Spread trading has been around since markets and exchanges were first developed. Exchanges and their markets were designed not for speculation but to transfer risk from one party to another; speculation made them more efficient through increased volume and tighter price spreads (bid/ask). Commercial trading companies and financial institutions apply hedging (long/short positions) to reduce their exposure and offset risk to their principal underlying positions across every type of commodity or financial instrument. This risk-averse approach is the driving force to their market activity and success.

As a trader we can only speculate on price movement. In many markets, in particular futures, the price activity can be volatile and erratic. This can play havoc on your temperament and undermine your decision-making process. This is where spread trading has one of its greatest advantages – reduced volatility and smoother trends than outright positions. These two attributes are prevalent mostly amongst calendar spreads, which are identical contracts with different expiry months. This pairing of identical contracts with different expiry or delivery months acts as a built-in hedge and provides a trading edge. This is the way many professional traders or commercials trade.

Spread trading has traditionally been applied to commodity (futures) markets. A spread trade requires the trader to hold a long position and a short position at the same time in the same or similar markets. This article will present some of the key features to a spread strategy as well as the level of risk to various types of spread combinations. As mentioned, to understand how spread trading might benefit your bottom line you’ll need to know the other features beyond reduced volatility and smoother trends as well as the risk associated with different types of spreads. The least risky of spread trades are the calendar spreads.

Spread Trading – A Range of Possibilities

All markets can apply a spread strategy but the main point is to know the level of risk created by combining or pairing certain contracts. Let’s begin with calendar spreads (high correlation) which are the least risky of spread combinations and then move along the risk spectrum to the most risky type of spreads (low correlation). Your comfort zone for managing risk will determine your combination of (spread) contracts.

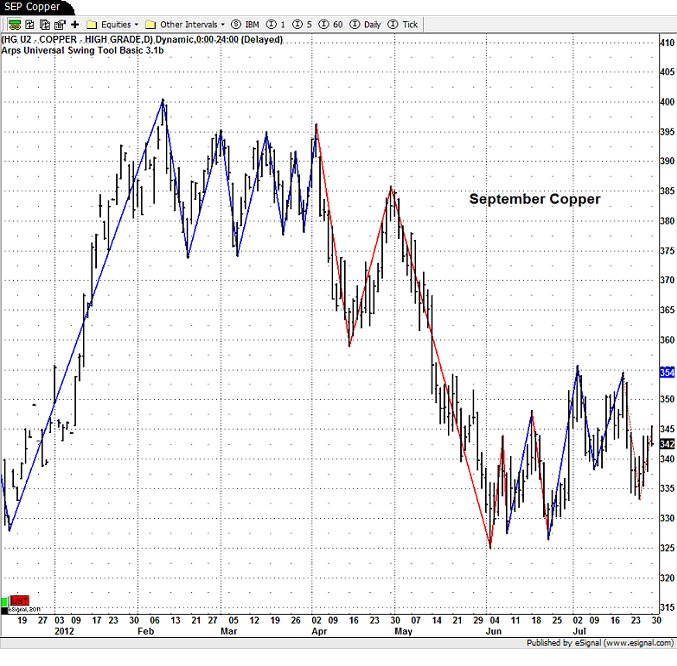

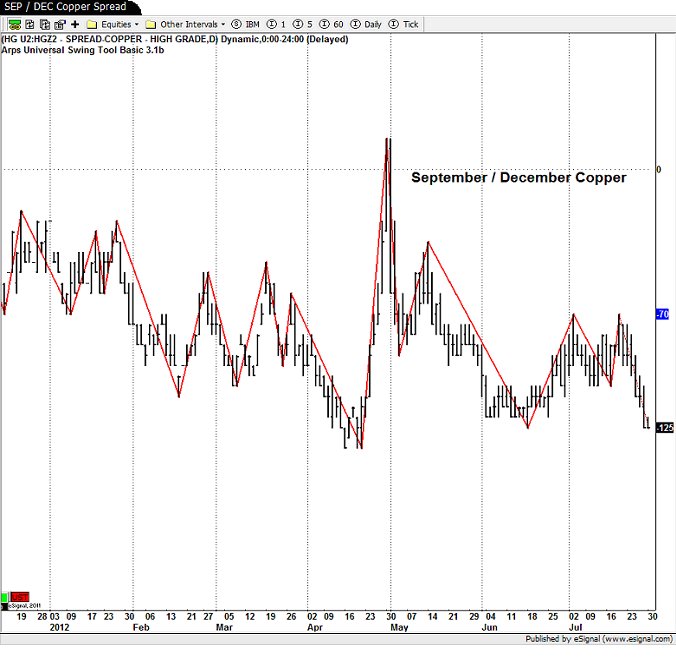

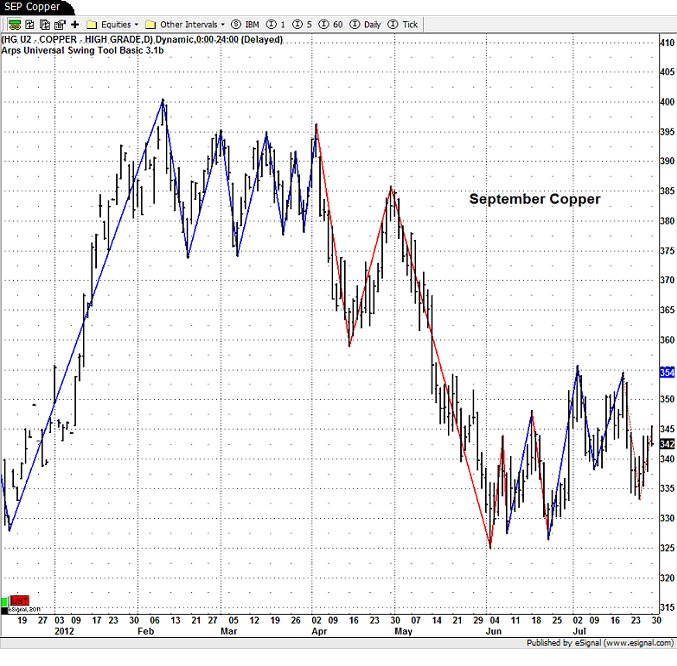

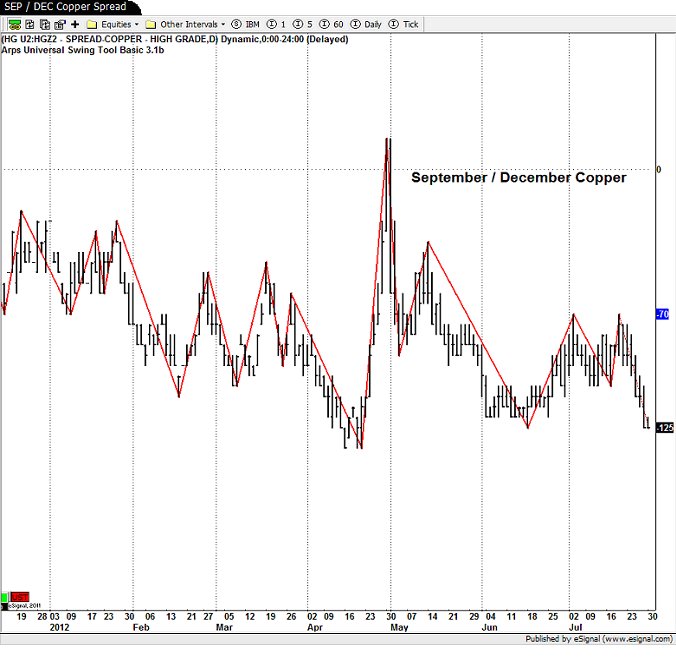

As mentioned, a calendar spread normally has the least amount of risk (for spreads) because the spread has identical contracts but with different expiry months. Generally speaking, spreads are a natural hedge, with less risk than an outright position but this is where a distinction must be made as we will illustrate. Spread trading is also referred to as hedge trading due to the nature of being long and short, especially in the same commodity i.e. calendar spreads, where you are more likely to have lower margin requirements, smoother trends and less stress in managing a position. The lower risk and volatility is evidenced by the lower margin requirements. An example is Copper, where margin for an outright position in a futures position is $5400 USD and a calendar spread in Copper is $304 USD or around 5% to that of the outright margin cost. In late April the September / December Copper spread moved 130 points or $325 USD whereas the (September or December) outright copper position over the same period had a move in excess of $6,000 USD. The point is that you can afford to hold multiple spread positions for far less capital (than an outright position) with greatly reduced volatility and leaves more capital to apply across other asset classes. The propensity to cut or close-out a losing trade is made easier when managing other spread trades that are profitable. This is all about managing risk within your comfort zone and staying in a groove. The charts below are for the September 2012 Copper futures and the other chart is for the September / December Copper spread for the same period.

Fig1

Fig 2

Spread Trading - Trade to Your Risk

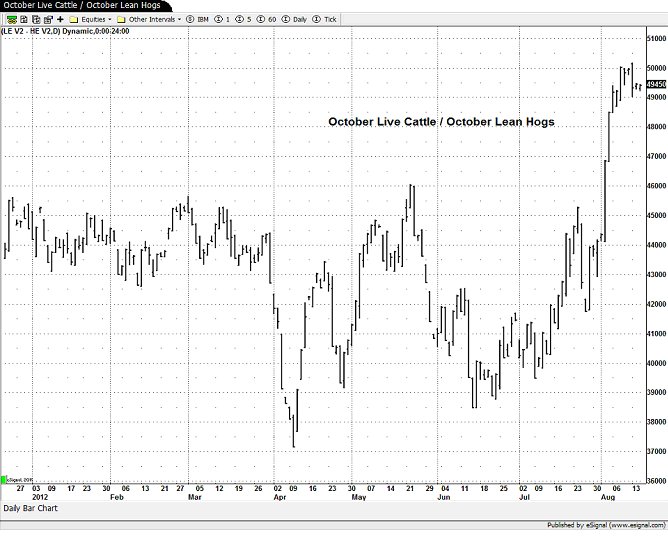

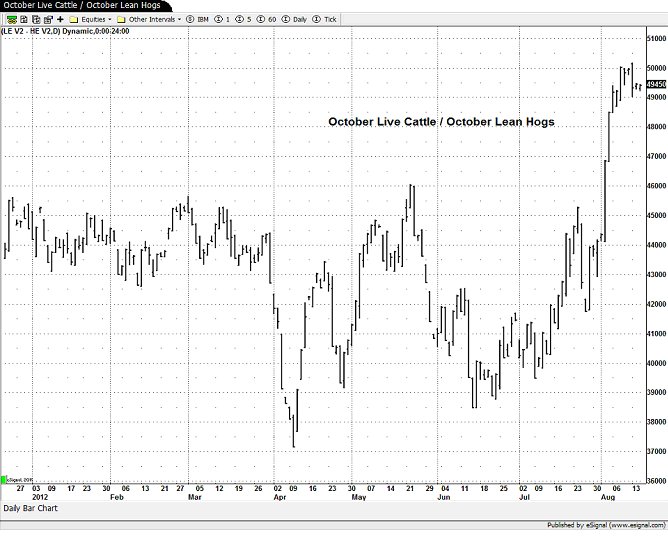

Let’s move along the risk curve to an inter-commodity spread. Here we have increased our risk by moving away from identical contracts (highly correlated) into semi or closely related (reduced correlation) contracts. In this spread, we will present October Live Cattle versus October Lean Hogs which are related, trade on the same exchange (CME) and therefore receive a reduced margin. This margin is reduced by around 30% to that of the combined or collective margin value of the two individual contracts. There is more risk compared to calendar spreads because they are not identical contracts and are therefore less correlated. The obvious risk is that each leg can go against you and this increased risk is reflected in the increased margin. For this reason some traders only use calendar spreads but as said earlier this is directly linked to your risk appetite. As an added edge to trading, especially in commodities are seasonal statistics. There has been much market hype in relation to seasonal statistics.

Fig 3

The fact is that spread trading futures based on a seasonal tendency has been around for donkey's years and is used routinely by professionals and commercial traders. Seasonal statistics provide an expectation of price behaviour during a specific time period every year. Supply and demand figures, political issues and interest rates are factored into their decision-making. An example is where a brokerage firm touts buying heating oil futures (North American) in summer because demand will increase going into the winter months. Unfortunately this (obvious) factor is most likely reflected in the November and December futures prices. The same is true for other markets’ seasonal price patterns. Most commodities experience a natural cycle of supply and demand during the year which can lead to natural cycles in higher and lower prices because of the seasonality of supply and demand. The best part about seasonal spreads is we can review different markets that have well-known seasonality trends. We know that the historical risks are the historical performance and we can be confident that our trades are well thought-out with defined risk and reward parameters. Trading seasonal futures spreads can offer a substantial edge or benefit based on past performance but too many traders rely solely on these time frames to enter and exit a trade in the hope that high probability will work for them this year. Unfortunately, many traders have been handed severe losses to this simple but loosely managed approach. In all cases trade management is what will allow you to preserve your equity, minimize losses and maximize profits. And of course the less correlated the individual legs or commodities are the greater the risk. In our final example this will become clear.

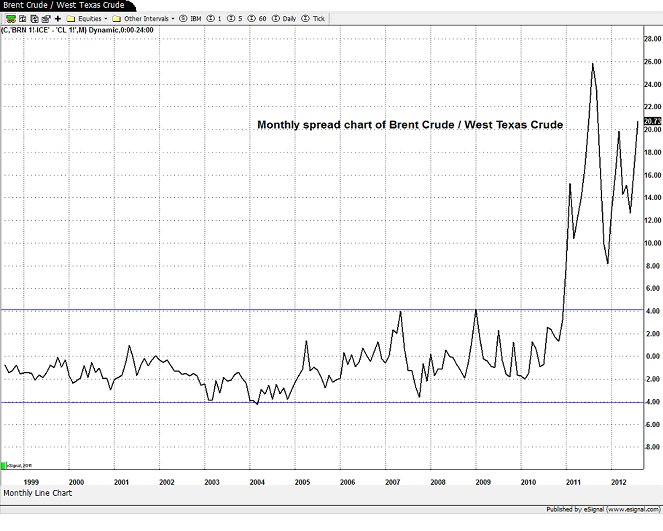

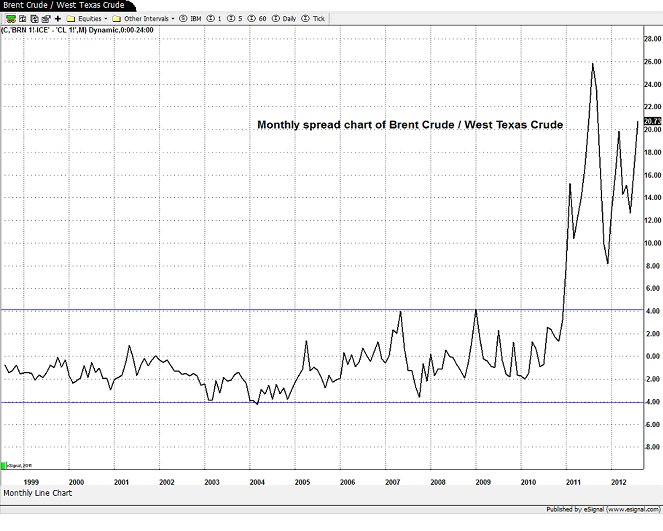

At the far (extreme) end of the risk curve for spread trading are the closely-related contracts but with different delivery locations and traded on different exchanges. Again, the risk has increased to such a degree that you will most likely receive no margin concession even though you have entered into a spread. For many years (1999 – 2011) the spread price between Brent Crude oil (Atlantic North Sea) and West Texas Intermediate oil (WTI) traded in an 8 dollar range i.e. -4 (negative) to +4 (positive) see the chart below. While this spread price remained constant or in a range for many years the aspects to each oil contract i.e. location, processing and storage changed. This became tragically evident in 2011 when the spread price blew-out causing enormous trading losses to many of the long-standing, active traders in this spread.

Fig 4

In conclusion, to understand the benefits and risk in spread trading you need to know the key features of spread trading as compared to an outright which are reduced volatility and margins along with smoother trends. A majority of spreads are not held to the influence of large commercial involvement as with an outright and are less concerned with liquidity and slippage. Remember, the higher the margin means you have increased the risk (less correlation) in the two commodities or contracts you have selected. So just because you have a spread does not necessarily provide you with reduced risk, rather it depends on the pairs you have selected.

Jay Richards can be contacted at JustSpreads.com

As a trader we can only speculate on price movement. In many markets, in particular futures, the price activity can be volatile and erratic. This can play havoc on your temperament and undermine your decision-making process. This is where spread trading has one of its greatest advantages – reduced volatility and smoother trends than outright positions. These two attributes are prevalent mostly amongst calendar spreads, which are identical contracts with different expiry months. This pairing of identical contracts with different expiry or delivery months acts as a built-in hedge and provides a trading edge. This is the way many professional traders or commercials trade.

Spread trading has traditionally been applied to commodity (futures) markets. A spread trade requires the trader to hold a long position and a short position at the same time in the same or similar markets. This article will present some of the key features to a spread strategy as well as the level of risk to various types of spread combinations. As mentioned, to understand how spread trading might benefit your bottom line you’ll need to know the other features beyond reduced volatility and smoother trends as well as the risk associated with different types of spreads. The least risky of spread trades are the calendar spreads.

Spread Trading – A Range of Possibilities

All markets can apply a spread strategy but the main point is to know the level of risk created by combining or pairing certain contracts. Let’s begin with calendar spreads (high correlation) which are the least risky of spread combinations and then move along the risk spectrum to the most risky type of spreads (low correlation). Your comfort zone for managing risk will determine your combination of (spread) contracts.

As mentioned, a calendar spread normally has the least amount of risk (for spreads) because the spread has identical contracts but with different expiry months. Generally speaking, spreads are a natural hedge, with less risk than an outright position but this is where a distinction must be made as we will illustrate. Spread trading is also referred to as hedge trading due to the nature of being long and short, especially in the same commodity i.e. calendar spreads, where you are more likely to have lower margin requirements, smoother trends and less stress in managing a position. The lower risk and volatility is evidenced by the lower margin requirements. An example is Copper, where margin for an outright position in a futures position is $5400 USD and a calendar spread in Copper is $304 USD or around 5% to that of the outright margin cost. In late April the September / December Copper spread moved 130 points or $325 USD whereas the (September or December) outright copper position over the same period had a move in excess of $6,000 USD. The point is that you can afford to hold multiple spread positions for far less capital (than an outright position) with greatly reduced volatility and leaves more capital to apply across other asset classes. The propensity to cut or close-out a losing trade is made easier when managing other spread trades that are profitable. This is all about managing risk within your comfort zone and staying in a groove. The charts below are for the September 2012 Copper futures and the other chart is for the September / December Copper spread for the same period.

Fig1

Fig 2

Spread Trading - Trade to Your Risk

Let’s move along the risk curve to an inter-commodity spread. Here we have increased our risk by moving away from identical contracts (highly correlated) into semi or closely related (reduced correlation) contracts. In this spread, we will present October Live Cattle versus October Lean Hogs which are related, trade on the same exchange (CME) and therefore receive a reduced margin. This margin is reduced by around 30% to that of the combined or collective margin value of the two individual contracts. There is more risk compared to calendar spreads because they are not identical contracts and are therefore less correlated. The obvious risk is that each leg can go against you and this increased risk is reflected in the increased margin. For this reason some traders only use calendar spreads but as said earlier this is directly linked to your risk appetite. As an added edge to trading, especially in commodities are seasonal statistics. There has been much market hype in relation to seasonal statistics.

Fig 3

The fact is that spread trading futures based on a seasonal tendency has been around for donkey's years and is used routinely by professionals and commercial traders. Seasonal statistics provide an expectation of price behaviour during a specific time period every year. Supply and demand figures, political issues and interest rates are factored into their decision-making. An example is where a brokerage firm touts buying heating oil futures (North American) in summer because demand will increase going into the winter months. Unfortunately this (obvious) factor is most likely reflected in the November and December futures prices. The same is true for other markets’ seasonal price patterns. Most commodities experience a natural cycle of supply and demand during the year which can lead to natural cycles in higher and lower prices because of the seasonality of supply and demand. The best part about seasonal spreads is we can review different markets that have well-known seasonality trends. We know that the historical risks are the historical performance and we can be confident that our trades are well thought-out with defined risk and reward parameters. Trading seasonal futures spreads can offer a substantial edge or benefit based on past performance but too many traders rely solely on these time frames to enter and exit a trade in the hope that high probability will work for them this year. Unfortunately, many traders have been handed severe losses to this simple but loosely managed approach. In all cases trade management is what will allow you to preserve your equity, minimize losses and maximize profits. And of course the less correlated the individual legs or commodities are the greater the risk. In our final example this will become clear.

At the far (extreme) end of the risk curve for spread trading are the closely-related contracts but with different delivery locations and traded on different exchanges. Again, the risk has increased to such a degree that you will most likely receive no margin concession even though you have entered into a spread. For many years (1999 – 2011) the spread price between Brent Crude oil (Atlantic North Sea) and West Texas Intermediate oil (WTI) traded in an 8 dollar range i.e. -4 (negative) to +4 (positive) see the chart below. While this spread price remained constant or in a range for many years the aspects to each oil contract i.e. location, processing and storage changed. This became tragically evident in 2011 when the spread price blew-out causing enormous trading losses to many of the long-standing, active traders in this spread.

Fig 4

In conclusion, to understand the benefits and risk in spread trading you need to know the key features of spread trading as compared to an outright which are reduced volatility and margins along with smoother trends. A majority of spreads are not held to the influence of large commercial involvement as with an outright and are less concerned with liquidity and slippage. Remember, the higher the margin means you have increased the risk (less correlation) in the two commodities or contracts you have selected. So just because you have a spread does not necessarily provide you with reduced risk, rather it depends on the pairs you have selected.

Jay Richards can be contacted at JustSpreads.com

Last edited by a moderator: