roughbert

Member

- Messages

- 94

- Likes

- 1

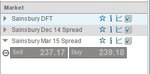

I don't spreadbet yet, but I may do so. This depends upon whether my proposed method can be successfully backtested. I'm close to being able to run tests, but I don't know how to estimate the broker's charges. I'm guessing that a flat percentage will have to do, while suspicious that the actual percentage will vary between brokers and possibly also on the volume traded.

Presuming that most spreadbetters plan their trades, what sort of cost/charge/commission do you allow for?

I'm starting testing with the FTSE100 constituents and some big ETFs, if that helps.

Presuming that most spreadbetters plan their trades, what sort of cost/charge/commission do you allow for?

I'm starting testing with the FTSE100 constituents and some big ETFs, if that helps.