A question recently came up about the symbols that represent options and what seems like a relatively boring and mundane topic is actually filled with twists and turns and many surprises. Okay, so it probably won't make you rich knowing more about option symbols than 99 percent of the non-professional options traders out there, but it will keep you from making mistakes when dealing with your broker, and in some circles, can make you a hit at cocktail parties.

The truth of the matter is that the system which has been in place for 25 years (since 1973) has not kept up with available technology and has become extremely unwieldy. In the industry, rumor has it that a particular large brokerage company, whose name I probably shouldn't mention (initials M.L.) has lobbied against making any changes so they would not have to make major expensive changes to their software. In any event, the situation has gotten out of control and an industry committee was formed to study the problems and propose solutions.

In this article, I'll describe the current symbology, associated problems and the proposed solutions and timetable.

Current Symbols

The original concept of the current symbology was to have every option represented by a symbol consisting of 3-5 alpha characters. The lack of numeric characters has proven to be painful. The characters would consist of a 1-3 letter base symbol, followed by a one letter expiration month code, followed by a one letter strike price code.

Limiting the base symbol to only 3 characters works well for stock symbols of 3 characters or less, i.e. Citigroup (C), General Electric (GE), or Avon Products (AVP). However when NASDAQ came along with its 4 and 5 letter symbols, that was the first major problem. So instead of allowing the base symbol to be up to 5 letters in length, it was decided to keep the maximum to 3, thereby creating the need for some ingenuity. It was decided that the OCC (Options Clearing Corporation) would assign base symbols for these stocks. Generally they will include the letter Q in the symbol, but not always. Example, Microsoft whose symbol is MSFT has a base symbol of MSQ, but Research in Motion, RIMM, has a base symbol of RUL. What a system!

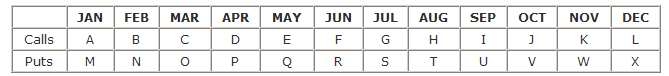

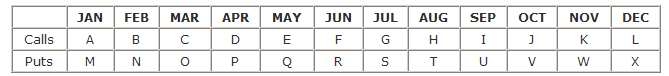

Next, we have the expiration month code, which also identifies the option as a Put or a Call. The expiration month codes are:

These codes assume the standard expiration, i.e. the Saturday following the 3rd Friday of each month. That worked fine for awhile, but with the introduction of options with non-standard expirations such as the VIX which expire on the 3rd Wednesday of the month, and then flex options, which can expire on almost any day of the year, there were problems of non-standardization. When weekly options were introduced the OCC had no choice but to add a weak indicator (pun intended) after the base symbol, changing the length of these options to as many as 6 characters. For that reason, many platforms cannot recognize these symbols and therefore won't let you trade weekly options.

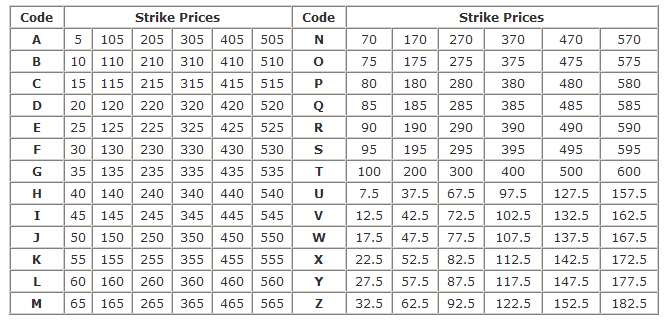

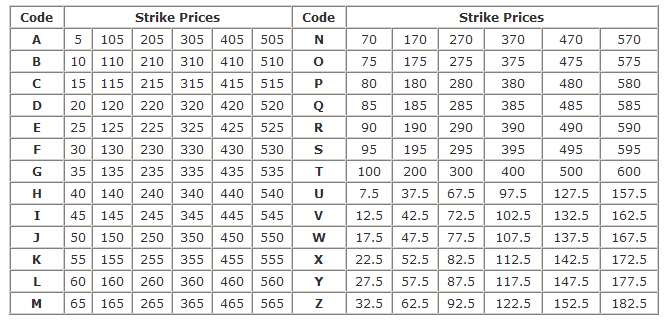

The final part of the symbol is the strike code. These are:

Let's look at some examples of what a complete option symbol looks like, and then I'll point out some more problems.

Notice that there are at most 26 possible strike codes for a given option; A-Z. In situations where a stock has been very volatile, there may be more than 26 strikes listed. For example, the RIMM April options have strikes from 40 to 150. So what the OCC decided to do was to add an additional base symbol that would also represent the same underlying stock. These symbols are called "wrap symbols." So for RIMM in April, there are 2 base symbols RFY and RUL.

There are many other problems such as how to handle LEAP options (you need different base symbols for January 09, 10, and 11.) Then there's the issue of non-standard strikes and, of course, stock splits, mergers, and other types of corporate re-organizations. Generally, most of these have been handled by adding more wrap symbols. To give you a feel for how confusing this can really get, I counted 13 different base symbols for GOOG. There's a good chance that unless you were trading Google options, you might not know that OUPAH are the Jan 09 440 Calls.

Proposed Symbols

Well, it's quite clear that the current system cannot continue. So a group of options industry professionals formed a committee "to overhaul the symbology used in representing listed options in data transmissions between market constituents." It may not seem like a big deal, but when you think about the quoting and reporting of options prices and the multitude of platforms that will have to be revised and programmed, and brokers and traders that will need to be re-educated, the project is huge.

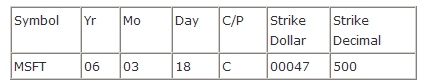

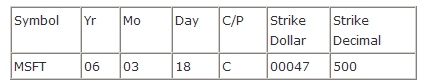

The proposed system would have a symbol that would have both alpha and numeric characters and would be up to 21 characters in length. This issue of length was discussed in great detail, because of the amount of data transmission going on there was a fear that the increased length could slow down the transmissions. However, with the ever increasing computer and bandwith technology, it was not determined to be a major issue. The new proposed symbol representing a Microsoft June 47.50 Call would look like this:

The first column, symbol, could be up to 6 characters. The next 3 columns represent the expiration date, then a Put/Call indicator and dollar part of the strike price followed by the decimal part of the strike price. I'm sure they must have a reason for breaking up the strike price like that, but I don't know it. This seems like a pretty nice solution, and there is some flexibility to allow for future changes in the options market, but even so it is not perfect. As new types of exotic options become exchange listed, (binary, one-touch, etc.) the symbology will have to keep pace.

The projected date for making changes is July 31, 2009, although several of my high level contacts tell me that it is likely to be delayed. We shall see.

The truth of the matter is that the system which has been in place for 25 years (since 1973) has not kept up with available technology and has become extremely unwieldy. In the industry, rumor has it that a particular large brokerage company, whose name I probably shouldn't mention (initials M.L.) has lobbied against making any changes so they would not have to make major expensive changes to their software. In any event, the situation has gotten out of control and an industry committee was formed to study the problems and propose solutions.

In this article, I'll describe the current symbology, associated problems and the proposed solutions and timetable.

Current Symbols

The original concept of the current symbology was to have every option represented by a symbol consisting of 3-5 alpha characters. The lack of numeric characters has proven to be painful. The characters would consist of a 1-3 letter base symbol, followed by a one letter expiration month code, followed by a one letter strike price code.

Limiting the base symbol to only 3 characters works well for stock symbols of 3 characters or less, i.e. Citigroup (C), General Electric (GE), or Avon Products (AVP). However when NASDAQ came along with its 4 and 5 letter symbols, that was the first major problem. So instead of allowing the base symbol to be up to 5 letters in length, it was decided to keep the maximum to 3, thereby creating the need for some ingenuity. It was decided that the OCC (Options Clearing Corporation) would assign base symbols for these stocks. Generally they will include the letter Q in the symbol, but not always. Example, Microsoft whose symbol is MSFT has a base symbol of MSQ, but Research in Motion, RIMM, has a base symbol of RUL. What a system!

Next, we have the expiration month code, which also identifies the option as a Put or a Call. The expiration month codes are:

These codes assume the standard expiration, i.e. the Saturday following the 3rd Friday of each month. That worked fine for awhile, but with the introduction of options with non-standard expirations such as the VIX which expire on the 3rd Wednesday of the month, and then flex options, which can expire on almost any day of the year, there were problems of non-standardization. When weekly options were introduced the OCC had no choice but to add a weak indicator (pun intended) after the base symbol, changing the length of these options to as many as 6 characters. For that reason, many platforms cannot recognize these symbols and therefore won't let you trade weekly options.

The final part of the symbol is the strike code. These are:

Let's look at some examples of what a complete option symbol looks like, and then I'll point out some more problems.

Notice that there are at most 26 possible strike codes for a given option; A-Z. In situations where a stock has been very volatile, there may be more than 26 strikes listed. For example, the RIMM April options have strikes from 40 to 150. So what the OCC decided to do was to add an additional base symbol that would also represent the same underlying stock. These symbols are called "wrap symbols." So for RIMM in April, there are 2 base symbols RFY and RUL.

There are many other problems such as how to handle LEAP options (you need different base symbols for January 09, 10, and 11.) Then there's the issue of non-standard strikes and, of course, stock splits, mergers, and other types of corporate re-organizations. Generally, most of these have been handled by adding more wrap symbols. To give you a feel for how confusing this can really get, I counted 13 different base symbols for GOOG. There's a good chance that unless you were trading Google options, you might not know that OUPAH are the Jan 09 440 Calls.

Proposed Symbols

Well, it's quite clear that the current system cannot continue. So a group of options industry professionals formed a committee "to overhaul the symbology used in representing listed options in data transmissions between market constituents." It may not seem like a big deal, but when you think about the quoting and reporting of options prices and the multitude of platforms that will have to be revised and programmed, and brokers and traders that will need to be re-educated, the project is huge.

The proposed system would have a symbol that would have both alpha and numeric characters and would be up to 21 characters in length. This issue of length was discussed in great detail, because of the amount of data transmission going on there was a fear that the increased length could slow down the transmissions. However, with the ever increasing computer and bandwith technology, it was not determined to be a major issue. The new proposed symbol representing a Microsoft June 47.50 Call would look like this:

The first column, symbol, could be up to 6 characters. The next 3 columns represent the expiration date, then a Put/Call indicator and dollar part of the strike price followed by the decimal part of the strike price. I'm sure they must have a reason for breaking up the strike price like that, but I don't know it. This seems like a pretty nice solution, and there is some flexibility to allow for future changes in the options market, but even so it is not perfect. As new types of exotic options become exchange listed, (binary, one-touch, etc.) the symbology will have to keep pace.

The projected date for making changes is July 31, 2009, although several of my high level contacts tell me that it is likely to be delayed. We shall see.

Last edited by a moderator: