Relative position sizing and risk adjustment

OK - look at AMZN

Daily ATR 14 = 6.22

10 Min ATR 14 = 1.37

Position size calculation is :

MMStop = (Capital * (FixedPercent/100))/(BASKET);

Psize = (MMStop / (AvgTrueRange(14)));

So - MMStop is amount to risk per stock. This gets divided by the relevant ATR to give position size.

As the daily ATR is much greater than the 10 min ATR, you are dividing risk by a larger number. Dividing by a larger number will give a lower Psize.

In this case Psize daily based on a 25 K margin account (100K capital) and basket of 2 gives me

daily - 160.72

10 min - 728.41

That is $42K based on the 10 min - way too much risk for a 25K margin account in my opinion - at least until I discover the Holy Grail.

BTW - when I say 'risk' - I'm thinking of the occasional inevitable spike that'll occur.

Pete

I appreciate the reasons why you want to reduce your position size, but I still think you are altering the wrong part of the equation. IMHO the best way to reduce position size to something you are comfortable with is to adjust either the portfolio size or the risk percentage until you get position sizes you are comfortable with.

The reason I say this can best be illustrated with an example. Let's say that you have 2 stocks that have been exhibiting pretty similar ATRs for the last 14 days, but today one of them starts to exhbit much greater volatility. If you use an ATR(14) based on days then you should get fairly similar position sizes and you would give them equal weighting today in your portfolio, yet one of them is exhibiting far more risk today. So now your portfolio is not following the principles espoused here of balancing your risk by correct position sizing.

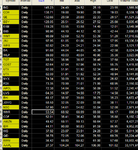

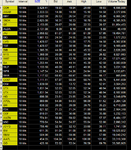

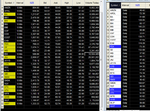

To illustrate with an example. Take 2 stocks today GE and UTX, chosen because they were showing large changes on Iraj N minute. I have set position size with portfolio = 120000 and risk = 1% and taken a screen print of the position size using a daily interval. GE = 132.66 and UTX = 82.00. This is a ratio of 1.61. I also took a screen print a couple of seconds later showing the same thing but with an interval of 10 mins. Here GE = 2153.85 and UTX = 1031.94. This is a ratio of 2.08. The 3rd attachment shows the situation a few minutes later. GE = 132.08 on daily and UTX unchanged at 82 i.e. a ratio of still 1.61, whereas the 10 min is showing GE = 2079.21 and UTX = 1029.41 i.e. a ratio of 2.01. Clearly the relative position sizes of a particular basket of stocks alters more rapidly on a 10 min ATR than on a daily ATR and the relative position sizes of each item in the basket on a 10 min ATR can be different to a daily ATR

I accept that for practical purposes for small position sizes this probably won't matter, because I suspect that you will round up or down in any case. However I think it is important to understand the principles being used and why they are being used, which is why I am being pernickety about this.

So what I would do to get the position size down to a similar level as the dailys in the above example would be to reduce the risk to say 0.1, which would divide by a constant of 10, but derive the relative risk/position sizing from an ATR whose length was more appropriate for day-trading.

Equally if you were swing-trading then you would use a daily interval on the position sizing indicator.

Charlton