One of the best kept secrets in trading is that of reduced margin spreads. You cannot name a trading method that provides more safety or a greater return on margin than does a reduced margin spread, while also being one of the least time-consuming ways to trade. Have you ever asked yourself why it is that many of the largest, most powerful traders trade spreads? I'm going to show you why!

What is a reduced margin spread?

Because of perceived lower volatility, exchanges grant reduced margins on certain types of spreads. Spreads consist of being long in one or more contracts of one market and short in one or more contracts of the same market but in different months - an intramarket spread; or being long in one or more contracts of one market and short one or more contracts of a different market, and in the same or different months - an intermarket spread.

Distortions about spreads

There are some distortions about spread trading that need to be dispelled. If we get them out of the way, I can show you the tremendous advantages spread trading has over any other form of trading.

It is said that spreads do not move as much as outright futures. I agree 100% with that statement. However, spreads trend much more often than outright futures, they trend much more dramatically than outright futures, and they trend for longer periods of time than do the outright futures. For these reasons you can make much more money with spreads than with the

outrights.

The second distortion about spread trading goes like this: "You have to pay double commissions when you trade spreads." Yes! You have to pay two commissions for every spread you enter in the market. So what? You are trading two contracts instead of one. You pay two commissions because you are trading two separate contracts, one in one place and the other in an entirely different place. Paying two commissions for two separate trades is hardly unfair. Let me tell you what is unfair - paying a round turn commission for an option that expires worthless. Why don't you hear people complaining about that? You pay for a round turn, and you receive only half a turn. Doesn't make a lot of sense, does it?

Advantages of Spread Trading

There are so many advantages to trading reduced margin spreads that I hope I don't run out of room here before I can tell you all of them. Let's begin with return on margin, i.e., yield.

Yield: As I write this, the margin to trade an outright futures position in crude oil is $4,725, whereas a spread trade in crude oil requires only $540, only 11.4% as much. If crude oil futures move one full point, that move is worth $1,000. If a crude oil spread moves one full point, that move is worth $1,000. That means either a 1 point favorable move in crude oil futures or a 1 point favorable move in a crude oil spread earns the trader $1,000. However, the difference in return on margin is extraordinary: In the futures the return is $1,000/$4,725=21%. For the spread, the return is $1000/540=185%. Think about that!

Leverage: This leads us to the next benefit of spread trading - with the same amount of margin, you could have traded 4 soybean spreads instead of one soybean futures. How's that for leverage? Instead of making $250 on a five point move, you could have made $1,000. Reduced margin spreads offer a much more efficient use of your margin money.

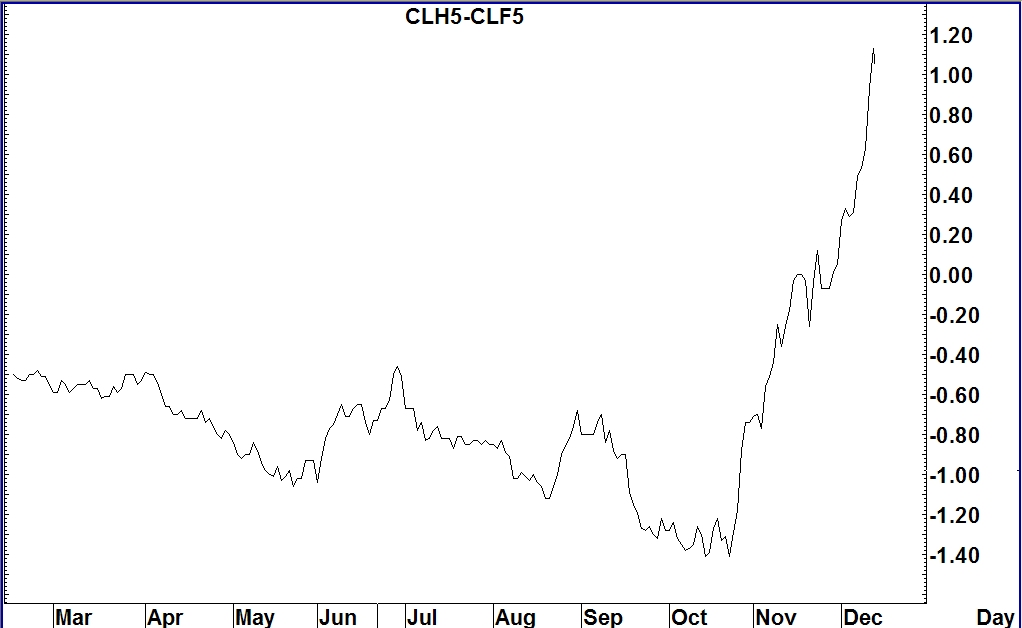

Trend: Earlier I said that spreads tend to trend much more dramatically than outright futures contracts. Not only that, but they trend more often than do outright futures. I don't have room here to show you the dozens of sharply trending spreads that can regularly be found in the markets, so we'll have to settle for a recent one. You'll have to take my word for it that this sort of trending happens frequently when trading spreads.

Opportunities: Because spreads tend to trend more often and more dramatically than do outright futures contracts, they offer more opportunities for earning money, and they do so without the interference and noise caused by computerized trading, scalpers, and market movers. Spreads avoid the "noise" in the markets. There are numerous reduced margin spread opportunities, enough to keep almost any trader busy. And it is the lack of interference by market makers and shakers that leads us to one of the most important advantage of trading spreads, whether they be reduced margin or full margin.

Invisibility: One of the primary problems with any kind of trading in the outrights, whether it be in futures or stocks, is that of stop running. The insiders love it when they can see your order. Even when your entry or exit is held mentally, they know where it is. They are keenly aware of where people place their orders. That is why they love Fibonacci and Gann traders. They know precisely where those people will place their orders. The same is true for anyone who uses one of the more commonly known indicators. The insiders fade moving average crossovers, and so-called overbought and oversold - regardless of which indicator is used to show either of those conditions. They know when prices have reached the outer limits of the Bollinger Bands, and they know the location of supposed support and resistance, etc. But with spreads, they have no idea of the location of your orders. You are long in one market and short in another. Your position is invisible to the insiders. They can't run your stop, because you don't have one. You cannot place a stop order in the market when trading spreads! Your exit point is entirely mental; it exists exclusively in your head. In that respect, spread trading is a more pure form of trading. It is the closest thing in trading to having a level playing field. Could that be the reason you hardly ever hear about spread trading?

Liquidity: Attempting to trade in "thin" illiquid markets is one of the surest ways to encounter serious stop running and bizarre price movements. However, other than occasional problems with getting filled, spread trading does not suffer from a lack of liquidity - which in itself creates more trading opportunities. I would never consider taking an outright position in feeder cattle. Feeders are a thin, illiquid market normally best left to professional interests. But a reduced margin (feeder cattle)-(live cattle) spread is something I look for all the time. Some of the moves in this particular spread are incredible. They are worth hundreds and even thousands of dollars per spread, several times a year. They are highly seasonal in nature due to the birth and growth cycles of cattle. The same thing is true of spreading both live and feeder cattle against lean hogs. These spreads are seasonal, which brings us to the next great advantage to spread trading - seasonality.

Seasonality: Whereas seasonality doesn't always take place as planned, i.e., seasonality can come early, late, or not at all, but when it is happening, you can see it. It is obvious when a seasonal trade is working as expected. Seasonality is not subject to the whims of man. Seasonality is one of the strongest reasons for trading spreads. Crops are planted within a given period of time. Calves and piglets are born according to their birth cycle and they grow according to their growth cycle. Even futures based on financial instruments are seasonal, and many of them offer reduced margin spreads.

Backwardation: Along with seasonality comes the huge profits that can be made when an underlying goes into backwardation. This is true for any agricultural commodity as well as any financial instrument. I don't have space here to explain backwardation, but when it occurs, which is commonplace, the spread between front and back months widens tremendously, thereby offering marvelous profit-making opportunities to the spread trader. As if that weren't enough, the same opportunity becomes available when the period of backwardation ends and the relationship between front and back months returns to normal.

Probabilities: If we eliminate those trades in the outrights in which you get yourself whipsawed in a sideways market and maybe win or lose a little, the actual odds of winning on any trade is 50%. If you are long and prices move down, you lose. Conversely, if you are short and prices move up, you lose. It doesn't matter how accurate is your trade selection, the bottom line is that your chances of being right once you enter a trade are one in two. However, when you enter a spread you are not primarily concerned with the direction of prices. Your primary concern is with the direction of the spread.

With a spread you can make money when both legs of the spread are moving up, both legs are moving down, when both legs are moving sideways but one more so than the other, or best of all, when the leg you are long is moving up and the leg you are short is moving down! As long as the leg you are long is moving better than the leg you are short, you will have a winning trade. There is only one situation in which you can lose with a spread, and that is to be dead wrong about both legs. So with a spread you can win even if you were wrong about the direction of price movement, as long as you're not too wrong. The chart gives you an idea of what I'm talking about. Both months of this natural gas trade were moving down, but the spread was widening and moving up.

There are additional opportunities in spread trading, including spreads that require full margin. You can trade spreads with stock indexes, sector funds, and single stock futures. Did you know you can daytrade stock index spreads? These are topics for another day and another time.

Unfortunately, either by accident or design, much of the truth of spread trading has been lost over the years. There are many more aspects to it than I have touched on here. Furthermore, there are some wonderful and inexpensive tools available that make spread trading a delight. Spread trading is one of the most relaxed ways to trade. It rarely takes more than 1-2 hours of your time each day, and more often than not, we are talking about only minutes per day to seek out and trade the wonderful opportunities that are available in reduced margin spreads.

Now that I've told you about spreads, my secret is no longer a secret.

What is a reduced margin spread?

Because of perceived lower volatility, exchanges grant reduced margins on certain types of spreads. Spreads consist of being long in one or more contracts of one market and short in one or more contracts of the same market but in different months - an intramarket spread; or being long in one or more contracts of one market and short one or more contracts of a different market, and in the same or different months - an intermarket spread.

Distortions about spreads

There are some distortions about spread trading that need to be dispelled. If we get them out of the way, I can show you the tremendous advantages spread trading has over any other form of trading.

It is said that spreads do not move as much as outright futures. I agree 100% with that statement. However, spreads trend much more often than outright futures, they trend much more dramatically than outright futures, and they trend for longer periods of time than do the outright futures. For these reasons you can make much more money with spreads than with the

outrights.

The second distortion about spread trading goes like this: "You have to pay double commissions when you trade spreads." Yes! You have to pay two commissions for every spread you enter in the market. So what? You are trading two contracts instead of one. You pay two commissions because you are trading two separate contracts, one in one place and the other in an entirely different place. Paying two commissions for two separate trades is hardly unfair. Let me tell you what is unfair - paying a round turn commission for an option that expires worthless. Why don't you hear people complaining about that? You pay for a round turn, and you receive only half a turn. Doesn't make a lot of sense, does it?

Advantages of Spread Trading

There are so many advantages to trading reduced margin spreads that I hope I don't run out of room here before I can tell you all of them. Let's begin with return on margin, i.e., yield.

Yield: As I write this, the margin to trade an outright futures position in crude oil is $4,725, whereas a spread trade in crude oil requires only $540, only 11.4% as much. If crude oil futures move one full point, that move is worth $1,000. If a crude oil spread moves one full point, that move is worth $1,000. That means either a 1 point favorable move in crude oil futures or a 1 point favorable move in a crude oil spread earns the trader $1,000. However, the difference in return on margin is extraordinary: In the futures the return is $1,000/$4,725=21%. For the spread, the return is $1000/540=185%. Think about that!

Leverage: This leads us to the next benefit of spread trading - with the same amount of margin, you could have traded 4 soybean spreads instead of one soybean futures. How's that for leverage? Instead of making $250 on a five point move, you could have made $1,000. Reduced margin spreads offer a much more efficient use of your margin money.

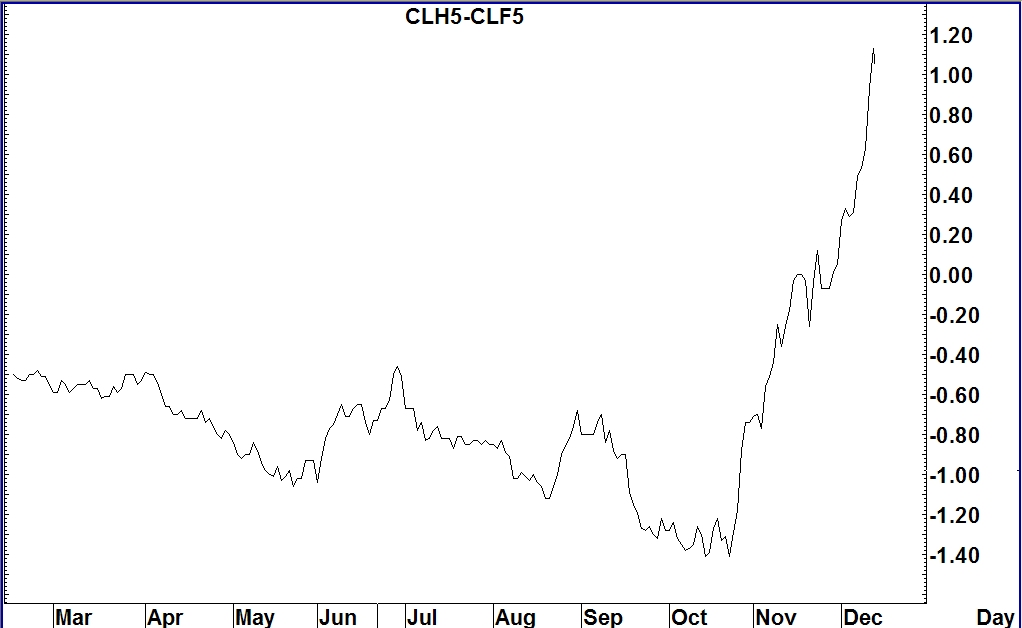

Trend: Earlier I said that spreads tend to trend much more dramatically than outright futures contracts. Not only that, but they trend more often than do outright futures. I don't have room here to show you the dozens of sharply trending spreads that can regularly be found in the markets, so we'll have to settle for a recent one. You'll have to take my word for it that this sort of trending happens frequently when trading spreads.

Opportunities: Because spreads tend to trend more often and more dramatically than do outright futures contracts, they offer more opportunities for earning money, and they do so without the interference and noise caused by computerized trading, scalpers, and market movers. Spreads avoid the "noise" in the markets. There are numerous reduced margin spread opportunities, enough to keep almost any trader busy. And it is the lack of interference by market makers and shakers that leads us to one of the most important advantage of trading spreads, whether they be reduced margin or full margin.

Invisibility: One of the primary problems with any kind of trading in the outrights, whether it be in futures or stocks, is that of stop running. The insiders love it when they can see your order. Even when your entry or exit is held mentally, they know where it is. They are keenly aware of where people place their orders. That is why they love Fibonacci and Gann traders. They know precisely where those people will place their orders. The same is true for anyone who uses one of the more commonly known indicators. The insiders fade moving average crossovers, and so-called overbought and oversold - regardless of which indicator is used to show either of those conditions. They know when prices have reached the outer limits of the Bollinger Bands, and they know the location of supposed support and resistance, etc. But with spreads, they have no idea of the location of your orders. You are long in one market and short in another. Your position is invisible to the insiders. They can't run your stop, because you don't have one. You cannot place a stop order in the market when trading spreads! Your exit point is entirely mental; it exists exclusively in your head. In that respect, spread trading is a more pure form of trading. It is the closest thing in trading to having a level playing field. Could that be the reason you hardly ever hear about spread trading?

Liquidity: Attempting to trade in "thin" illiquid markets is one of the surest ways to encounter serious stop running and bizarre price movements. However, other than occasional problems with getting filled, spread trading does not suffer from a lack of liquidity - which in itself creates more trading opportunities. I would never consider taking an outright position in feeder cattle. Feeders are a thin, illiquid market normally best left to professional interests. But a reduced margin (feeder cattle)-(live cattle) spread is something I look for all the time. Some of the moves in this particular spread are incredible. They are worth hundreds and even thousands of dollars per spread, several times a year. They are highly seasonal in nature due to the birth and growth cycles of cattle. The same thing is true of spreading both live and feeder cattle against lean hogs. These spreads are seasonal, which brings us to the next great advantage to spread trading - seasonality.

Seasonality: Whereas seasonality doesn't always take place as planned, i.e., seasonality can come early, late, or not at all, but when it is happening, you can see it. It is obvious when a seasonal trade is working as expected. Seasonality is not subject to the whims of man. Seasonality is one of the strongest reasons for trading spreads. Crops are planted within a given period of time. Calves and piglets are born according to their birth cycle and they grow according to their growth cycle. Even futures based on financial instruments are seasonal, and many of them offer reduced margin spreads.

Backwardation: Along with seasonality comes the huge profits that can be made when an underlying goes into backwardation. This is true for any agricultural commodity as well as any financial instrument. I don't have space here to explain backwardation, but when it occurs, which is commonplace, the spread between front and back months widens tremendously, thereby offering marvelous profit-making opportunities to the spread trader. As if that weren't enough, the same opportunity becomes available when the period of backwardation ends and the relationship between front and back months returns to normal.

Probabilities: If we eliminate those trades in the outrights in which you get yourself whipsawed in a sideways market and maybe win or lose a little, the actual odds of winning on any trade is 50%. If you are long and prices move down, you lose. Conversely, if you are short and prices move up, you lose. It doesn't matter how accurate is your trade selection, the bottom line is that your chances of being right once you enter a trade are one in two. However, when you enter a spread you are not primarily concerned with the direction of prices. Your primary concern is with the direction of the spread.

With a spread you can make money when both legs of the spread are moving up, both legs are moving down, when both legs are moving sideways but one more so than the other, or best of all, when the leg you are long is moving up and the leg you are short is moving down! As long as the leg you are long is moving better than the leg you are short, you will have a winning trade. There is only one situation in which you can lose with a spread, and that is to be dead wrong about both legs. So with a spread you can win even if you were wrong about the direction of price movement, as long as you're not too wrong. The chart gives you an idea of what I'm talking about. Both months of this natural gas trade were moving down, but the spread was widening and moving up.

There are additional opportunities in spread trading, including spreads that require full margin. You can trade spreads with stock indexes, sector funds, and single stock futures. Did you know you can daytrade stock index spreads? These are topics for another day and another time.

Unfortunately, either by accident or design, much of the truth of spread trading has been lost over the years. There are many more aspects to it than I have touched on here. Furthermore, there are some wonderful and inexpensive tools available that make spread trading a delight. Spread trading is one of the most relaxed ways to trade. It rarely takes more than 1-2 hours of your time each day, and more often than not, we are talking about only minutes per day to seek out and trade the wonderful opportunities that are available in reduced margin spreads.

Now that I've told you about spreads, my secret is no longer a secret.

Last edited by a moderator: