bought them with sharebuilder came out to 8.13 with all the fees and bull**** $1640.00 for 200 shares. im new to this

platnum525

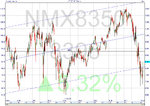

you have just bought Bear Sterns at the high of the day.

If JP Morgan Chase do buy Bear Sterns and noone else offers a higher price, you will get $2 for your shares which will mean you lose $6 .13 per share, about $1226 dollars plus dealing fees.

This will not be a good start to your trading.

Last edited: