Hi Everyone,

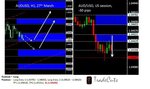

Today's pair is Aud/Usd. Overall strength of USD remains unclear and there is no clear direction. Current price action suggests sideways movements and mixed sentiments around USD pairs. Trade USD pairs with caution and keep a hawk’s eye.

Best

TradeCuts

Today's pair is Aud/Usd. Overall strength of USD remains unclear and there is no clear direction. Current price action suggests sideways movements and mixed sentiments around USD pairs. Trade USD pairs with caution and keep a hawk’s eye.

Best

TradeCuts