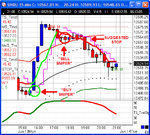

Trading with Trendsignal trading software is a unique approach to trading the markets. Whether you are a total beginner, a day trader or a professional - whether you are spread betting or futures trading and whether you trade equities, indices or forex, successful trading requires market knowledge and an ability to predict market trends. Trends change every minute of every day. Trendsignal will help you identify the trend to make you money. Trading with Trendsignal software takes the guesswork out and puts the profit in.

TrendSignal

- Author T2W Bot

- Creation date