You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Algorithmic trading (also called automated trading, black-box trading, or algo-trading) uses a computer program that follows a defined set of instructions (an algorithm) to place a trade. The trade, in theory, can generate profits at a speed and frequency that is impossible for a human trader.

The defined sets of instructions are based on timing, price, quantity, or any mathematical model. Apart from profit opportunities for the trader, algo-trading renders markets more liquid and trading more systematic by ruling out the impact of human emotions on trading activities.

Algorithmic Trading in Practice

Suppose a trader follows these simple trade criteria:

Buy 50 shares of a stock when its 50-day moving average goes above the 200-day...

While using algorithmic trading, traders trust their hard-earned money to the trading software they use. The right piece of computer software is very important to ensure effective and accurate execution of the trade orders. Faulty software, or one without the required features, may lead to huge losses.

A Quick Preview on Algorithmic Trading

An algorithm is defined as a specific set of step-by-step instructions to complete a particular task. Be it the simple-yet-addictive computer game like Pac-Man or a spreadsheet that offers huge number of functions, each program follows a specific set of instructions based on an underlying algorithm.

Algorithmic trading is the process of using a computer program that follows a defined set of...

Futures

trade with high leverage in comparison to the stocks making up the

indexes. Buying 100 shares of the SPY

(the ETF that tracks the S&P 500 index) would cost nearly $29,200 at the

time of this writing. Even with 2:1

margin, a trader would need $14,600 to maintain the position. To trade one contract of the ES (the S&P

500 eMini future), a trader only needs $6930.

For an intraday trade, the margin could be as low as $500!

The

first half hour to hour of the equity markets can be very volatile. Sometimes

it seems like prices are fluctuating wildly with no rhyme or reason. However,

there is a technique that could help you predict the morning price movement and

even potential price reversals. This technique could be used for...

For a time, it looked as if high-frequency trading, or HFT, would take over the market completely. In 2010, HFT made up over 60% of U.S. equity volume. But the trend may be waning. In 2009, high-frequency traders moved about 3.25 billion shares a day. In 2012, it was 1.6 billion a day, according to Bloomberg. At the same time, average profits fell from “about a tenth of a penny per share to a twentieth of a penny,” the report noted.

In 2017, HFT accounted for just under half of all domestic equity volume.

In HFT, powerful computers use complex algorithms to analyze markets and execute super fast trades, usually in large volumes. HFT requires advanced trading infrastructure like powerful computers with high-end hardware costing huge...

There is an old saying in business: "Fail to plan and you plan to fail." It may sound glib, but those who are serious about being successful, including traders, should follow these eight words as if they were written in stone. Ask any trader who makes money on a consistent basis and they will tell you, "You have two choices: you can either methodically follow a written plan, or fail."

If you have a written trading or investment plan, congratulations! You are in the minority. While it is still no absolute guarantee of success, you have eliminated one major roadblock. If your plan uses flawed techniques or lacks preparation, your success won't come immediately, but at least you are in a position to chart and modify your course. By...

Do you find yourself flitting from one way of trading to another? Or constantly tweaking the way you are trading, never quite finding that consistent winning streak?

The internet is an amazing thing – there are thousands of trading strategies described in forums, social media and YouTube videos etc. But how do you know if they work? The answer is much simpler than it seems. Test the strategy properly!

A proper test constitutes at least 30 correctly taken live or demo trades. The two elements to this are ’30 trades’ and ‘correctly taken’.

Why do you have to wait for 30 trades?

One of the biggest mistakes that newbie traders make is to give up on a trading strategy after a run of losing trades. The thinking behind doing this is...

Momentum investing was all the rage in the 1990s when the markets were rising like a hot air balloon. This strategy is based upon the idea of purchasing whatever sector of the market has posted the greatest earnings or price gains in the market over the past year. Many funds, such as American Century Ultra (TWCUX), relied heavily on variations of the momentum strategy during this time and when the tech bubble burst, they went down with it, some harder than others.

But a new group of studies has indicated that momentum investing is actually a viable long-term investment strategy and has performed admirably over longer periods of time.

The Research

AQR Capital Management published a white paper in September of 2014 that was titled...

Just like good boy scouts, traders need to be prepared for the unexpected. It is virtually inevitable that part of a trader's workstation will melt down at some point, and this can lead to a financial loss. Platforms can experience problems, including surprises in strategy automation, for which traders need to plan. And, although it (thankfully) doesn't happen very often, entire exchanges can even shut down. All traders need a well thought out plan - in writing - to deal with these types of eventualities. If traders are ready to deal with problems as they arise, they'll be back to trading sooner - and hopefully with a minimum of stress and financial loss. Think of this preparation as a form of risk control.

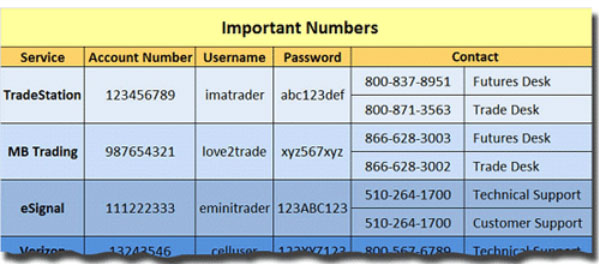

Important Numbers

At the...

Introduction

Many traders think that to make consistent profits in the markets, all you need is a holy grail. From my experience, a trading methodology or system is only one of the ingredients of success. The advancement of technology blinds us into thinking that all we need to be successful is state-of-the-art kit and the latest software. After all, banks fit into this category and they tend to do pretty well. However, technical wizardry is only of value if you know what to do with it. Does Warren Buffett rely on the latest technology to make his investments, or does he put his faith and his money into time tested principles of yesteryear? Modern technology is a useful tool for many traders, but to ensure it’s used wisely and to full...

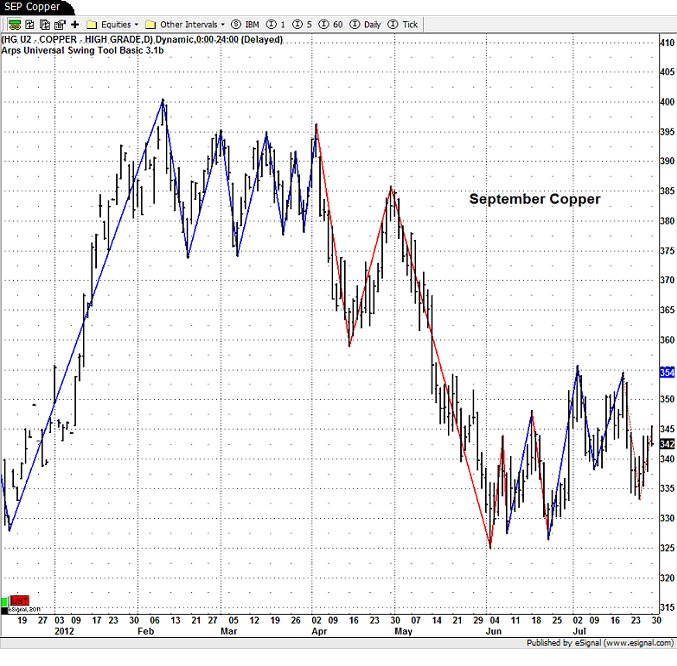

Spread trading has been around since markets and exchanges were first developed. Exchanges and their markets were designed not for speculation but to transfer risk from one party to another; speculation made them more efficient through increased volume and tighter price spreads (bid/ask). Commercial trading companies and financial institutions apply hedging (long/short positions) to reduce their exposure and offset risk to their principal underlying positions across every type of commodity or financial instrument. This risk-averse approach is the driving force to their market activity and success.

As a trader we can only speculate on price movement. In many markets, in particular futures, the price activity can be volatile and...

Headging is often considered an advanced investing strategy, but the principles of hedging are fairly simple. With the popularity - and accompanying criticism - of hedge funds, the practice of hedging is becoming more widespread. Despite this, it is still not widely understood.

Everyday Hedges

Most people have, whether they know it or not, engaged in hedging. For example, when you take out insurance to minimize the risk that an injury will erase your income, or you buy life insurance to support your family in the case of your death, this is a hedge.

You pay money in monthly sums for the coverage provided by an insurance company. Although the textbook definition of hedging is an investment taken out to limit the risk of another...