I feel that the market will move the funds from risky assets to safe haven trades. With Syria, Tapering and Debt Ceiling in mind, my view is to go long the treasuries. I am going long far end and shorting the near end. See below a grab from Bloomberg. It show’s the hedge ratio. IF you long 10 EuroDollars then you need to sell 6 Two Year Notes or 5 Five yr Notes or 3 Ten Yr Notes and 2 30 yr Bonds Basically I view the curve as flattening going into the weekend.

The best correlations for EuroDollar with 2 yr notes is Sep15 EuroDollar and with 5yr Notes is Dec16. Again my view to long the far End.

For ED Sep 15 vs 2 yr notes, I will sell 5 ED Sep15 and buy 3 Two Year Notes

For ED Dec16 vs 5yr notes, I will se;; 2 ED Dec 16 and Buy 1 5yr Notes.

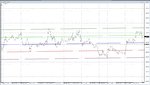

See the chart below. I am doing a FYT, Sell Five YR Notes to buy the 10 yr Notes,

I am selling 3 5yr notes and buying 2 Ten yr Notes. I get the chart price by taking the (5 yr notes price X 1000 X 3 Lots) – (10 yr notes price X 1000 X 2 Lots)

I would want to sell the spread @ 110500 with a stop @ 110650,

You can use CME’ ICT spreads tp trade the spreads. It’s quoted in net change, at least you won’t get any leg outs.

The best correlations for EuroDollar with 2 yr notes is Sep15 EuroDollar and with 5yr Notes is Dec16. Again my view to long the far End.

For ED Sep 15 vs 2 yr notes, I will sell 5 ED Sep15 and buy 3 Two Year Notes

For ED Dec16 vs 5yr notes, I will se;; 2 ED Dec 16 and Buy 1 5yr Notes.

See the chart below. I am doing a FYT, Sell Five YR Notes to buy the 10 yr Notes,

I am selling 3 5yr notes and buying 2 Ten yr Notes. I get the chart price by taking the (5 yr notes price X 1000 X 3 Lots) – (10 yr notes price X 1000 X 2 Lots)

I would want to sell the spread @ 110500 with a stop @ 110650,

You can use CME’ ICT spreads tp trade the spreads. It’s quoted in net change, at least you won’t get any leg outs.