Thank you for your view on hard stops.

Yes you are right those could be really wrong entry.

Now, i will ask few questions, having some confusion. Some may find it repetitive, but honestly i feel that's the place where i need to improve.

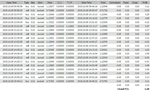

Case 1: This is the last trade which i have taken. After 3rd attempt I made profit. There was some multi lots. Which eventually helped me to reduce my losses. If i holded that trade more 5 pips. I could reach 10+ profit. But i didn't wanted to hold my risked lots longer so closed.

View attachment 201660

Zooming in same chart:

View attachment 201662

So far what i have noticed your charts, that your entries are at first level based on faster LR. I mean trend change first shows up on those 2 LRs. Then other LRs get lined up. Just like the picture posted above under such case, i need lots of trial before getting a good trend isn't it?

If I made any mistake please correct me. New addition 100 LR, sometimes market stays below or above it. Say above it, Now my job will be looking for buy trades? Where? When market pullback around 100 LR there? or I shall scalp sell trades towards 100 LR pullback zone? (bit risky if the trend is strong)

I know i asked lots of question. Reply at your pace. No hurry.

Regards

Hi Sun

I am going to try and help you now over October cherry pick the scalp opportunities you have available every normal trading hour - in theory with my system 5 or 6 per hour - but maybe only 2 or 3 max may be good and offering over 5+ pips.

The longer 2 LRs you are now using will start to help you with session price structure for the next 30 -60 mins.

You have given a good example on your EJ chart

You need to use the 2 quick LRs to be in "sync" with the 2 slightly longer ones - ie on EJ chart we could see the buy developing further

Other clues to assist you cherry pick are the previous 10 -30 mins of action - if we have had a new interim low or high - ideal opportunity to look for interim S & R's and time all coming together so that you can take a new scalp in the opposite direction

As an example this afternoon I had scalp sold the UCad after 1 39 pm - 9 mins after news and a scalp buy - and expected to scalp buy again approx 22 - 27 pips lower around 3105

When we got to that price - the supports were not strong enough to give the momentum for a bounce and a 5 -10+ pip bounce back up

So I stayed with 30% on the sell and looked again to buy approx 7 pips lower

That also failed - I did not enter as I could see my multi LRs still said bear sell bias

In the end the whole move dropped approx 100 pips from were I originally scalp sold - and i was only looking for 15 -25 pips initially

By banking 70% and staying with 30% on the sell as we kept breaching interim supports I could add more stakes on more scalp sells and then any bounces just take some profit off ( pyramid and peeling)

I will get more into this in stage 4 and 5

The key on the scalp sell on the UCad after 1 39 pm was the fact it had been bullish and did a new daily high after news ( I got 21 pips on a scalp buy) and so more bulls would be coming in expecting price to continue rising.

See chart on set up below

It was market set up of false sentiment to catch out new bulls as well as bears not expecting a 100 pip fall - perfect - the market tricks all - except experienced intraday scalpers etc

After I had scalp sold and it breached my first scalp buy possibility - then it was more clues it wanted lower as time rules came in over 30 and 60 mins with no new highs - favouring lower again

This is how you will eventually be able to turn a scalp into a swing and even make a 50 pip move make you 80 or even 100+ pips - just by PPNDing and keeping stops in profit - so with less stress and baby sitting required

Its a few stages away yet - first on stage 3 we need to improve your timing slightly - get win ratios averaging over 65% and maintain your excellent disciplines you are already incorporating.

You will be lining up scalps and cherry picking more - some days you might only take 7 or 10 single trades and easily make over 50 pips because you winner will be 15+ - instead of just 5 -10 pips

Step by step and you will see the difference in this month

😉

Regards

F