Krzysiaczek99

Well-known member

- Messages

- 430

- Likes

- 1

John Ehler's supersmoother

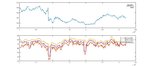

I think I did this test some time ago but now is a new era of my system so why not to repeat this test, simple to filter the price data using John Ehler's super smoother.

According to him the aliasing noise and spectral dilation should go away so it should be much easier to predict from this data than from raw data. This what theory says.

here is a link to his presentation

and here are the results

before smoothing

and after smoothing

so clearly it degrades the performance. PF down from 1.1 to 0.94. As result is based on 3.2 mln trades i think is quite significant.

Krzysztof

I think I did this test some time ago but now is a new era of my system so why not to repeat this test, simple to filter the price data using John Ehler's super smoother.

According to him the aliasing noise and spectral dilation should go away so it should be much easier to predict from this data than from raw data. This what theory says.

here is a link to his presentation

and here are the results

before smoothing

Code:

>> resultsAll('')

resultsAll('*Peg*')

resultsAll('*CHIRP*')

resultsAll('*J48*')

resultsAll('*RBM*')

resultsAll('*SDAE*')

resultsAll('*ELM*')

NORMAL DATA AVERAGE RESULTS

Profit PF avMC avPP avRC totTP totFP PF>1 algosnum perTrade

153524895.60 1.10 -0.31 63.57 0.33 2057179 1142804 685 1146 47.98

NORMAL DATA AVERAGE RESULTS

Profit PF avMC avPP avRC totTP totFP PF>1 algosnum perTrade

18313270.30 1.06 -0.35 62.34 0.37 396627 231428 115 191 29.16

NORMAL DATA AVERAGE RESULTS

Profit PF avMC avPP avRC totTP totFP PF>1 algosnum perTrade

99547243.10 1.51 -0.17 67.07 0.34 347466 161197 128 191 195.70

NORMAL DATA AVERAGE RESULTS

Profit PF avMC avPP avRC totTP totFP PF>1 algosnum perTrade

28772075.10 1.10 -0.33 62.44 0.36 381382 203698 111 191 49.18

NORMAL DATA AVERAGE RESULTS

Profit PF avMC avPP avRC totTP totFP PF>1 algosnum perTrade

-44923482.80 0.81 -0.37 60.81 0.23 245033 165306 105 191 -109.48

NORMAL DATA AVERAGE RESULTS

Profit PF avMC avPP avRC totTP totFP PF>1 algosnum perTrade

43758625.80 1.19 -0.34 66.31 0.31 326497 167161 112 191 88.64

NORMAL DATA AVERAGE RESULTS

Profit PF avMC avPP avRC totTP totFP PF>1 algosnum perTrade

8057164.10 1.03 -0.31 62.31 0.35 360174 214014 114 191 14.03

>>and after smoothing

Code:

>> resultsAll('')

resultsAll('*Peg*')

resultsAll('*CHIRP*')

resultsAll('*J48*')

resultsAll('*RBM*')

resultsAll('*SDAE*')

resultsAll('*ELM*')

NORMAL DATA AVERAGE RESULTS

Profit PF avMC avPP avRC totTP totFP PF>1 algosnum perTrade

-101993241.90 0.94 -0.34 60.33 0.32 1963830 1207497 627 1146 -32.16

NORMAL DATA AVERAGE RESULTS

Profit PF avMC avPP avRC totTP totFP PF>1 algosnum perTrade

-80552728.10 0.80 -0.37 60.33 0.39 399735 266821 112 191 -120.85

NORMAL DATA AVERAGE RESULTS

Profit PF avMC avPP avRC totTP totFP PF>1 algosnum perTrade

4939925.40 1.02 -0.23 61.31 0.35 355152 204655 117 191 8.82

NORMAL DATA AVERAGE RESULTS

Profit PF avMC avPP avRC totTP totFP PF>1 algosnum perTrade

16094468.20 1.05 -0.34 61.36 0.36 376003 212934 113 191 27.33

NORMAL DATA AVERAGE RESULTS

Profit PF avMC avPP avRC totTP totFP PF>1 algosnum perTrade

-41257476.50 0.76 -0.45 51.70 0.14 143284 118435 63 191 -157.64

NORMAL DATA AVERAGE RESULTS

Profit PF avMC avPP avRC totTP totFP PF>1 algosnum perTrade

-12799560.40 0.95 -0.41 61.73 0.30 321478 188821 109 191 -25.08

NORMAL DATA AVERAGE RESULTS

Profit PF avMC avPP avRC totTP totFP PF>1 algosnum perTrade

11582129.50 1.04 -0.30 62.14 0.36 368178 215831 113 191 19.83

>>so clearly it degrades the performance. PF down from 1.1 to 0.94. As result is based on 3.2 mln trades i think is quite significant.

Krzysztof