You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

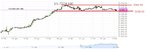

Short NASDAQ-100

Net P/L -6.67 points

Amount 1 Contracts

Opening Rate 5053.04

Close Rate 5059.71

Open Time 1/13/2017 3:56 PM

Close Time 1/13/2017 4:51 PM

Stop loss: fixed stop above the highest high

Entry and exit on a 1m chart

Reason of closure: fixed stop loss got hit

Comments

Rather late entry but still plenty of opportunity. I did hesitate for a bit because I thought there may have formed a new support level around the orange line but then I thought price staying 5 minutes at the same level does not mean its support yet. Alas I was right and it was. If I had established that as support I could have narrowed my SL near the second full orange line and instead of a big loser had a small +2 point winner. But now there was no reason to tighten cause 5044 was still far off. Legitimate loser, price is continuously moving and so are S&R levels, if you happen to be in a trade while one is forming (or rather exposing itself) you need to make a descision whether to act on it or ignore it. I chose the latter but turned out bad.

Net P/L -6.67 points

Amount 1 Contracts

Opening Rate 5053.04

Close Rate 5059.71

Open Time 1/13/2017 3:56 PM

Close Time 1/13/2017 4:51 PM

Stop loss: fixed stop above the highest high

Entry and exit on a 1m chart

Reason of closure: fixed stop loss got hit

Comments

Rather late entry but still plenty of opportunity. I did hesitate for a bit because I thought there may have formed a new support level around the orange line but then I thought price staying 5 minutes at the same level does not mean its support yet. Alas I was right and it was. If I had established that as support I could have narrowed my SL near the second full orange line and instead of a big loser had a small +2 point winner. But now there was no reason to tighten cause 5044 was still far off. Legitimate loser, price is continuously moving and so are S&R levels, if you happen to be in a trade while one is forming (or rather exposing itself) you need to make a descision whether to act on it or ignore it. I chose the latter but turned out bad.

Short NASDAQ-100

Net P/L -6.67 points

Amount 1 Contracts

Opening Rate 5053.04

Close Rate 5059.71

Open Time 1/13/2017 3:56 PM

Close Time 1/13/2017 4:51 PM

Stop loss: fixed stop above the highest high

Entry and exit on a 1m chart

View attachment 233262

Reason of closure: fixed stop loss got hit

Comments

Rather late entry but still plenty of opportunity. I did hesitate for a bit because I thought there may have formed a new support level around the orange line but then I thought price staying 5 minutes at the same level does not mean its support yet. Alas I was right and it was. If I had established that as support I could have narrowed my SL near the second full orange line and instead of a big loser had a small +2 point winner. But now there was no reason to tighten cause 5044 was still far off. Legitimate loser, price is continuously moving and so are S&R levels, if you happen to be in a trade while one is forming (or rather exposing itself) you need to make a descision whether to act on it or ignore it. I chose the latter but turned out bad.

Mine turned out disappointing, too. Shorted at 5058 and, after more than an hour, lost patience and called it a day for a loss of 5 points. Wish you luck from this point!

Well, I am hoping to not need any luck in the future 😉 But I appreciate the gesture 🙂Mine turned out disappointing, too. Shorted at 5058 and, after more than an hour, lost patience and called it a day for a loss of 5 points. Wish you luck from this point!

Short NASDAQ-100

Net P/L +7.74 points

Amount 1 Contracts

Opening Rate 5066.24

Close Rate 5058.5

Open Time 1/19/2017 4:07 PM

Close Time 1/19/2017 4:17 PM

Stop loss: fixed stop above the highest high

Entry and exit on a 1m chart

Reason of closure: narrow trailing SL got hit.

Comments

Before I got into the position I said to myself I would enter if price reached the orange dot. I was a bit late but there was still enough opportunity so I entered short. At 16:15 price was nearing the 5053.70 level so I removed my fixed SL and put in an as tight as possible trailing SL. Which got hit two minutes later. Good trade, classic example of what I am trying to take advantage of. Afterwards price kept hovering around the 5053.70 level confirming it's a support level.

Net P/L +7.74 points

Amount 1 Contracts

Opening Rate 5066.24

Close Rate 5058.5

Open Time 1/19/2017 4:07 PM

Close Time 1/19/2017 4:17 PM

Stop loss: fixed stop above the highest high

Entry and exit on a 1m chart

Reason of closure: narrow trailing SL got hit.

Comments

Before I got into the position I said to myself I would enter if price reached the orange dot. I was a bit late but there was still enough opportunity so I entered short. At 16:15 price was nearing the 5053.70 level so I removed my fixed SL and put in an as tight as possible trailing SL. Which got hit two minutes later. Good trade, classic example of what I am trying to take advantage of. Afterwards price kept hovering around the 5053.70 level confirming it's a support level.

Yesterday the setup was good enough to trade but price was going down again as you can see on previous daily chart. I waited for an upmove but during the time I watched that didn't really happen as you can see on the 5 min chart below between the two red lines. The vertical orange line is the end of the 23-01-2017 preparation screenshot. After that I wasn't watching the market anymore but price fell again, whereafter it finally recovered.

Good that I avoided this trade cause it would have stopped me out for sure. Too bad for the missed opportunity but there are plenty anyway.

Purely technically speaking according to my current plan I should have taken a position at either one of the blue dots. I did not because price already reversed from a first reversal and failed to make a higher high on both the blue dots. I almost certainly have to add that rule to my trading plan!!!.

Good that I avoided this trade cause it would have stopped me out for sure. Too bad for the missed opportunity but there are plenty anyway.

Purely technically speaking according to my current plan I should have taken a position at either one of the blue dots. I did not because price already reversed from a first reversal and failed to make a higher high on both the blue dots. I almost certainly have to add that rule to my trading plan!!!.

Long NASDAQ-100

Net P/L +2.74 points

Amount 0.005 Contracts (broker suddenly allows to buy less than one contract, which means I can trade again with my real 500 euro account)

Opening Rate 5067.88

Close Rate 5070.62

Open Time 1/24/2017 4:13 PM

Close Time 1/24/2017 4:29 PM

Stop loss: fixed stop below the lowest low

Entry and exit on a 1m chart

Reason of closure: narrow trailing SL got hit.

Comments

Wanted to enter juuuuust a little earlier than I did, but work obligations. Because of this I was closer to the resistance level than I wanted and when price was nearing the resistance level I technically should have put a tigher SL. However if price from then on reversed it would mean I would make a loss, which defeats the purpose of why I put that into my system so I decided to not put it yet. Believe it or not but exactly at the peak I put a trailing 2.50 point SL in place. Which got hit at 5070.62. Why put it there? Well the resistance level was breached and could become support and this time there were actual profits to saveguard. As you can see that did happen.

Pretty big move but only modest profits, this is why you should only play big moves. Spread + traling SL and possibly not optimal timing can ruin a trade with a narrow margin for error.

Net P/L +2.74 points

Amount 0.005 Contracts (broker suddenly allows to buy less than one contract, which means I can trade again with my real 500 euro account)

Opening Rate 5067.88

Close Rate 5070.62

Open Time 1/24/2017 4:13 PM

Close Time 1/24/2017 4:29 PM

Stop loss: fixed stop below the lowest low

Entry and exit on a 1m chart

Reason of closure: narrow trailing SL got hit.

Comments

Wanted to enter juuuuust a little earlier than I did, but work obligations. Because of this I was closer to the resistance level than I wanted and when price was nearing the resistance level I technically should have put a tigher SL. However if price from then on reversed it would mean I would make a loss, which defeats the purpose of why I put that into my system so I decided to not put it yet. Believe it or not but exactly at the peak I put a trailing 2.50 point SL in place. Which got hit at 5070.62. Why put it there? Well the resistance level was breached and could become support and this time there were actual profits to saveguard. As you can see that did happen.

Pretty big move but only modest profits, this is why you should only play big moves. Spread + traling SL and possibly not optimal timing can ruin a trade with a narrow margin for error.

Long NASDAQ-100

Net P/L -7.81 points

Amount 1 Contract

Opening Rate 5155.03

Close Rate 5147.22

Open Time 1/27/2017 4:02 PM

Close Time 1/27/2017 4:08 PM

Stop loss: fixed stop below the lowest low

Entry and exit on a 1m chart

Reason of closure: fixed SL got hit

Comments

I was watching the 1m chart and thinking, just wait to go in just wait, but it kept going up and price was about to make a higher high but not just quite yet so I decided on a whim to enter to not miss most of the action, conform to the system yes technically.... although I would have to had entered earlier then. But those trades are always the worst. I bought at the top of course and got stopped out at the bottom 😆. No higher high was made so price continued downwards.

Also, price was not that close to support yet. I guess I didn't put too much important on the levels because I felt they were weak, but it seems again that they were somewhat correct. Anyway, this is an emotional patience mistake. I think it is good to wait to enter until price makes a higher high in these circumstances. In this case it would mean giving up almost half of the move, but it's better to gain half than to lose. The difference was still big enough to make a good profit. That would be at the blue dot. And it is what I did in my second trade. But there I made another mistake haha 😆

Net P/L -7.81 points

Amount 1 Contract

Opening Rate 5155.03

Close Rate 5147.22

Open Time 1/27/2017 4:02 PM

Close Time 1/27/2017 4:08 PM

Stop loss: fixed stop below the lowest low

Entry and exit on a 1m chart

Reason of closure: fixed SL got hit

Comments

I was watching the 1m chart and thinking, just wait to go in just wait, but it kept going up and price was about to make a higher high but not just quite yet so I decided on a whim to enter to not miss most of the action, conform to the system yes technically.... although I would have to had entered earlier then. But those trades are always the worst. I bought at the top of course and got stopped out at the bottom 😆. No higher high was made so price continued downwards.

Also, price was not that close to support yet. I guess I didn't put too much important on the levels because I felt they were weak, but it seems again that they were somewhat correct. Anyway, this is an emotional patience mistake. I think it is good to wait to enter until price makes a higher high in these circumstances. In this case it would mean giving up almost half of the move, but it's better to gain half than to lose. The difference was still big enough to make a good profit. That would be at the blue dot. And it is what I did in my second trade. But there I made another mistake haha 😆

Long NASDAQ-100

Net P/L +0.07 points

Amount 1 Contract

Opening Rate 5154.15

Close Rate 5154.22

Open Time 1/27/2017 4:27 PM

Close Time 1/27/2017 4:41 PM

Stop loss: fixed stop below the lowest low

Entry and exit on a 1m chart

Reason of closure: manually exited position.

Comments

I manually exited because I thought price was going nowhere, and it was, for a short time, but since I was watching 1min chart that was only for 15 minutes. If I had trusted in my system I had a good profit or a very good profit depending on where I would have tightened my SL, now I just have a break even trade.

Anyway, price ONCE MORE adheres very nicely to my predefined levels. Seems like I got that down... and still I'm not able to make money haha. Keep getting closer and closer though I have the feeling. At least now I am trading break even give or take while making mistakes. In the past I had huge loses while making mistakes.

We keep marching on. Gotta think about adapting the system though, I find it difficult to stick with it because I have come to new insights. Probably best to change it so that it is conform my new insights but not before I double check it with my other data in here. I have resisted the urge to change it a few times already and rightfully so, but you have to re-evaluate at some point.

Oh yeah, price started going up THE exact moment I closed the position, one of those days huh 😛

Net P/L +0.07 points

Amount 1 Contract

Opening Rate 5154.15

Close Rate 5154.22

Open Time 1/27/2017 4:27 PM

Close Time 1/27/2017 4:41 PM

Stop loss: fixed stop below the lowest low

Entry and exit on a 1m chart

Reason of closure: manually exited position.

Comments

I manually exited because I thought price was going nowhere, and it was, for a short time, but since I was watching 1min chart that was only for 15 minutes. If I had trusted in my system I had a good profit or a very good profit depending on where I would have tightened my SL, now I just have a break even trade.

Anyway, price ONCE MORE adheres very nicely to my predefined levels. Seems like I got that down... and still I'm not able to make money haha. Keep getting closer and closer though I have the feeling. At least now I am trading break even give or take while making mistakes. In the past I had huge loses while making mistakes.

We keep marching on. Gotta think about adapting the system though, I find it difficult to stick with it because I have come to new insights. Probably best to change it so that it is conform my new insights but not before I double check it with my other data in here. I have resisted the urge to change it a few times already and rightfully so, but you have to re-evaluate at some point.

Oh yeah, price started going up THE exact moment I closed the position, one of those days huh 😛

Trading System as of 30-01-2017 (to be tested)

1) Define S&R levels up front monthly, weekly and daily

2) Look for big moves 8 points or more (over the course of maximum 4 hours), that is either within a Range (between S and R levels) or an outbreak from them

3) Watch where it reverses after a lower low and wait for price to retrace.

4) If price reverses once again, take a position once the high (or low) previous to the retrace has been breached.

5) put stop loss at 0.25 above or below highest high or lowest low

6) when nearing resistance (1p distance) or 3R profit put in a tight (tightest possible) trailing SL.

7) avoid trading during US market open for now. Must a trade drag on long and would still be open during US market open, put tight trailings SL. Or close in case left over profit would be 0 or less.

1) Define S&R levels up front monthly, weekly and daily

2) Look for big moves 8 points or more (over the course of maximum 4 hours), that is either within a Range (between S and R levels) or an outbreak from them

3) Watch where it reverses after a lower low and wait for price to retrace.

4) If price reverses once again, take a position once the high (or low) previous to the retrace has been breached.

5) put stop loss at 0.25 above or below highest high or lowest low

6) when nearing resistance (1p distance) or 3R profit put in a tight (tightest possible) trailing SL.

7) avoid trading during US market open for now. Must a trade drag on long and would still be open during US market open, put tight trailings SL. Or close in case left over profit would be 0 or less.

Last edited:

Long NASDAQ-100

Net P/L +6.95 points

Amount 0.1 Contract (I did this on my real account but since there is not much cash left there I could not buy a full contract)

Opening Rate 5109.03

Close Rate 5115.98

Open Time 1/30/2017 5:11 PM

Close Time 1/30/2017 8:55 PM

Stop loss: fixed stop below the lowest low

Entry and exit on a 1m chart

Entry and exit on a 5m chart

Reason of closure: manually exited position because 3R has been reached and should have hit my tightened SL at 18:30 anyway had I been there to actually set it. I was not so I just exited manually.

Comments

Very big move but the counter move was minimal. Still by waiting for a retrace(of the reversal) and waiting for the reversal of that beating the first reversal quite a good result was made since price did move quite a bit, only not that much relative to the initial big move.

Ok, my previous system would have scored better here cause the SL would never have been reached in this case. But, that is of course this case. No levels visible on the result charts because they are out of range. Yeah one can be drawn on the 5m chart at the top but it's not very relevant for this trade.

Net P/L +6.95 points

Amount 0.1 Contract (I did this on my real account but since there is not much cash left there I could not buy a full contract)

Opening Rate 5109.03

Close Rate 5115.98

Open Time 1/30/2017 5:11 PM

Close Time 1/30/2017 8:55 PM

Stop loss: fixed stop below the lowest low

Entry and exit on a 1m chart

Entry and exit on a 5m chart

Reason of closure: manually exited position because 3R has been reached and should have hit my tightened SL at 18:30 anyway had I been there to actually set it. I was not so I just exited manually.

Comments

Very big move but the counter move was minimal. Still by waiting for a retrace(of the reversal) and waiting for the reversal of that beating the first reversal quite a good result was made since price did move quite a bit, only not that much relative to the initial big move.

Ok, my previous system would have scored better here cause the SL would never have been reached in this case. But, that is of course this case. No levels visible on the result charts because they are out of range. Yeah one can be drawn on the 5m chart at the top but it's not very relevant for this trade.

Similar threads

- Replies

- 817

- Views

- 85K

- Replies

- 152

- Views

- 52K

- Replies

- 0

- Views

- 2K