From a young age we have been taught that it is good to be right in work and in play, like our grades at school, during sports and in day to day business. The problem is, you take this attitude to the market and you will inevitably fail. You can be right nine times out of ten, take just one big loss and your account is down. The flip side is that with a good starting risk to reward ratio, you can be wrong more than right and still be profitable, a concept I’ve discussed in previous articles. This is tough for the newer trader to get their head around as they have not made the shift in thinking that being right most of the time does not always make you money. There are times you can even be right on a trade or investment, have a profit developing and then still see it turn into a loser because of a lack of planning ahead of time.

With a well put together plan and by understanding the power of an objective, rules-based approach to the markets, we can often make profitable choices in the Forex Market, even though our analysis may be a little off. When I first got into trading, I was always looking for the big moves, attempting to hit the haymaker trades which ran forever. Sure, I got some now and then, but I also had plenty of losses too and the more frustrating ones typically turned from a decent profit into a loss because I had no idea how to set realistic profit targets. Fast forward many years later and I have learned a few things since then.

I’ve learned that sometimes, you’ll be in the trend at exactly the right time to enjoy massive upside and other times you will join it too late and only get the last few dregs from it. Nobody really knows how it’s going to turn out but if you have a set of rules and can follow what the price is showing you, there is no reason why you still can’t make some decent returns along the way.

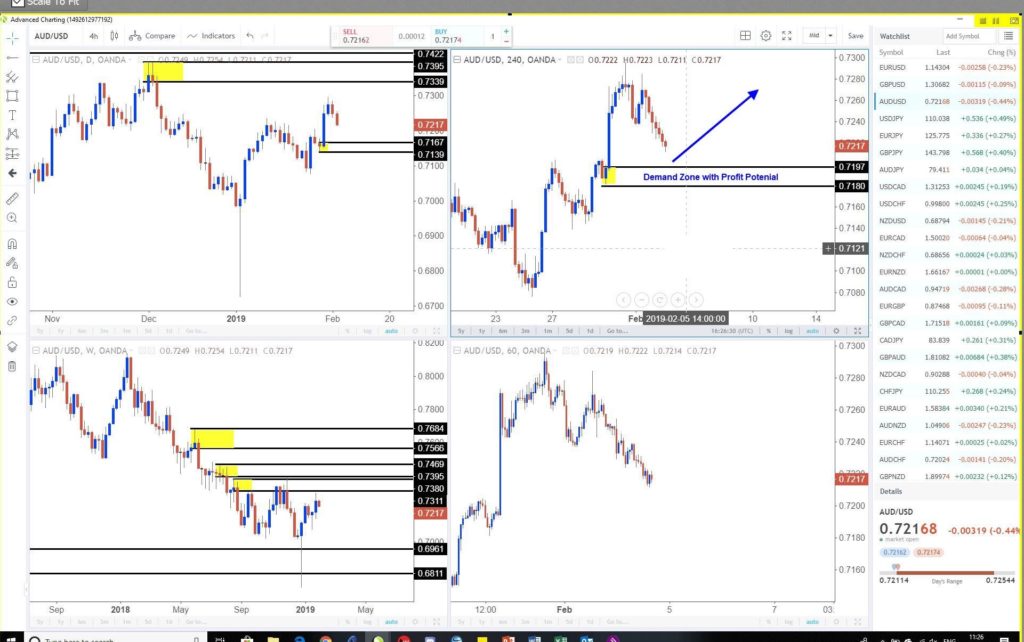

Here is a screenshot of a recent Live session I was leading in the FX room, where we were analysing setups and opportunities on the AUDUSD. This is what the charts looked like from multiple perspectives at the time:

Look at the upper right chart. We have a clean and established level of price demand on the 4hr chart, signalling a decent low risk buying opportunity. We have been in a short-term upwards trend which suggested there was also probability for a bounce on our side as well. There was also overhead price supply around 0.7280 giving us at least a 1:3 risk to reward ratio, which is a good minimum to look for. At this stage in the setup of the trade, it looks like a pure go with the trend trade, but we also recognized that there was some strong institutional supply above current price which indicated some weakness in the upside momentum. Taking this into account, a 1:3 was safe a target to use. Remember that if the price goes higher, we can always take another trade.

This is how the trade ended up working out for us:

Looks like we got that one wrong! Well in the longer term anyhow…because we managed to hit the 1:3 target on the buy at demand trade, even though prices then dropped from the overhead supply and broke down into a longer downside move. You may be asking, was this the right trade to take? Well, if it was profitable then sure, but you had to see that there was a profit in the first place, as this may have ended up being a loser if we had gotten greedy and gone for more profit.

I like to assume that I never know what price is going to do next. I focus on buying near areas of demand and selling near areas of supply which offer us solid risk to reward ratios. This way, we are always giving ourselves room to find a profit, even if we get into the trend late or maybe too early. After all, price is truly the only leading indicator we have, so what could be better to focus on as a primary decision-making tool?

Sam Evans can be contacted on this link: Sam Evans

Last edited by a moderator: