AMP Futures - Chicago USA now have the CQG data feed with NinjaTrader 7

besides offering a lot more exchanges than the other AMP feeds, it also means the

CQG feed only, has a minimum account margin of US$500 , a result of offering the

Globex mini and micro contracts

here's the Globex mini and micro Euro FX contract specs for AMP/CQG/NT:

E-Mini Euro FX - E7 - $62,500 Contract - $6.25 per pip - Daytrade Margin $250 - roundturn commission - $3.37

Micro Euro FX - M6E - $12,500 Contract - $1.25 per pip - Daytrade Margin $100 - roundturn commission - $1.99

same for the other currencies

reported volume for Feb 23/11: 6E 307,530 - E7 5,967 - M6E 5,810

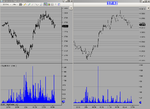

attached chart is the 6E and M6E about 3am PST and gives you an idea of how the

micro contract trades; thin volume and what might result in 'slippage'; the lines are

4 pips apart. the E7 was n/a in NT, possibly because it's a limited 5 day demo

http://www.ampfutures.com/

.

besides offering a lot more exchanges than the other AMP feeds, it also means the

CQG feed only, has a minimum account margin of US$500 , a result of offering the

Globex mini and micro contracts

here's the Globex mini and micro Euro FX contract specs for AMP/CQG/NT:

E-Mini Euro FX - E7 - $62,500 Contract - $6.25 per pip - Daytrade Margin $250 - roundturn commission - $3.37

Micro Euro FX - M6E - $12,500 Contract - $1.25 per pip - Daytrade Margin $100 - roundturn commission - $1.99

same for the other currencies

reported volume for Feb 23/11: 6E 307,530 - E7 5,967 - M6E 5,810

attached chart is the 6E and M6E about 3am PST and gives you an idea of how the

micro contract trades; thin volume and what might result in 'slippage'; the lines are

4 pips apart. the E7 was n/a in NT, possibly because it's a limited 5 day demo

http://www.ampfutures.com/

.