another. For example, you might use one momentum indicator and one volume indicator successfully, but two momentum indicators aren't better than one.

- Bollinger Bands can also be used to clarify pure price patterns such as "M" tops and "W" bottoms, momentum shifts, etc.

- Price can, and does, walk up the upper Bollinger Band and down the lower Bollinger Band.

- Closes outside the Bollinger Bands are continuation signals, not reversal signals. (This has been the basis for many successful volatility breakout systems.)

- The default parameters of 20 periods for the moving average and standard deviation calculations, and two standard deviations for the bandwidth are just that, defaults. The actual parameters needed for any given market/task may be different.

- The average deployed should not be the best one for crossovers. Rather, it should be descriptive of the intermediate-term trend.

- If the average is lengthened the number of standard deviations needs to be increased simultaneously; from 2 at 20 periods, to 2.5 at 50 periods. Likewise, if the average is shortened the number of standard deviations should be reduced; from 2 at 20 periods, to 1.5 at 10 periods.

- Bollinger Bands are based upon a simple moving average. This is because a simple moving average is used in the standard deviation calculation and we wish to be logically consistent.

- Make no statistical assumptions based on the use of the standard deviation calculation in the construction of the bands. The sample size in most deployments of Bollinger Bands is simply too small for statistical significance.

- Indicators can be normalized with %b, eliminating fixed thresholds in the process.

- Finally, tags of the bands are just that, tags not signals. A tag of the upper Bollinger Band is NOT in-and-of-itself a sell signal. A tag of the lower Bollinger Band is NOT in-and-of-itself a buy signal.

Editor's Note: Bollinger Bands are a fairly ubiquitous study in modern technical analysis. Their creator, John Bollinger, offers his advice for their application above. For those new to the Bands, they can be thought of as a volatility adaptive moving average envelope or channel. Notice in the chart below how the Bands widen or narrow based on the market's volatility (in this case monthly S&P e-mini prices).

The central line of the Bollinger Band plot is a simple moving average. The upper Band is plotted a number of standard deviations above the average, and the lower Band is drawn the same distance below. The standard deviation is calculated on the same data as the moving average. The default setting of many charting systems is 20 periods for the average and 2 standard deviations for the Band plot.

Last edited by a moderator: