There are many ways to trade, but I like combining some fundamental, knowledge or perhaps some news, an understanding of technical analysis, a grasp of how markets behave and the ability to read sentiment as demonstrated in price action, buy/sell pressures and the actual trades printing off - the deals being done.

This may sound a little involved but is actually quite easy with a little knowledge, common sense and reading the market.

On September 1st I made a list of those stocks that were already benefiting from buying interest, (or selling pressure like some insurers), in the wake of the devastating Hurricane Katrina. Building material stocks, alternative energy stocks, insurers, specialist manufacturers of rescue products were of interest, as were oil and refining stocks. You don't need an encyclopaedic knowledge to do this; you just need a basic news service that tells you such things pre-market.

One such stock was an alternative energy one, FCEL, which had already risen pre-market following on from substantial gains the two previous days. These facts put the stock firmly on my radar for the day.

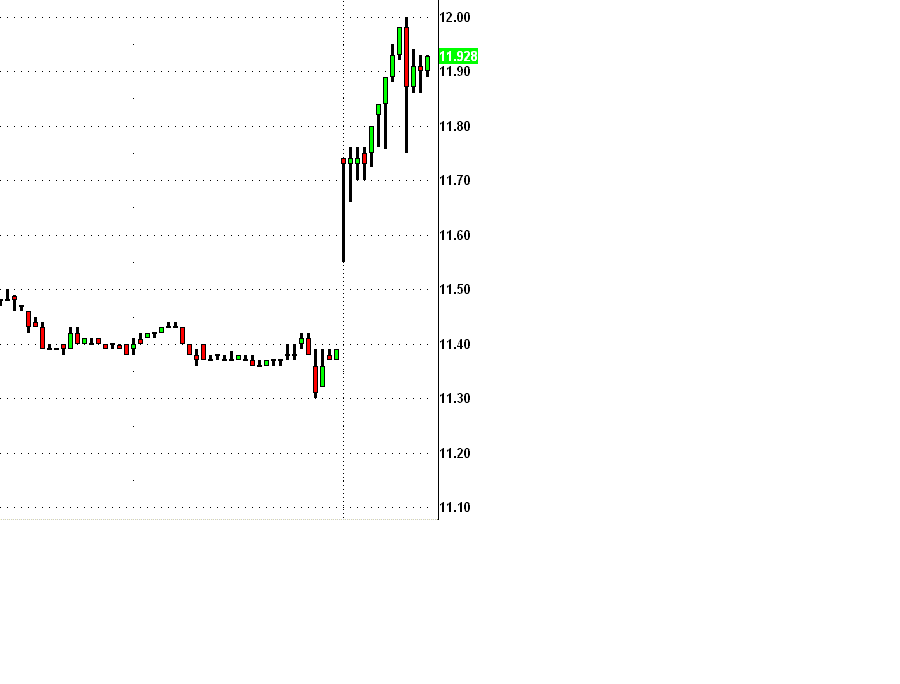

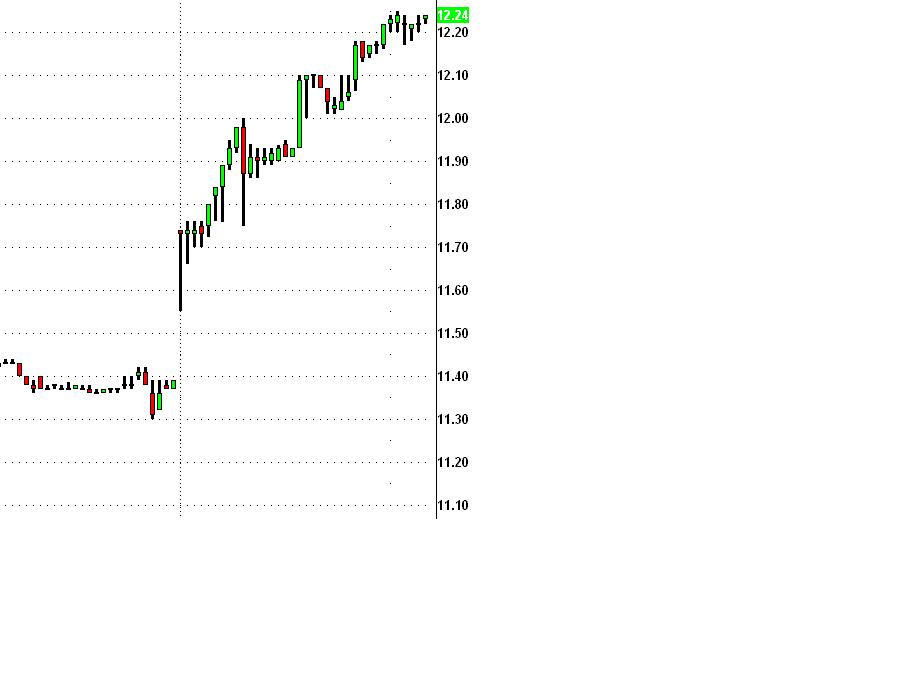

When the market opened on September 1st, buying pushed the price up to the critical $12 level at which point it was unable to go higher and, as can be seen on the first chart below, it collapsed down on the 10th one minute candle.

Now I was watching and waiting to read how it behaved at that level and I saw two of the market participants suddenly cut the ground from under the stock - an activity some in the UK call "shaking the tree".

Although this understandably panicked out a few traders, most stayed in their positions anticipating further gains. Price began to inexorably rise. By reading the buy and sell pressures, market participant behaviour and the actual trades being done, (something I refer to as "micro-analysis"), I could see growing strength and support.

In view of that I felt this trade was a no-brainer. Had that proved wrong I would have been able to see that upward pressure abating and would have simply exited the trade before any rush of selling - in other words I would have sold to those dwindling buyers before any sharp fall.

Had that happened immediately on entry, a very unlikely possibility in these circumstances, I would have been out for a maximum loss of about 5c at worst.

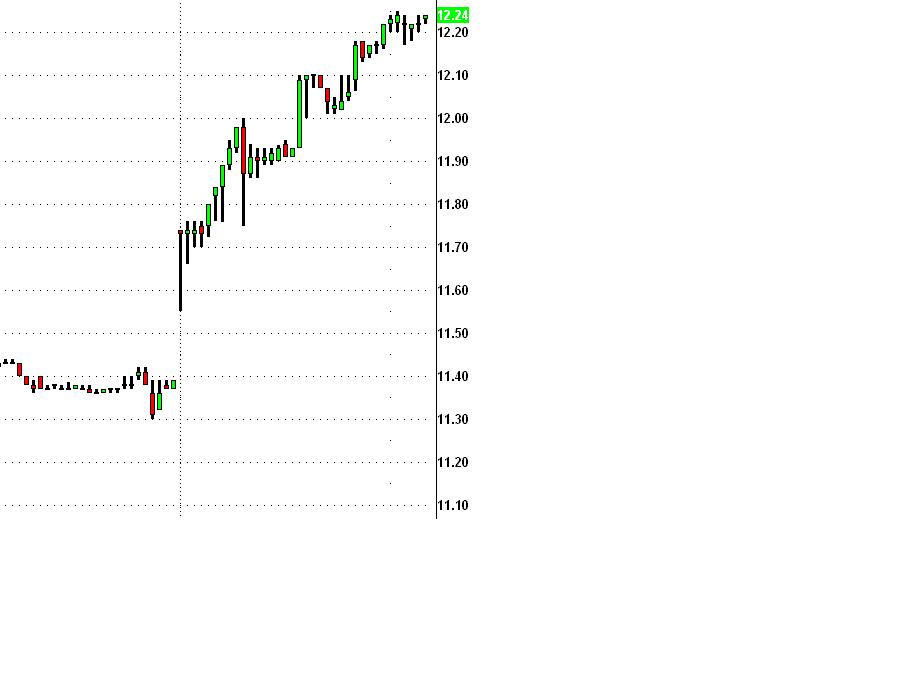

Here is a screen shot of my point of entry:

Had the move died at $12 I would have exited for a few cents profit. As expected, though, it continued upwards.

In a situation with such a high probability of success it is comfortable to take a larger position size than normal.

As price moved upwards I continued to watch my Level 2 screens until I saw that buying strength abate.

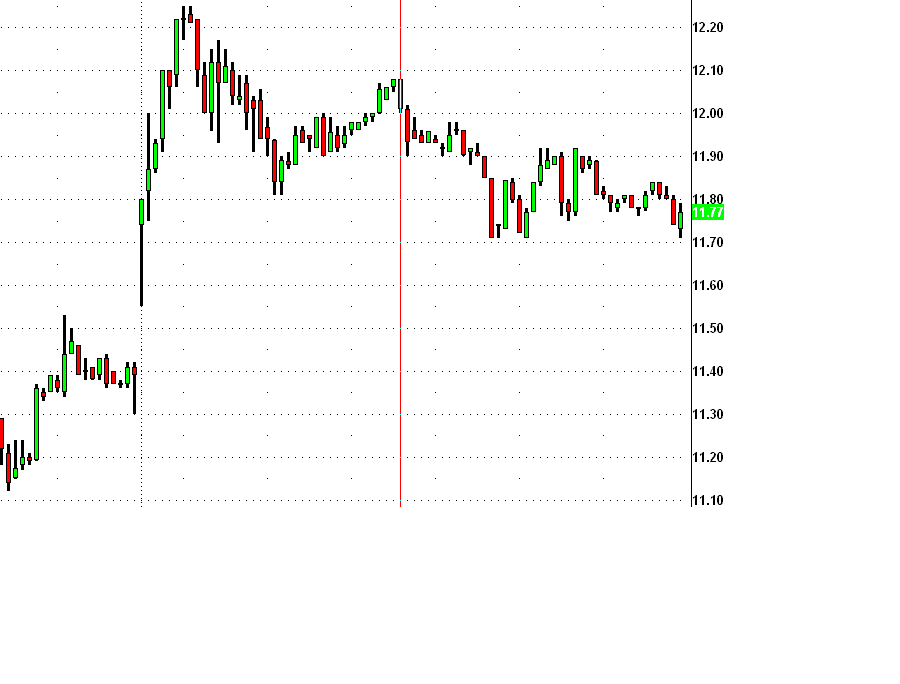

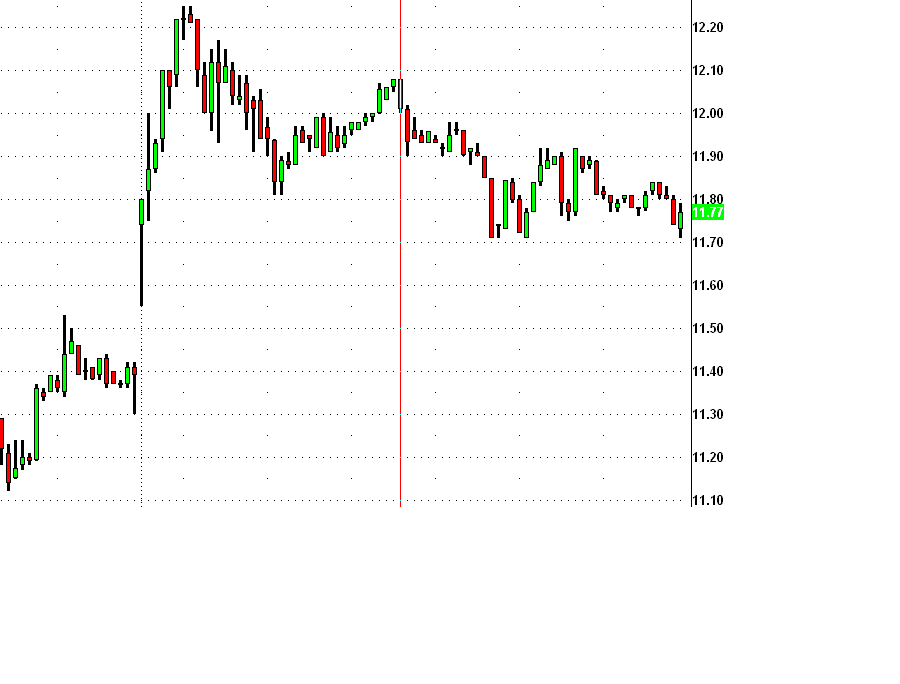

Now if you see only the chart, as below, you would have expected a further rise. However, I could see the move was spent and that there was simply no further demand for the stock.. In fact market participants were beginning to line up to sell. When that occurs when I am long, I take profits.

In the business of intra - day trading you take the profits the market offers you. After all, having banked your money, you can always re-enter if further conditions present themselves. I like to think of it as eating in a tapas bar. You might end up having a very substantial meal of one dish, but often you will enjoy several smaller ones.

Here is a screen shot of my point of exit:

This was a profit of 32c in 23 minutes. A nice gentle, relaxing trade. For someone trading 2000 shares that is a profit of $640.

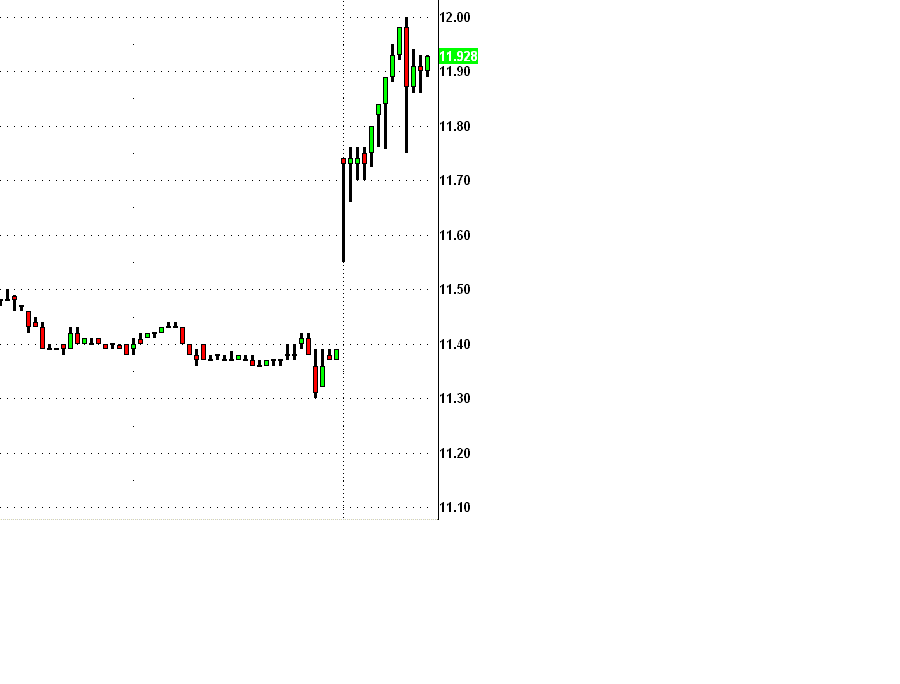

So, as a matter of interest, what happened afterwards?

As I said, that doesn't really matter as the profit had been taken and another trade initiated had there been another set up and trigger. As it happened, I caught the very high of the whole day's trading and it weakened afterwards as shown in the following full day chart.

For me the stock selection comes first, then the set up with the accompanying understanding and reading of market action, then the trigger of micro-analysis. When the reasons for being in the trade no longer exist or there is pressure in the opposite direction to my trade, then it is time to lock in profits and move on to the next trade in that or another stock..

This may sound a little involved but is actually quite easy with a little knowledge, common sense and reading the market.

On September 1st I made a list of those stocks that were already benefiting from buying interest, (or selling pressure like some insurers), in the wake of the devastating Hurricane Katrina. Building material stocks, alternative energy stocks, insurers, specialist manufacturers of rescue products were of interest, as were oil and refining stocks. You don't need an encyclopaedic knowledge to do this; you just need a basic news service that tells you such things pre-market.

One such stock was an alternative energy one, FCEL, which had already risen pre-market following on from substantial gains the two previous days. These facts put the stock firmly on my radar for the day.

When the market opened on September 1st, buying pushed the price up to the critical $12 level at which point it was unable to go higher and, as can be seen on the first chart below, it collapsed down on the 10th one minute candle.

Now I was watching and waiting to read how it behaved at that level and I saw two of the market participants suddenly cut the ground from under the stock - an activity some in the UK call "shaking the tree".

Although this understandably panicked out a few traders, most stayed in their positions anticipating further gains. Price began to inexorably rise. By reading the buy and sell pressures, market participant behaviour and the actual trades being done, (something I refer to as "micro-analysis"), I could see growing strength and support.

In view of that I felt this trade was a no-brainer. Had that proved wrong I would have been able to see that upward pressure abating and would have simply exited the trade before any rush of selling - in other words I would have sold to those dwindling buyers before any sharp fall.

Had that happened immediately on entry, a very unlikely possibility in these circumstances, I would have been out for a maximum loss of about 5c at worst.

Here is a screen shot of my point of entry:

Had the move died at $12 I would have exited for a few cents profit. As expected, though, it continued upwards.

In a situation with such a high probability of success it is comfortable to take a larger position size than normal.

As price moved upwards I continued to watch my Level 2 screens until I saw that buying strength abate.

Now if you see only the chart, as below, you would have expected a further rise. However, I could see the move was spent and that there was simply no further demand for the stock.. In fact market participants were beginning to line up to sell. When that occurs when I am long, I take profits.

In the business of intra - day trading you take the profits the market offers you. After all, having banked your money, you can always re-enter if further conditions present themselves. I like to think of it as eating in a tapas bar. You might end up having a very substantial meal of one dish, but often you will enjoy several smaller ones.

Here is a screen shot of my point of exit:

This was a profit of 32c in 23 minutes. A nice gentle, relaxing trade. For someone trading 2000 shares that is a profit of $640.

So, as a matter of interest, what happened afterwards?

As I said, that doesn't really matter as the profit had been taken and another trade initiated had there been another set up and trigger. As it happened, I caught the very high of the whole day's trading and it weakened afterwards as shown in the following full day chart.

For me the stock selection comes first, then the set up with the accompanying understanding and reading of market action, then the trigger of micro-analysis. When the reasons for being in the trade no longer exist or there is pressure in the opposite direction to my trade, then it is time to lock in profits and move on to the next trade in that or another stock..

Last edited by a moderator: