ETFandAlgo

Newbie

- Messages

- 8

- Likes

- 0

Hi!

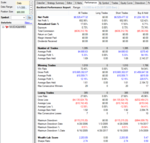

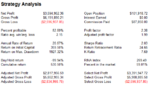

My name is Alexander, I'm from Moscow (from Russia with Love(c) 🙂. Sorry for the bad English, sometimes use translator. I am 30 years old. I trade on the main stock exchanges a little more than 10 years. Worked as a trader in investment companies. The results for the last 5 years I attached below. This is my personal trading account.

The purpose of the journal.

Show professional trading and find a large investor ($1M).

Investment philosophy.

I use both passive investing and algorithmic trading. In my opinion, using both approaches can be achieved the best results.

In recent months, I revised my long-term strategy and decided to focus on stability of results, high Sharpe ratio. For this, I developed 2 algorithms in addition to my main strategy and lowered the target profitability to 40-50 per annum.Beginning in April, I will post my monthly results here every month.

Practice.

On 100% of the capital I bought ETF XLP. Why XLP and not SPY? XLP has a higher Sharpe and dividend. My broker (IB) gives overnight 2 leverage, so 50% of the capital will be available. I will allocate free capital to 3 strategies in proportion to their historical Sharpe.

Algorithms.

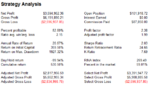

Below are the backtests of strategies that I will use in my trading. All backtests considered costs. Results are presented without reinvestment, fixed amount. I will not describe in detail the algorithms and share transactions, as in moments of market inefficiencies all traders compete for fill. I hope for your understanding. There will be only backtests and results of real trading.

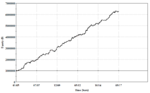

Strategy #1. Stocks NASDAQ and AMEX.

We earn on correction of the stock after strong growth. Short only. Mean reversion.

Sharpe ~3.

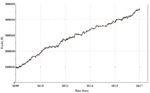

Strategy #2. Gold spot.

We earn the breakout of multi-day levels. Long and Short. Momentum.

Sharpe ~2.

Strategy #3. VXX.

We earn on VXX drift down. Short only. Trend following.

Sharpe ~2.

Strategies #2 and #3 have a small number of trades per year. It takes many months to realize their statistical advantage.

My name is Alexander, I'm from Moscow (from Russia with Love(c) 🙂. Sorry for the bad English, sometimes use translator. I am 30 years old. I trade on the main stock exchanges a little more than 10 years. Worked as a trader in investment companies. The results for the last 5 years I attached below. This is my personal trading account.

The purpose of the journal.

Show professional trading and find a large investor ($1M).

Investment philosophy.

I use both passive investing and algorithmic trading. In my opinion, using both approaches can be achieved the best results.

In recent months, I revised my long-term strategy and decided to focus on stability of results, high Sharpe ratio. For this, I developed 2 algorithms in addition to my main strategy and lowered the target profitability to 40-50 per annum.Beginning in April, I will post my monthly results here every month.

Practice.

On 100% of the capital I bought ETF XLP. Why XLP and not SPY? XLP has a higher Sharpe and dividend. My broker (IB) gives overnight 2 leverage, so 50% of the capital will be available. I will allocate free capital to 3 strategies in proportion to their historical Sharpe.

Algorithms.

Below are the backtests of strategies that I will use in my trading. All backtests considered costs. Results are presented without reinvestment, fixed amount. I will not describe in detail the algorithms and share transactions, as in moments of market inefficiencies all traders compete for fill. I hope for your understanding. There will be only backtests and results of real trading.

Strategy #1. Stocks NASDAQ and AMEX.

We earn on correction of the stock after strong growth. Short only. Mean reversion.

Sharpe ~3.

Strategy #2. Gold spot.

We earn the breakout of multi-day levels. Long and Short. Momentum.

Sharpe ~2.

Strategy #3. VXX.

We earn on VXX drift down. Short only. Trend following.

Sharpe ~2.

Strategies #2 and #3 have a small number of trades per year. It takes many months to realize their statistical advantage.

Last edited: