It's time to answer some post. It was weekend.

1st of all thank you NVP for your support & my kind regards to Splitlink, Swissy & other members too.

😉

Now I already mentioned & so as NVP said it was a holiday time, so they were not active. People need break too.

About my performance & KTs. I use KTs to avoid over trading.

I am following this template from this July.

View attachment 226490

My performance:

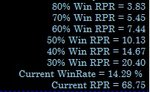

View attachment 226492

It may be small pips but better win rate & no over trading etc. It's improving.

I can not share my June performance because that time I was not using any template. So I made loss during the last day of brexit. It was wrong decision anyway to trade during such volatile moment (Gamblers day).

But I am happy that I found my way.

I am tired of listening to all those negative comments.

From now on, I think it will be wise not to share any trading development / Upgradation on my thread. I will only share my performance report either weekly or monthly.

That's all. I'm done.

Keep Trading....

😏