You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Dark pools are an ominous-sounding term for private exchanges or forums for trading securities; unlike stock exchanges, dark pools are not accessible by the investing public. Also known as “dark pools of liquidity,” they are so named for their complete lack of transparency. Dark pools came about primarily to facilitate block trading by institutional investors, who did not wish to impact the markets with their large orders and consequently obtain adverse prices for their trades. While dark pools have been cast in a very unfavorable light in Michael Lewis’ bestseller “Flash Boys: A Wall Street Revolt,” the reality is that they do serve a purpose. However, their lack of transparency makes them vulnerable to potential conflicts of interest...

With slow economic growth persisting in many developed nations, investors have taken a liking to emerging market economies. Featuring the right combination of fast-growing populations, fiscal responsibility and burgeoning middle classes, these nations have become portfolio necessities.

Much of investors' fascination with emerging markets is pointed towards the BRIC. Rightfully so, as Brazil, Russia, India and China have all seen tremendous growth in their economies due to having the right combination of resources. Collectively, it is estimated that these countries account for more than 40% of the world's population and hold more than one-third of the total foreign exchange reserves and gold. However, there are more fish in the sea...

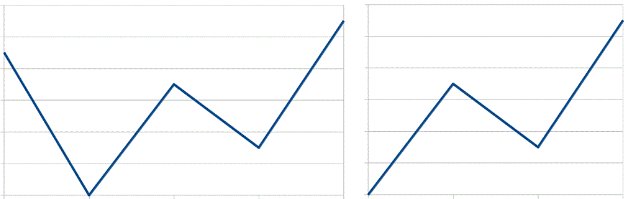

It is no secret that various people or bodies within the financial services industry will say or write whatever will sell the products, rather than what is actually true and correct. For this reason, buyers may be more inclined to rely on what they think is hard evidence – in the form of statistics and charts. Regrettably, one can lie with these too.

In 1954, Darell Huff wrote a classic book titled "How To Lie With Statistics," and a German professor by the name of Walter Krämer has had enormous success with a similar book with the same title, except in German "So Lügt Man Mit Statistik" (revised edition, Piper Verlag, 2011). The charts below are also from the book.

In this article, we will see that it is possible to present financial...

This article is a basic introduction to the fixed income market. It covers the primary facets and features of fixed income as they relate to trading from the individual, as opposed to institutional, perspective.

The term "fixed income" is used to describe a collection of

securities which have predefined pay-out terms. An example would be a certificate of deposit (CD) in which one deposits a set amount of money and in return receives a given amount of money, which includes both the original deposit plus

interest income, at some future date, known as the maturity. Fixed income securities, unlike

stocks, are based on loans. While one might think of "buying" a CD, what he/she is in fact doing is loaning the bank money, for which they...

Why is this a good time to invest in the U.S.? Believe it or not, but it may be because of the deficit! Amid all the hand ringing and gnashing of teeth by politicians of both political parties over growth of the federal budget deficit, evidence suggests that right now may be the best time in a decade to be saving and investing.

Revisiting the bursting of the bubble

To fully appreciate why now may be a good time to invest in U.S. stocks despite record high deficits, it would be time profitably spent to revisit the spring of 2000 just before the tax deadline. The government was running a record budget surplus for the third straight year, and the stock market was at an all time high. During the week leading up to April 15 indices started...