counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

Right here's the plan.

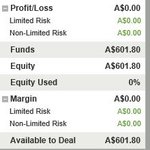

I'm gonna trade £555 up to £555,000. In 3 stages.

Stage 1 will be £555 to £5,000

Stage 2 will be £5,000 to £55,000

Stage 3 will be £55,000 to £555,000

300 trades in total or there about, in blocks of 100.

Each block will be numbered 1-100 and each number will be crossed off when a trade closes in profit.

The idea is to close out profitable trades and try to accumulate profitable trades that outrun any trades in drawdown.

Variable stakes, averaging occasionally, basically anything goes, to achieve the objective.

I may have multiple trades open, but I expect this to be capped at 3 open trades at any one time.

There may be an occasional stop out, although I figure they will be rare, but should a stop out occur, I will carry on crossing off profitable trades on the card and come back to any stop out trades at the end of each series.

At the end of each series I may need to make a trade or two, that account for adjustments. For example, if I place a limit to close and I get some + slippage, only the number I intended will be crossed off and the slippage amount will go into the + column. - numbers, for overnight financing etc, will be logged in the - column. Take one from the other and if in deficit, trade for the difference at the end of each series.

Here's my dummy run scorecard, as you can see, smaller numbers closed out first to build up some fat before progressing up the card, although if I do get a nice looking runner, I will allow it to deliver out of sequence.

I'm gonna trade £555 up to £555,000. In 3 stages.

Stage 1 will be £555 to £5,000

Stage 2 will be £5,000 to £55,000

Stage 3 will be £55,000 to £555,000

300 trades in total or there about, in blocks of 100.

Each block will be numbered 1-100 and each number will be crossed off when a trade closes in profit.

The idea is to close out profitable trades and try to accumulate profitable trades that outrun any trades in drawdown.

Variable stakes, averaging occasionally, basically anything goes, to achieve the objective.

I may have multiple trades open, but I expect this to be capped at 3 open trades at any one time.

There may be an occasional stop out, although I figure they will be rare, but should a stop out occur, I will carry on crossing off profitable trades on the card and come back to any stop out trades at the end of each series.

At the end of each series I may need to make a trade or two, that account for adjustments. For example, if I place a limit to close and I get some + slippage, only the number I intended will be crossed off and the slippage amount will go into the + column. - numbers, for overnight financing etc, will be logged in the - column. Take one from the other and if in deficit, trade for the difference at the end of each series.

Here's my dummy run scorecard, as you can see, smaller numbers closed out first to build up some fat before progressing up the card, although if I do get a nice looking runner, I will allow it to deliver out of sequence.

Attachments

Last edited: