A brief look at the different ways in which an FX trader can diversify within their account.

While there are an unlimited number of publications covering the advantages of portfolio diversification, few of them explore the possibilities of trading Forex along with typical stock, bond and real estate investments. It is even more rare to find theory on diversifying within a FX portfolio. Although fund managers are very aware of the importance of diversity, speculators often overlook its value. As we have all come to realize, you can't expect consistent success by being a conformist.

As all currency traders know, the Forex market is a great way to hedge the economic risk of a pool of investments. Studies have even suggested that the Efficient Frontier's optimal portfolio is actually shifted outward by including commodities. Meaning that for each additional unit of risk a higher return is attainable.

Because markets are often driven by human emotion and unforeseen events, it is impossible to predict future prices. Consequently it is important to have a truly diversified portfolio of investment strategies. The ability to profit without regard to its direction is a priceless advantage over buying stocks. Investors should be willing to sacrifice some of the upside potential of a pure equity portfolio in order to preserve capital in times of a declining stock market. This preservation can be done through alternative investments such as futures and Forex trading.

However, all traders that have experienced the treachery of the Forex market will agree that currency trading is challenging. While the idea of diversifying a portfolio through trading may seem simple - that is far from the case. In fact, most people that trade FX lose some, most or even all of their original investment.

The FOREX market allows traders to control massive amounts of leverage with minimal margin requirements, some firms offer as much as 100:1 leverage. For example, traders can control a $100,000 position with $1,000, or 1%.

Obviously, leverage can be a powerful tool for currency traders but should be seen as a double-edged sword. While leverage does contribute to the risk of a given position, it is necessary in the FOREX market. This is because the average daily move of a major currency is about 1%, while a stock typically sees much more substantial moves.

Due to the nature of the currency markets, it is very important that traders diversify within their trading accounts. The keys to diversification in Forex, is not necessarily buying the Euro and selling the Swiss Franc. True diversification can be achieved through the use if various trading strategies and talents. In other words, traders should look to have a portion of their trading account managed by professional traders. The purpose of this is not to say that professionals will ultimately have better results than you, but is simply for the purpose of diversification. Regardless of skill all traders will go through periods of winning and losing trades, thus having more that one trader handling your account may decrease some of the volatility within a trading portfolio.

However, there are more direct ways to hedge in FX trading. Traders may increase their odds of success by trading spreads rather than outright currency pairs. The net result of this strategy would be a decreased level of volatility, but also provides less profit potential. In essence, traders that are trading spreads are simply placing one position in speculation and another as a direct hedge to protect against the possibility of an incorrect forecast.

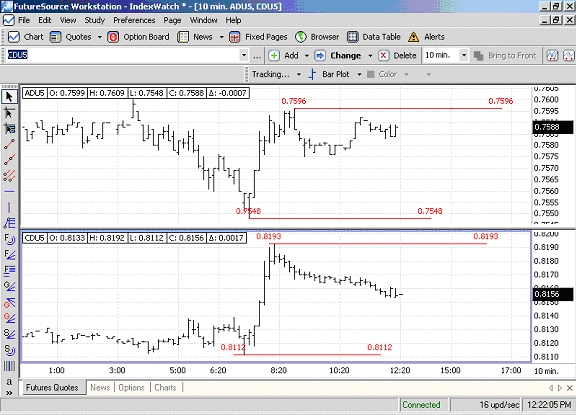

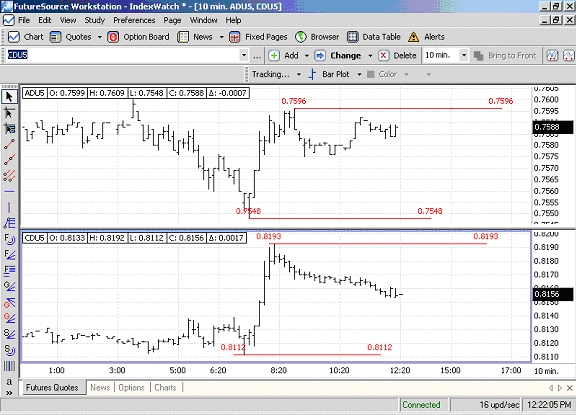

In order to construct a proper spread, it is important to determine the correlations between specific currencies. The simplest example of this would be the Franc vs. Euro. The Franc is extremely positively correlated to the Euro, but tends to have significantly smaller moves in terms of pips. By posting both currencies against a common denominator, you can easily hedge any Euro position by taking the opposite Franc position.

In order to construct a proper spread, it is important to determine the correlations between specific currencies. The simplest example of this would be the Franc vs. Euro. The Franc is extremely positively correlated to the Euro, but tends to have significantly smaller moves in terms of pips. By posting both currencies against a common denominator, you can easily hedge any Euro position by taking the opposite Franc position. See diagram on next page.

We have obviously just touched on the subject of diversity in the FX markets. Just as there are an infinite number of trading theories and strategies, there are unlimited numbers of ways to diversify any given position. It is also important to note, that in certain market conditions hedging positions may fail resulting in losses on both legs of the spread. Fortunately, this is relatively uncommon.

While there are an unlimited number of publications covering the advantages of portfolio diversification, few of them explore the possibilities of trading Forex along with typical stock, bond and real estate investments. It is even more rare to find theory on diversifying within a FX portfolio. Although fund managers are very aware of the importance of diversity, speculators often overlook its value. As we have all come to realize, you can't expect consistent success by being a conformist.

As all currency traders know, the Forex market is a great way to hedge the economic risk of a pool of investments. Studies have even suggested that the Efficient Frontier's optimal portfolio is actually shifted outward by including commodities. Meaning that for each additional unit of risk a higher return is attainable.

Because markets are often driven by human emotion and unforeseen events, it is impossible to predict future prices. Consequently it is important to have a truly diversified portfolio of investment strategies. The ability to profit without regard to its direction is a priceless advantage over buying stocks. Investors should be willing to sacrifice some of the upside potential of a pure equity portfolio in order to preserve capital in times of a declining stock market. This preservation can be done through alternative investments such as futures and Forex trading.

However, all traders that have experienced the treachery of the Forex market will agree that currency trading is challenging. While the idea of diversifying a portfolio through trading may seem simple - that is far from the case. In fact, most people that trade FX lose some, most or even all of their original investment.

The FOREX market allows traders to control massive amounts of leverage with minimal margin requirements, some firms offer as much as 100:1 leverage. For example, traders can control a $100,000 position with $1,000, or 1%.

Obviously, leverage can be a powerful tool for currency traders but should be seen as a double-edged sword. While leverage does contribute to the risk of a given position, it is necessary in the FOREX market. This is because the average daily move of a major currency is about 1%, while a stock typically sees much more substantial moves.

Due to the nature of the currency markets, it is very important that traders diversify within their trading accounts. The keys to diversification in Forex, is not necessarily buying the Euro and selling the Swiss Franc. True diversification can be achieved through the use if various trading strategies and talents. In other words, traders should look to have a portion of their trading account managed by professional traders. The purpose of this is not to say that professionals will ultimately have better results than you, but is simply for the purpose of diversification. Regardless of skill all traders will go through periods of winning and losing trades, thus having more that one trader handling your account may decrease some of the volatility within a trading portfolio.

However, there are more direct ways to hedge in FX trading. Traders may increase their odds of success by trading spreads rather than outright currency pairs. The net result of this strategy would be a decreased level of volatility, but also provides less profit potential. In essence, traders that are trading spreads are simply placing one position in speculation and another as a direct hedge to protect against the possibility of an incorrect forecast.

In order to construct a proper spread, it is important to determine the correlations between specific currencies. The simplest example of this would be the Franc vs. Euro. The Franc is extremely positively correlated to the Euro, but tends to have significantly smaller moves in terms of pips. By posting both currencies against a common denominator, you can easily hedge any Euro position by taking the opposite Franc position.

In order to construct a proper spread, it is important to determine the correlations between specific currencies. The simplest example of this would be the Franc vs. Euro. The Franc is extremely positively correlated to the Euro, but tends to have significantly smaller moves in terms of pips. By posting both currencies against a common denominator, you can easily hedge any Euro position by taking the opposite Franc position. See diagram on next page.

We have obviously just touched on the subject of diversity in the FX markets. Just as there are an infinite number of trading theories and strategies, there are unlimited numbers of ways to diversify any given position. It is also important to note, that in certain market conditions hedging positions may fail resulting in losses on both legs of the spread. Fortunately, this is relatively uncommon.

Last edited by a moderator: