In this article we take a more detailed look at more advanced money and trade management strategies.

Introduction

The term “Trade Management” refers to methods and manipulations which can be followed before and after a trade has been made to ensure a protection from undesirable movements of the tradable and at the same time to guarantee that if the position finally proved to be right, the profit will compensate the risk taken. There are two concepts of trade management mentioned in the literature: the use of trailing stop and the reward-to-risk ratio (also known as Profit/Loss ratio) .

In respect to the trailing stop, in the case of a long position, the trader sets an initial stop loss level which is raised as long as the price of the tradable rises. In other words, the price “trails” the stop loss level upward. Similarly, in the case of a short position, an initial stop loss level declines as long as the price of the tradable declines. That is, the price “trails” the stop loss level downward.

As far as the Profit/Loss ratio is concerned, the trader determines an initial stop loss level before entering a trade and calculates the loss he will take if the stop is reached. He then moves on and calculates the expected profit from the trade. Finally, he calculates the Profit/Loss ratio and discards the trade if this ratio is less than an amount, otherwise he moves on and makes the trade.

In the present article I will introduce and discuss three subtle but important enhancements to the above concepts of trade management:

Using Two Intraday Stop-Loss Levels

Almost all traders have faced the frustrating situation where a stop loss level is penetrated during a day just to force him to exit a trade and immediately after that the market starts moving in the favor of the original position. In many of these cases, as soon as the stop loss level is penetrated, the rigid trader immediately gets out of his position usually placing at-the-market orders for the full position.

A solution for this problem is to use two stop loss levels. When the first level is penetrated, a stop loss order is activated and a portion of the original position is immediately liquidated and protected from further losses. In the sequence, if the market reverses and moves in the favor of the original position then the remaining portion of the position will produce profits. If, on the other hand, the situation gets worse and the second level is penetrated, a second stop loss order will be activated and the remaining portion of the position will be liquidated.

The use of two stop loss levels is equivalent to the use of one stop loss level. More precisely, if you use a first stop loss level L1 assigned with a portion p% of your position and a second stop loss level L2 assigned with the remaining (100-p)% of your position then it is like using a single stop loss level L where:

L = p%.L1+(100- p)%.L2 (Equation 1).

L , by its definition, always lies between L1 and L2.

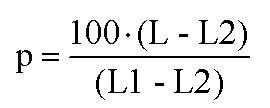

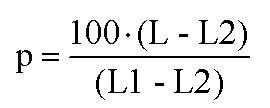

Equation 1 can be rewritten as:

(Equation 2). For objectivity reasons and for minimizing “wishful thinking” it is advised that you first determine the L, L1 and L2 levels and then using Equation 2 calculate the portion p% of the position that must be liquidated after the penetration of the L1 level.

Using a CE Level

In his book “Market Wizards” (see [2]), Jack D. Schwager cited an interesting though controversial opinion from Tom Baldwin: “Don’t get out of a losing trade too hastily; instead, wait and choose your time”. This opinion does contradict the basic tenet of trading to “cut losses quickly” unless the trading management rules themselves incorporate the case where a position will be considered undesirable but not unaffordable. This is exactly the purpose of a CE level.

A CE level (Change-of-Expectation level) is a price level which when penetrated it triggers the change of the original expectations of a position. Its purpose is to inform the trader that its original position is not so good as it was originally expected and he must exit his position but not necessarily immediately. In other words, it is a form of stop loss level offering the trader a period of grace to find a good exit point.

It is advised that the CE level is based upon the closing prices. That is, wait for the closing price to penetrate the CE level before considering the penetration valid. This is due to the sentiment attached in the closing prices for a great portion of market participants. As the closing price is the most mentioned after the market is closed, it is quite likely that in the next trading session you will get the desirable pullback to make a gracious exit.

Using Dynamic Reward/Risk Ratios

As already mentioned, the initial Reward/Risk ratio (simply RR) is the ratio of the expected profit (reward) from a trade P to the potential loss L from the trade as determined by the stop loss (risk taken). In his book “Technical Analysis of The Financial Markets” (see [1]), John J. Murphy proposes the avoidance of trades when their RR is less than 3 so, the number of false trades must be more than three times the number of the correct ones to actually reduce the total value of a portfolio. What is not generally known however is that the RR ratio must be continually calculated as prices move.

It is commonly said that a powerful rule to determine if it is time to get out of a position is to ask your self: “If I were out of the position, would I like to enter the market?”. If the answer is “No” then the rule advises that the position must be liquidated. Don’t let the simplicity of the rule fool you. Seeing your position from a third-person position is the best way to take away the emotions from your trading. Since however you compute the RR ratio before entering a trade, you must also calculate it as long as your position is active to ensure that you continuously see your active position as if you were out of it and you were trying to evaluate if it merits entering the market.

Critical Observations

Before choosing whether it merits using the methods described above, you must consider the following facts:

Adequate Time.

Most intraday traders and scalpers make many small trades during a day. It is mentally laborious to continuously monitor and adjust two trailing stops, a CE level and a Profit/Loss ratio at the same time.

The ambiguity of Closing Price in intraday charts.

I mentioned above that it is better to base the CE levels in closing prices. The Closing Price in a chart has a meaning only if it represents the last trade in a time frame between periods where the market is actually closed. Thereupon, for the markets which are not continually traded, only the closing prices in daily and weekly charts have true meaning. The closing prices of monthly and yearly charts follow in order of importance since the evaluation of positions and portfolios at the end of months and years are usually used as milestones by investors. Last in order of importance (if any) lie the closing prices of intraday charts (5min, 15 min, 60 min. etc.).

The use of two stop loss levels is equivalent to having two positions simultaneously.

Indeed, the first position is the portion of the full position attached to the first stop loss level and the second position is the remaining portion of the full position which is attached to the second stop loss level. Many brokers charge a considerable minimum commission per order. Since intraday traders and scalpers make many small trades during a day It is not always a good idea to split their position into two parts using two stop loss levels. On the other hand, due to the nature of trade selection for position traders (especially when fundamentals are used in addition to technicals), the good opportunities are not so many and grabbing all opportunities that arise is essential. The use of two stop loss orders helps in a better management of these opportunities.

Immediate from the above is that if you are going to use two trailing stop loss levels then use them in position trades mostly (that is, trades that are expected to last from several days to several months). You should attempt to use them with caution in intraday trades only if you trade significant volume per trade, you are very experienced and rapid in making decisions.

The use of a CE level can be used for intraday trading or for markets that are open 24 hours a day but in this case don’t rely on closing prices of charts. As soon as the CE level you have set is penetrated, start thinking of an exit point.

The Reward/Risk ratio on the other hand is a different story. It must be continuously calculated and been taking into account in all type of trades you make. Say for example that you buy a stock at 30$ setting one stop loss order at 29$ based on a support level. If your expect that the price of the stock will reach 34$ and the minimum RR you demand is 3 then the set up is OK since you risk 1$ to gain 4$ (which means that RR = 4 in this case). Suppose that you buy the stock at 30$ and its price rise at 32$. You trail the stop at 30$. Does it make sense? The answer is no. You are now risking 2$ to gain 2$ which gives a current RR ratio of 1. The stop in this case must be higher than 32$ to produce a RR ratio 3 or higher.

Linking Reward/Risk to the Stop Selection

Having set a constant minimum desirable Reward/Risk ratio (namely minRR) for a trade helps in defining the maximum distance of a trailing stop from the current price. More precisely, the stop must not be more than away from the current price at any time, where G$ is the expected gain from the trade. (Note that G changes as the price of the tradable changes. Also it is advised that minRR is close to 3).

Using elementary algebra it is easy to see that a barrier for stops is determined by the number, where P$ is the current price of the tradable, T$ is its target price (the price that will produce the expected gain) and minRR is the constant minimum accepted Reward/Risk ratio. More precisely, for a long position, the stop prices must be greater than SB $ and for a short position, the stop prices must be lower than SB $.

If you consider using two stop loss levels for a trade then note that the SB barrier must be used for both stops and not the average stop loss. The reason for this is that the use of two stop loss levels is equivalent to having two lesser positions simultaneously.

Some Final Thoughts

I often hear that “You have not made or lost real money from a trade as long as this trade is not closed”. This may seem true from the first place because as long as you are in a position you think that anything can happen. It is not true however since every claim, skill or thing in this world has a value at any given time and the same holds for all trading positions. Closing your trade will not give you the profit or loss. You already have it. If you bought a stock at 30$ and you can sell it now at 40$ then you have a 10$ profit regardless of whether you actually sell it now at 40$ or not. Think of this profit as a part of your capital. You now have 40$ put in this stock. This is the only way you will respect this 10$ you have earned. You owe it to your self to respect it. This 10$ was not given to you for free after all. It is your reward for taking the risk to buy the stock at 30$. Define your new stops and Reward/Risk ratio now based on your 40$.

Epilogue

Some points of the present article may not be unfamiliar to you. At times, you may have closed a portion of a position and not the full position and at other times you may have decided that it is time to get out of a position but not immediately. The first key point of the article is to indicate that these concepts should be incorporated in a rigid method. The second key point of the article and probably the most important is that you should continually evaluate the stops and Reward/Risk ratios to determine if it worths being in a trade or not.

References

[1] Murphy, John J. [1986], Technical Analysis of the Futures Markets,, New York, New York Institute of Finance..

[2] Schwager, D. Jack [1989]. Market Wizards, Interviews With Top Traders, New York Institute of Finance.

Introduction

The term “Trade Management” refers to methods and manipulations which can be followed before and after a trade has been made to ensure a protection from undesirable movements of the tradable and at the same time to guarantee that if the position finally proved to be right, the profit will compensate the risk taken. There are two concepts of trade management mentioned in the literature: the use of trailing stop and the reward-to-risk ratio (also known as Profit/Loss ratio) .

In respect to the trailing stop, in the case of a long position, the trader sets an initial stop loss level which is raised as long as the price of the tradable rises. In other words, the price “trails” the stop loss level upward. Similarly, in the case of a short position, an initial stop loss level declines as long as the price of the tradable declines. That is, the price “trails” the stop loss level downward.

As far as the Profit/Loss ratio is concerned, the trader determines an initial stop loss level before entering a trade and calculates the loss he will take if the stop is reached. He then moves on and calculates the expected profit from the trade. Finally, he calculates the Profit/Loss ratio and discards the trade if this ratio is less than an amount, otherwise he moves on and makes the trade.

In the present article I will introduce and discuss three subtle but important enhancements to the above concepts of trade management:

- The use of two intraday stop-loss levels.

- The use of a threshold (CE level) which will be used to trigger the change of the original expectations from the position.

- The use of dynamic Reward/Risk ratios.

Using Two Intraday Stop-Loss Levels

Almost all traders have faced the frustrating situation where a stop loss level is penetrated during a day just to force him to exit a trade and immediately after that the market starts moving in the favor of the original position. In many of these cases, as soon as the stop loss level is penetrated, the rigid trader immediately gets out of his position usually placing at-the-market orders for the full position.

A solution for this problem is to use two stop loss levels. When the first level is penetrated, a stop loss order is activated and a portion of the original position is immediately liquidated and protected from further losses. In the sequence, if the market reverses and moves in the favor of the original position then the remaining portion of the position will produce profits. If, on the other hand, the situation gets worse and the second level is penetrated, a second stop loss order will be activated and the remaining portion of the position will be liquidated.

The use of two stop loss levels is equivalent to the use of one stop loss level. More precisely, if you use a first stop loss level L1 assigned with a portion p% of your position and a second stop loss level L2 assigned with the remaining (100-p)% of your position then it is like using a single stop loss level L where:

L = p%.L1+(100- p)%.L2 (Equation 1).

L , by its definition, always lies between L1 and L2.

Equation 1 can be rewritten as:

(Equation 2). For objectivity reasons and for minimizing “wishful thinking” it is advised that you first determine the L, L1 and L2 levels and then using Equation 2 calculate the portion p% of the position that must be liquidated after the penetration of the L1 level.

Using a CE Level

In his book “Market Wizards” (see [2]), Jack D. Schwager cited an interesting though controversial opinion from Tom Baldwin: “Don’t get out of a losing trade too hastily; instead, wait and choose your time”. This opinion does contradict the basic tenet of trading to “cut losses quickly” unless the trading management rules themselves incorporate the case where a position will be considered undesirable but not unaffordable. This is exactly the purpose of a CE level.

A CE level (Change-of-Expectation level) is a price level which when penetrated it triggers the change of the original expectations of a position. Its purpose is to inform the trader that its original position is not so good as it was originally expected and he must exit his position but not necessarily immediately. In other words, it is a form of stop loss level offering the trader a period of grace to find a good exit point.

It is advised that the CE level is based upon the closing prices. That is, wait for the closing price to penetrate the CE level before considering the penetration valid. This is due to the sentiment attached in the closing prices for a great portion of market participants. As the closing price is the most mentioned after the market is closed, it is quite likely that in the next trading session you will get the desirable pullback to make a gracious exit.

Using Dynamic Reward/Risk Ratios

As already mentioned, the initial Reward/Risk ratio (simply RR) is the ratio of the expected profit (reward) from a trade P to the potential loss L from the trade as determined by the stop loss (risk taken). In his book “Technical Analysis of The Financial Markets” (see [1]), John J. Murphy proposes the avoidance of trades when their RR is less than 3 so, the number of false trades must be more than three times the number of the correct ones to actually reduce the total value of a portfolio. What is not generally known however is that the RR ratio must be continually calculated as prices move.

It is commonly said that a powerful rule to determine if it is time to get out of a position is to ask your self: “If I were out of the position, would I like to enter the market?”. If the answer is “No” then the rule advises that the position must be liquidated. Don’t let the simplicity of the rule fool you. Seeing your position from a third-person position is the best way to take away the emotions from your trading. Since however you compute the RR ratio before entering a trade, you must also calculate it as long as your position is active to ensure that you continuously see your active position as if you were out of it and you were trying to evaluate if it merits entering the market.

Critical Observations

Before choosing whether it merits using the methods described above, you must consider the following facts:

Adequate Time.

Most intraday traders and scalpers make many small trades during a day. It is mentally laborious to continuously monitor and adjust two trailing stops, a CE level and a Profit/Loss ratio at the same time.

The ambiguity of Closing Price in intraday charts.

I mentioned above that it is better to base the CE levels in closing prices. The Closing Price in a chart has a meaning only if it represents the last trade in a time frame between periods where the market is actually closed. Thereupon, for the markets which are not continually traded, only the closing prices in daily and weekly charts have true meaning. The closing prices of monthly and yearly charts follow in order of importance since the evaluation of positions and portfolios at the end of months and years are usually used as milestones by investors. Last in order of importance (if any) lie the closing prices of intraday charts (5min, 15 min, 60 min. etc.).

The use of two stop loss levels is equivalent to having two positions simultaneously.

Indeed, the first position is the portion of the full position attached to the first stop loss level and the second position is the remaining portion of the full position which is attached to the second stop loss level. Many brokers charge a considerable minimum commission per order. Since intraday traders and scalpers make many small trades during a day It is not always a good idea to split their position into two parts using two stop loss levels. On the other hand, due to the nature of trade selection for position traders (especially when fundamentals are used in addition to technicals), the good opportunities are not so many and grabbing all opportunities that arise is essential. The use of two stop loss orders helps in a better management of these opportunities.

Immediate from the above is that if you are going to use two trailing stop loss levels then use them in position trades mostly (that is, trades that are expected to last from several days to several months). You should attempt to use them with caution in intraday trades only if you trade significant volume per trade, you are very experienced and rapid in making decisions.

The use of a CE level can be used for intraday trading or for markets that are open 24 hours a day but in this case don’t rely on closing prices of charts. As soon as the CE level you have set is penetrated, start thinking of an exit point.

The Reward/Risk ratio on the other hand is a different story. It must be continuously calculated and been taking into account in all type of trades you make. Say for example that you buy a stock at 30$ setting one stop loss order at 29$ based on a support level. If your expect that the price of the stock will reach 34$ and the minimum RR you demand is 3 then the set up is OK since you risk 1$ to gain 4$ (which means that RR = 4 in this case). Suppose that you buy the stock at 30$ and its price rise at 32$. You trail the stop at 30$. Does it make sense? The answer is no. You are now risking 2$ to gain 2$ which gives a current RR ratio of 1. The stop in this case must be higher than 32$ to produce a RR ratio 3 or higher.

Linking Reward/Risk to the Stop Selection

Having set a constant minimum desirable Reward/Risk ratio (namely minRR) for a trade helps in defining the maximum distance of a trailing stop from the current price. More precisely, the stop must not be more than away from the current price at any time, where G$ is the expected gain from the trade. (Note that G changes as the price of the tradable changes. Also it is advised that minRR is close to 3).

Using elementary algebra it is easy to see that a barrier for stops is determined by the number, where P$ is the current price of the tradable, T$ is its target price (the price that will produce the expected gain) and minRR is the constant minimum accepted Reward/Risk ratio. More precisely, for a long position, the stop prices must be greater than SB $ and for a short position, the stop prices must be lower than SB $.

If you consider using two stop loss levels for a trade then note that the SB barrier must be used for both stops and not the average stop loss. The reason for this is that the use of two stop loss levels is equivalent to having two lesser positions simultaneously.

Some Final Thoughts

I often hear that “You have not made or lost real money from a trade as long as this trade is not closed”. This may seem true from the first place because as long as you are in a position you think that anything can happen. It is not true however since every claim, skill or thing in this world has a value at any given time and the same holds for all trading positions. Closing your trade will not give you the profit or loss. You already have it. If you bought a stock at 30$ and you can sell it now at 40$ then you have a 10$ profit regardless of whether you actually sell it now at 40$ or not. Think of this profit as a part of your capital. You now have 40$ put in this stock. This is the only way you will respect this 10$ you have earned. You owe it to your self to respect it. This 10$ was not given to you for free after all. It is your reward for taking the risk to buy the stock at 30$. Define your new stops and Reward/Risk ratio now based on your 40$.

Epilogue

Some points of the present article may not be unfamiliar to you. At times, you may have closed a portion of a position and not the full position and at other times you may have decided that it is time to get out of a position but not immediately. The first key point of the article is to indicate that these concepts should be incorporated in a rigid method. The second key point of the article and probably the most important is that you should continually evaluate the stops and Reward/Risk ratios to determine if it worths being in a trade or not.

References

[1] Murphy, John J. [1986], Technical Analysis of the Futures Markets,, New York, New York Institute of Finance..

[2] Schwager, D. Jack [1989]. Market Wizards, Interviews With Top Traders, New York Institute of Finance.

Last edited by a moderator: