Many traders are seeking out assistance in their trading decisions from decision support tools we call technical indicators. While these are helpful, they are only to be used as support for our decision to buy where demand outstrips supply or to sell when supply overwhelms demand. We see this supply/demand imbalance on our charts as support and resistance. However, there is another useful data set that is independent of price that will give us clues as to the possible future of the markets. This data can be found in the Commitment of Traders report.

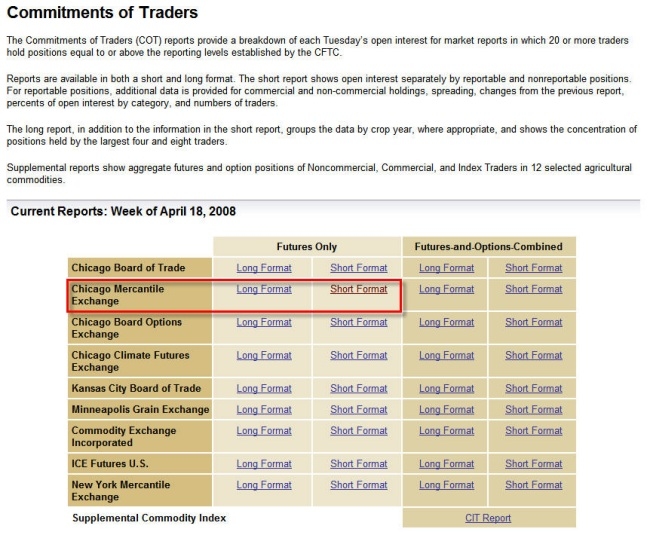

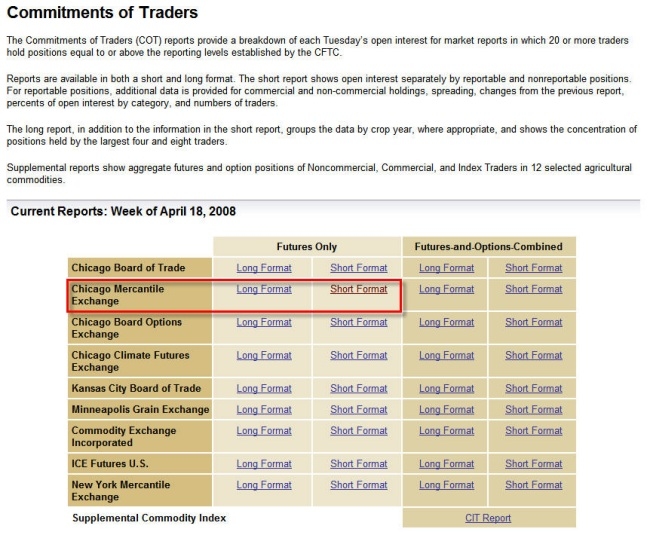

The Commitment of Traders (commonly referred to as the COT) report has been published by the Commodity Futures Trading Commission since 1962 and provides information on the open interest of futures contracts. The report can be found at www.cftc.gov and is published every Friday and contains the data from the previous Tuesday. A futures contract is a derivative which gets its value from an underlying asset. They are traded to either profit from future values of the asset or to hedge a position in the asset against a drop in price. The COT shows open interest in a multitude of commodity, currency, and stock index futures. Open interest differs from volume in that volume is the number of contracts actually traded per day while open interest is the number of contracts entered into, either long or short, that have not been offset by transactions or exercise. They are new or open contracts which can offer clues as to what the traders are anticipating price to do in the asset. This information can be used to assist us in our own trading decisions whether we are trading currency, commodities, futures, , or even stocks.

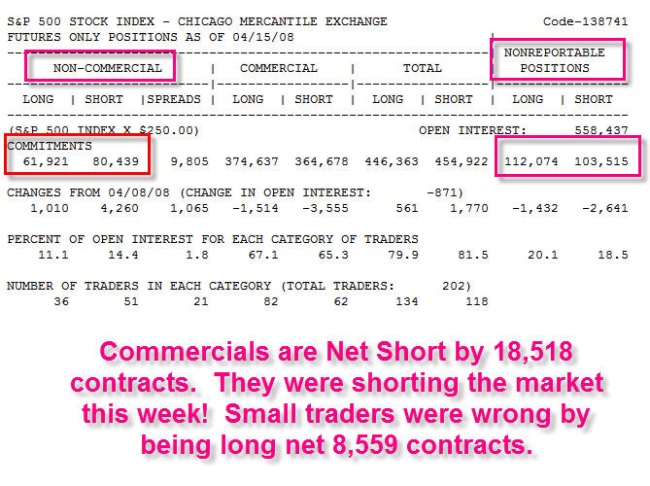

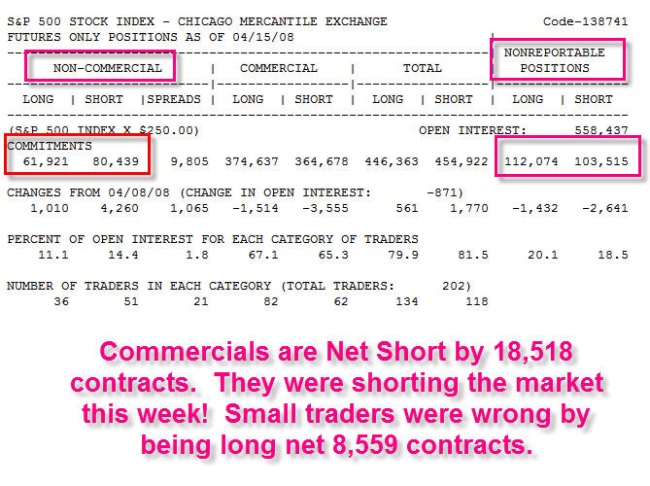

The COT breaks down open longs and shorts into three categories. We have the Commercials, the Non-Commercials, and the Non-Reportables. The Commercials are people or businesses who deal directly with the underlying asset such as farmers, miners, and international businesses. With commodity futures, they understand the true supply and demand of the asset and are trying to hedge against future price movement that could hurt operating profits. They are not usually trying to profit from the futures contract itself. Stock index futures are used to hedge institutional portfolios and for arbitrage opportunities. The Non-Commercials are large speculators and can represent "smart money." They are speculating on the future movement of the trend in the underlying asset. The Non-Reportable positions are the so called "dumb money." There are the small individual traders trying to play the direction of the markets for profit and are often wrong.

The COT provides the open interest for both longs and shorts for all three categories of traders. Subtract the net shorts from the net longs in each category to see if the Commercials, Non-Commercials, and small traders are net long or net short. To use the COT data, you should keep a chart of the data and see what the trend is for the three groups. This is not the simplest task as you will have to manually enter the data each week from the COT report but it can be beneficial to do the work. Are the traders going net long or net short? Are they increasing their longs or their shorts? To trade with the trend, follow the Non-Commercials. Remember, this is the "smart money" that seeks to profit from price movement in the futures contract. If they are net short and increasing their shorts, look to go short yourself. If they are net long and increasing their net longs, look to open longs as well.

The most powerful trading signal comes when the Commercials and Non-Commercials are trending in one direction while the Non-Reportables (small traders), are trending in the opposite. The divergence of these groups shows the professionals taking money from the public and you should definitely follow the professionals for greater probability of success.

The Commitment of Traders (commonly referred to as the COT) report has been published by the Commodity Futures Trading Commission since 1962 and provides information on the open interest of futures contracts. The report can be found at www.cftc.gov and is published every Friday and contains the data from the previous Tuesday. A futures contract is a derivative which gets its value from an underlying asset. They are traded to either profit from future values of the asset or to hedge a position in the asset against a drop in price. The COT shows open interest in a multitude of commodity, currency, and stock index futures. Open interest differs from volume in that volume is the number of contracts actually traded per day while open interest is the number of contracts entered into, either long or short, that have not been offset by transactions or exercise. They are new or open contracts which can offer clues as to what the traders are anticipating price to do in the asset. This information can be used to assist us in our own trading decisions whether we are trading currency, commodities, futures, , or even stocks.

The COT breaks down open longs and shorts into three categories. We have the Commercials, the Non-Commercials, and the Non-Reportables. The Commercials are people or businesses who deal directly with the underlying asset such as farmers, miners, and international businesses. With commodity futures, they understand the true supply and demand of the asset and are trying to hedge against future price movement that could hurt operating profits. They are not usually trying to profit from the futures contract itself. Stock index futures are used to hedge institutional portfolios and for arbitrage opportunities. The Non-Commercials are large speculators and can represent "smart money." They are speculating on the future movement of the trend in the underlying asset. The Non-Reportable positions are the so called "dumb money." There are the small individual traders trying to play the direction of the markets for profit and are often wrong.

The COT provides the open interest for both longs and shorts for all three categories of traders. Subtract the net shorts from the net longs in each category to see if the Commercials, Non-Commercials, and small traders are net long or net short. To use the COT data, you should keep a chart of the data and see what the trend is for the three groups. This is not the simplest task as you will have to manually enter the data each week from the COT report but it can be beneficial to do the work. Are the traders going net long or net short? Are they increasing their longs or their shorts? To trade with the trend, follow the Non-Commercials. Remember, this is the "smart money" that seeks to profit from price movement in the futures contract. If they are net short and increasing their shorts, look to go short yourself. If they are net long and increasing their net longs, look to open longs as well.

The most powerful trading signal comes when the Commercials and Non-Commercials are trending in one direction while the Non-Reportables (small traders), are trending in the opposite. The divergence of these groups shows the professionals taking money from the public and you should definitely follow the professionals for greater probability of success.

Last edited by a moderator: