Hi,

I am working on a spreadsheet to back out the implied yield from the Bund price. I have my textbooks and examples, but cant seem to come up with yields that match what I see on Frankfurt Stock Exchange page for the deliverable bonds.

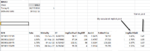

An example is the best way to show my working, so I attached a screenshot of my spreadsheet.

My calculated fwd price (FutInvPrice column) is the current futures price (143.7) * CF (from Eurex site) + accrued interest (from the last coupon to delivery date of futures contract). I then plug this into the Excel YIELD function, using the delivery date of the futures contract as the settlement, and the maturity of the bond in question.

You can see that the market yield is way off, especially for the first two.

Is anyone able to spot the error I am making here?

Thanks.

I am working on a spreadsheet to back out the implied yield from the Bund price. I have my textbooks and examples, but cant seem to come up with yields that match what I see on Frankfurt Stock Exchange page for the deliverable bonds.

An example is the best way to show my working, so I attached a screenshot of my spreadsheet.

My calculated fwd price (FutInvPrice column) is the current futures price (143.7) * CF (from Eurex site) + accrued interest (from the last coupon to delivery date of futures contract). I then plug this into the Excel YIELD function, using the delivery date of the futures contract as the settlement, and the maturity of the bond in question.

You can see that the market yield is way off, especially for the first two.

Is anyone able to spot the error I am making here?

Thanks.