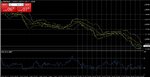

On Thursday, the dollar is stable to seven-week highs against other major currencies, as the US currency had a significant support to the renewed expectations of an increase of the base rate in the US in June. The EUR/USD is almost unchanged at 1.1217, the low of March.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

During Wednesday session the single currency extended losses. The EUR/USD pair traded in a narrow range, dropped to intraday low at 1.1179 and ticked daily high at 1.1229. Technically the euro recorded third consecutive weak session to a closing price of 1.1201. First support is seen at 1.1150, and resistance at 1.1220.

volfixtrader

Member

- Messages

- 86

- Likes

- 2

On the pair EUR/USD (6E) using volumetric analysis we can see that price has reached global level of support. Also we can see that yesterday day's profile approved it. When we look at the hour chart we can see that also big local volume accumulation near level. So this is a big probability of pullback price from this level. If you have short position you should think about closing part of them.

Yesterday EURUSD fell with a narrow range and closed in the middle of the daily range, however managed to close below the previous day low, suggesting bearish momentum.

The pair is trading below the 10 and the 50-day moving averages that are acting as dynamic resistances although still trading above the 200-day moving average that is acting as a dynamic support.

The key levels to watch are: The 50-day moving average at 1.1333 (resistance), the 10-day moving average at 1.1319 (resistance), a daily resistance at 1.1237, a swing low at 1.1141 (support) and a daily support at 1.1097.

The pair is trading below the 10 and the 50-day moving averages that are acting as dynamic resistances although still trading above the 200-day moving average that is acting as a dynamic support.

The key levels to watch are: The 50-day moving average at 1.1333 (resistance), the 10-day moving average at 1.1319 (resistance), a daily resistance at 1.1237, a swing low at 1.1141 (support) and a daily support at 1.1097.

On Friday, the dollar is trading at seven-week highs against other major currencies, as the expectations of the Fed raising interest rates next month, continues to provide significant support to the US currency, while today, investors are preparing for the publication of US data on home sales in the secondary market. The EUR/USD rose 0.17% to 1.1221, but remains near a seven-week Thursday's low 1.1180.

victoriajensen

Established member

- Messages

- 648

- Likes

- 10

Considering the doji candlestick on the four-hour time-frame EUR/USD will likely continue falling and break below 1.1200 again. If it does next target is probably 1.1150.

ForexDisco

Newbie

- Messages

- 8

- Likes

- 0

I'm staying long USDJPY. As I said earlier this week the BOJ is going to be adding liquidity not taking it away.

I think today's announcement by the BOJ late in North American trading was a smoke screen to keep the discourse during the G7 polite.

I think today's announcement by the BOJ late in North American trading was a smoke screen to keep the discourse during the G7 polite.

fxstrategist

Established member

- Messages

- 603

- Likes

- 17

Eurusd

The EURUSD bounces to the upside from the 1.1200 level. May reach the 1.1300 again.

The EURUSD bounces to the upside from the 1.1200 level. May reach the 1.1300 again.

On the last Friday’s session the EURUSD rose with a narrow range and closed near the high of the day, but closed within the previous day range, suggesting being slightly on the bullish side of neutral.

The pair is trading below the 10 and the 50-day moving averages that are acting as dynamic resistances although still trading above the 200-day moving average that is acting as a dynamic support.

The key levels to watch are: The 50-day moving average at 1.1333 (resistance), the 10-day moving average at 1.1304 (resistance), a daily resistance at 1.1237, a swing low at 1.1141 (support) and a daily support at 1.1097.

The pair is trading below the 10 and the 50-day moving averages that are acting as dynamic resistances although still trading above the 200-day moving average that is acting as a dynamic support.

The key levels to watch are: The 50-day moving average at 1.1333 (resistance), the 10-day moving average at 1.1304 (resistance), a daily resistance at 1.1237, a swing low at 1.1141 (support) and a daily support at 1.1097.

arigoldman

Established member

- Messages

- 626

- Likes

- 10

Bearish on this pair.

victoriajensen

Established member

- Messages

- 648

- Likes

- 10

I agree, the pair is clearly bearish, but it is also still testing the support at 1.1200. Let's hope that tomorrow there will be a bit more volatility.

Last edited:

I agree, the pair is clearly bearish, but it is also still testing the support at 1.1200. Let's hope that tomorrow there will be a bit more volatility.

I would say very likely, let's see the pair could break out it's current range from 1.1250 to 1.1170.

fxstrategist

Established member

- Messages

- 603

- Likes

- 17

Eurusd

The consolidation continues on the EURUSD around the 1.1200 level, it looks like it wants to break to the downside.

The consolidation continues on the EURUSD around the 1.1200 level, it looks like it wants to break to the downside.

Yesterday EURUSD went back and forward without any clear direction bur managed to close in the green, the middle of the daily range and closed within Fridays range, being clearly neutral, neither side is showing control.

The pair is trading below the 10 and the 50-day moving averages that are acting as dynamic resistances although still trading above the 200-day moving average that is acting as a dynamic support.

The key levels to watch are: The 50-day moving average at 1.1335 (resistance), the 10-day moving average at 1.1268 (resistance), a daily resistance at 1.1237, a swing low at 1.1141 (support) and a daily support at 1.1097.

The pair is trading below the 10 and the 50-day moving averages that are acting as dynamic resistances although still trading above the 200-day moving average that is acting as a dynamic support.

The key levels to watch are: The 50-day moving average at 1.1335 (resistance), the 10-day moving average at 1.1268 (resistance), a daily resistance at 1.1237, a swing low at 1.1141 (support) and a daily support at 1.1097.

On Monday, the euro was slightly elevated gainst the US dollar, but after a volatile session, added only 11 pips. The graphics continue to develop under moving averages, while the index of relative strength remained in neutral territory. Still the sentiment is bearish and may expect test of the support at 1.1100.