Trader Dale

Active member

- Messages

- 175

- Likes

- 8

How to do an Intraday VWAP Analysis

I use two trading setups you can use with the VWAP indicator. One setup which you can use when there is a rotation and the other setup when there is a trend.

Today, I would like to show you how you can apply those setups in your trading.

I will demonstrate this on a 60 Minute AUD/JPY chart. I will use a Weekly VWAP – which means that every new week a new VWAP gets calculated anew.

Trend vs. Rotation

The first thing you need to do is to identify whether there is a trend or a rotation. Why? Because in the trend you will want to use the “Trend VWAP setup” and in rotation the “Rotation VWAP setup”.

As I said at the webinar – it is best to use VWAP deviations to identify a trend from a rotation. When deviation (the grey line) moves vertically, then there is a trend. When it moves horizontally, then there is a rotation.

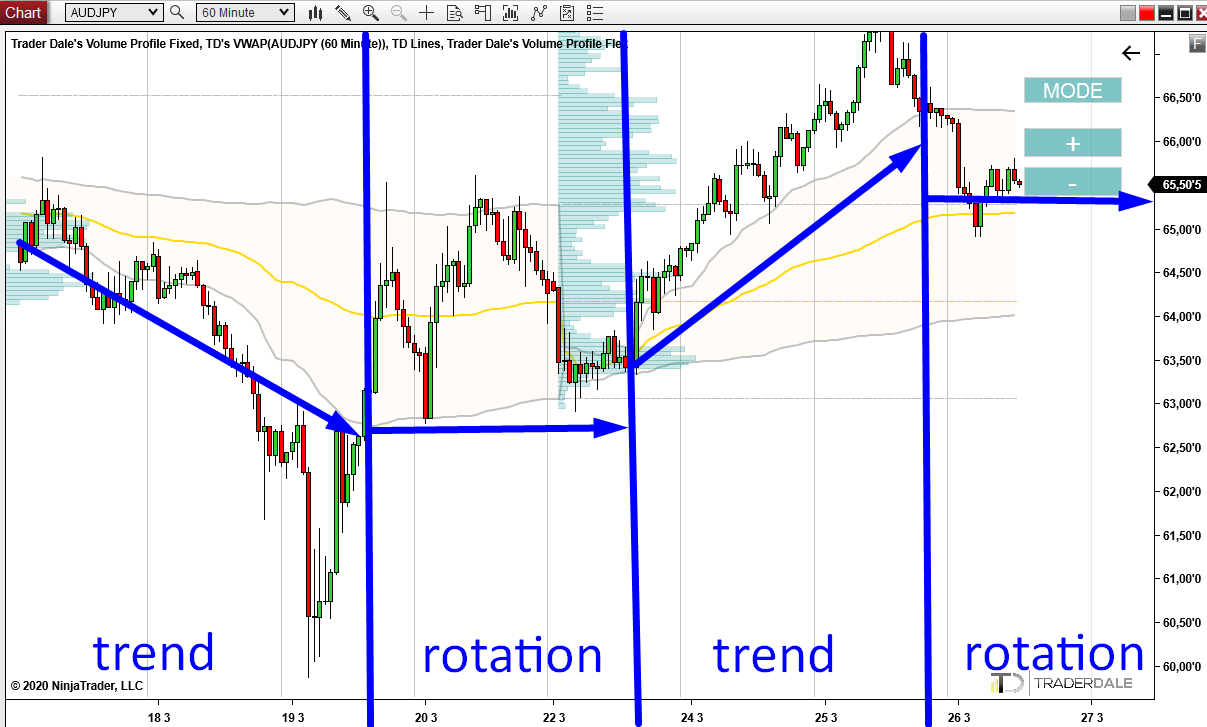

In the picture below, I divided the chart into four sectors.

In the first one, the 1st deviation (grey line) moves downwards – so there is a trend and we want to trade the “Trend VWAP setup“

In the second section, the 1st deviation moves horizontally. This means there is a rotation and we want to look for the “Rotation VWAP setup“.

The third section shows a trend again, so we want to look only for the “Trend VWAP setup“.

The most recent section shows a rotation, so now I am looking for the “Rotation VWAP setup”.

Trade entries

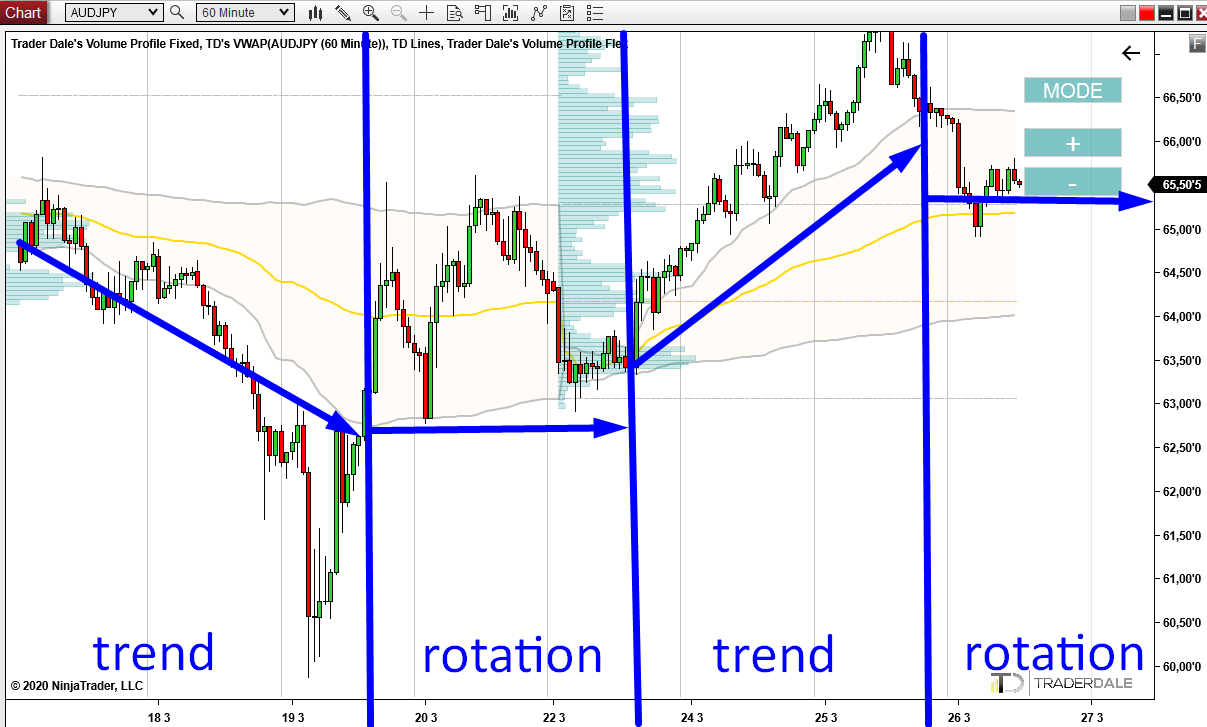

The picture below shows the same chart. This time I indicated possible trade entries. Those trade entries are based on the two VWAP setups.

The first trade is a short and it is based on the “Trend VWAP setup”. Then the second trade is also a short but this time it is based on the “Rotation VWAP setup”. The same goes for the next four trades (all based on “Rotation VWAP setup”). Then the market goes into a trend again so the next trade is a long and it is based on the “Trend VWAP setup”.

The current rotation

Currently, there is a rotation and there are two areas where we could trade from – long and short.

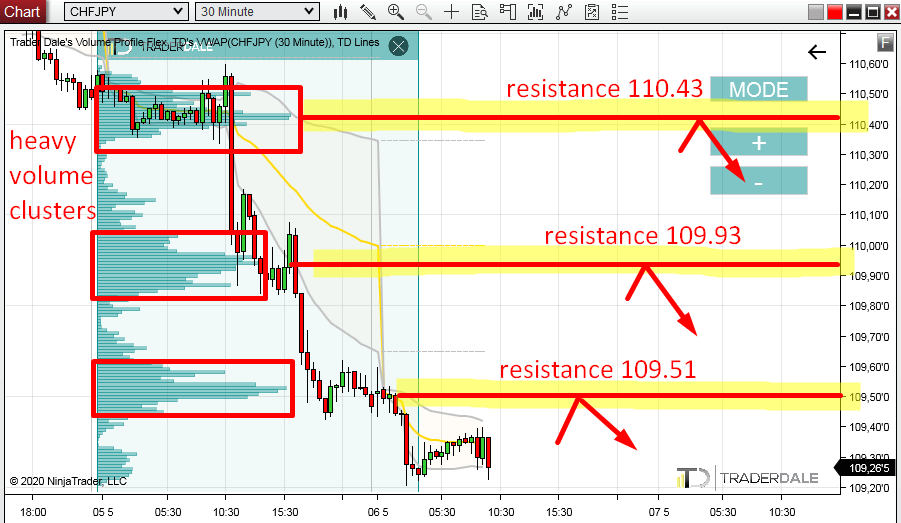

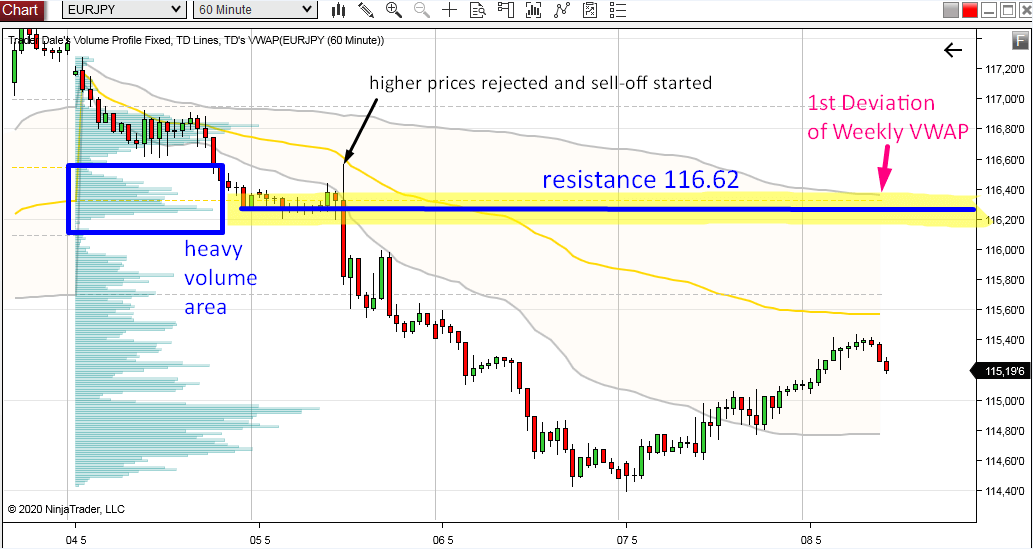

What I like about the short is a confluence with Volume Profile Indicator. If you use the Volume Profile to look into the recent selling area, then you can see that there is a “volume cluster“. This means heavy volumes got traded there. Quite possibly volumes of aggressive sellers who are currently pushing the price downwards. If the price makes it back to this area again, then those sellers could start selling aggressively again and defend their short positions. This would help to move the price downwards again.

This makes this area (around 66.30) an interesting place for a short trade. I marked it in the 60 Minute chart below:

Stay safe and happy trading!

-Dale

I use two trading setups you can use with the VWAP indicator. One setup which you can use when there is a rotation and the other setup when there is a trend.

Today, I would like to show you how you can apply those setups in your trading.

I will demonstrate this on a 60 Minute AUD/JPY chart. I will use a Weekly VWAP – which means that every new week a new VWAP gets calculated anew.

Trend vs. Rotation

The first thing you need to do is to identify whether there is a trend or a rotation. Why? Because in the trend you will want to use the “Trend VWAP setup” and in rotation the “Rotation VWAP setup”.

As I said at the webinar – it is best to use VWAP deviations to identify a trend from a rotation. When deviation (the grey line) moves vertically, then there is a trend. When it moves horizontally, then there is a rotation.

In the picture below, I divided the chart into four sectors.

In the first one, the 1st deviation (grey line) moves downwards – so there is a trend and we want to trade the “Trend VWAP setup“

In the second section, the 1st deviation moves horizontally. This means there is a rotation and we want to look for the “Rotation VWAP setup“.

The third section shows a trend again, so we want to look only for the “Trend VWAP setup“.

The most recent section shows a rotation, so now I am looking for the “Rotation VWAP setup”.

Trade entries

The picture below shows the same chart. This time I indicated possible trade entries. Those trade entries are based on the two VWAP setups.

The first trade is a short and it is based on the “Trend VWAP setup”. Then the second trade is also a short but this time it is based on the “Rotation VWAP setup”. The same goes for the next four trades (all based on “Rotation VWAP setup”). Then the market goes into a trend again so the next trade is a long and it is based on the “Trend VWAP setup”.

The current rotation

Currently, there is a rotation and there are two areas where we could trade from – long and short.

What I like about the short is a confluence with Volume Profile Indicator. If you use the Volume Profile to look into the recent selling area, then you can see that there is a “volume cluster“. This means heavy volumes got traded there. Quite possibly volumes of aggressive sellers who are currently pushing the price downwards. If the price makes it back to this area again, then those sellers could start selling aggressively again and defend their short positions. This would help to move the price downwards again.

This makes this area (around 66.30) an interesting place for a short trade. I marked it in the 60 Minute chart below:

Stay safe and happy trading!

-Dale