One of the most regular and largely misunderstood phenomena of trading, particularly for newer traders, is the gap. What precisely is a gap? What causes one to happen? And most importantly, how should one trade a gap when it occurs?

In this article, I'll answer these questions, and delve into identifying higher probability assessments for trading gaps.

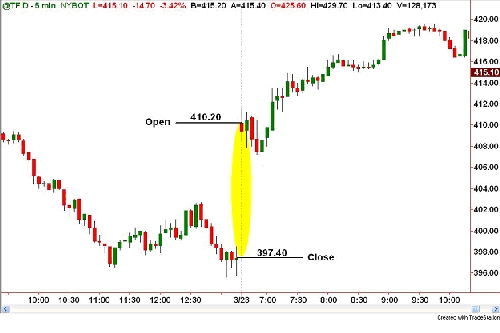

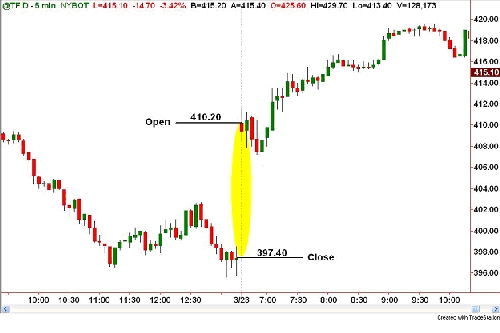

First, a gap is the discrepancy between one day's opening price and the prior day's closing price. The chart below clearly illustrates a large gap in the E-mini Russell 2000 (TF) which occurred on Monday, March 23. Note that the Russell closed at 397.40 on Friday the 20th, and opened at a price of 410.20 the following Monday, forming a 12.80 point up gap.

By any standard, this would be considered a very large gap (more than 3%). So what could have caused price to open so much higher? In this case, it was positive overnight news, the unveiling and positive reception of the long awaited bank rescue plan by the Treasury Secretary early Monday morning. If, on the other hand, the catalyst had been negative, the opening gap most likely would have been to the downside.

The fact that news dissemination, when the New York Stock Exchange and the Nasdaq market is closed, causes prices to gap leads to another frequently asked question I get regarding gaps: If the markets are closed when all this news hits the tape, who did all the buying or selling? The answer: it was done via the Futures market in the Globex (overnight) session.

Some folks are not aware that the Futures market is a 24-hour market, which trades Sunday afternoon through Friday. In addition, most Asian and European traders are more commonly engaged in trading the S&P E-mini rather than any of their own markets, which is where some of the reaction is seen after-hours.

When we delve deeper into how gaps should be treated in regards to trading, the first statistic is that gaps have a higher-than-average tendency to attempt to be filled in the early part of the trading session. Now there is a big difference in "going into the gap" as opposed to filling it. Filling a gap is when price trades back to the prior day's close.

Most traders that have had some experience with gaps generally will fade the gap. Fading simply connotes trading in the opposite direction of the gap. Therefore, if you had a gap higher, fading it would be shorting it, and vice versa. Statistically, this is a bit better than 50% with no other consideration taken into account. The odds are enhanced, however, if taken in the context of larger factors. Additionally, when we look at the bigger picture, playing (trading in the same direction) versus fading will perhaps reveal itself as a higher probability trade.

Two critical areas to weigh are if the gap occurs in the same direction of the dominant trend, or if the gap happens counter after a protracted move. For a better understanding, the hourly chart below is a depiction of the E-mini Russell 2000 in an extended downtrend. Notice that all of the gaps (highlighted in yellow) were to the downside, hence the higher probability trade was to short at the open or wait for the attempted fill to sell it then.

There was one exception, though, that was the substantial gap higher that I've noted in the chart. This gap was significant in two ways: first, in its magnitude, and second in its location. Big gaps (more than 2%) are manifestations of large order imbalances, due to information that prompted market participants to react in a very significant manner. In this example, we might extrapolate that this was a change in perception - from extremely bearish to "maybe the market's discounted all the bad news," therefore increasing the odds of the market moving in the direction of the gap. Moreover, the market opened appreciably higher after nearly a month of unremitting selling pressure.

The size of the gap should also be taken into account when assessing whether to "fade or play". By this I mean that the bigger the gap, the less the likelihood it will be filled that day. Furthermore, large gaps have a high tendency of developing into trending days (chart below).

Since some of these larger gaps are not filled right away, they are said to be "open." Open gaps are very important to identify, because as I stated earlier, they are large order imbalances, and as such, would be considered important areas of support or resistance. Two examples of gaps acting as support and resistance can be found in last week's trading.

The first example (below) is Tuesday's down gap of TF (E-mini Russell 2K). The TF traded higher (faded), initially filling the gap, and subsequently met with stiff resistance at the prior day's closing price, causing it to retreat sharply.

The last example (below) happened on Wednesday, March 25th. The TF had some wild gyrations that day, initially rallying strongly - then reversing down, and finally finding a bottom (support) at the top of the large gap from two days prior.

All in all, gaps are very important as they provide us with important information of overnight order flow and sentiment. Readers should do their own homework, and assess risk carefully before attempting to trade morning gaps, as volatility in the early part of the trading session is usually elevated. Nonetheless, gaps provide tremendous trading opportunities for those that have a well-defined plan and know their probabilities.

Until next time, I hope everyone has a profitable week, month, and year.

In this article, I'll answer these questions, and delve into identifying higher probability assessments for trading gaps.

First, a gap is the discrepancy between one day's opening price and the prior day's closing price. The chart below clearly illustrates a large gap in the E-mini Russell 2000 (TF) which occurred on Monday, March 23. Note that the Russell closed at 397.40 on Friday the 20th, and opened at a price of 410.20 the following Monday, forming a 12.80 point up gap.

By any standard, this would be considered a very large gap (more than 3%). So what could have caused price to open so much higher? In this case, it was positive overnight news, the unveiling and positive reception of the long awaited bank rescue plan by the Treasury Secretary early Monday morning. If, on the other hand, the catalyst had been negative, the opening gap most likely would have been to the downside.

The fact that news dissemination, when the New York Stock Exchange and the Nasdaq market is closed, causes prices to gap leads to another frequently asked question I get regarding gaps: If the markets are closed when all this news hits the tape, who did all the buying or selling? The answer: it was done via the Futures market in the Globex (overnight) session.

Some folks are not aware that the Futures market is a 24-hour market, which trades Sunday afternoon through Friday. In addition, most Asian and European traders are more commonly engaged in trading the S&P E-mini rather than any of their own markets, which is where some of the reaction is seen after-hours.

When we delve deeper into how gaps should be treated in regards to trading, the first statistic is that gaps have a higher-than-average tendency to attempt to be filled in the early part of the trading session. Now there is a big difference in "going into the gap" as opposed to filling it. Filling a gap is when price trades back to the prior day's close.

Most traders that have had some experience with gaps generally will fade the gap. Fading simply connotes trading in the opposite direction of the gap. Therefore, if you had a gap higher, fading it would be shorting it, and vice versa. Statistically, this is a bit better than 50% with no other consideration taken into account. The odds are enhanced, however, if taken in the context of larger factors. Additionally, when we look at the bigger picture, playing (trading in the same direction) versus fading will perhaps reveal itself as a higher probability trade.

Two critical areas to weigh are if the gap occurs in the same direction of the dominant trend, or if the gap happens counter after a protracted move. For a better understanding, the hourly chart below is a depiction of the E-mini Russell 2000 in an extended downtrend. Notice that all of the gaps (highlighted in yellow) were to the downside, hence the higher probability trade was to short at the open or wait for the attempted fill to sell it then.

There was one exception, though, that was the substantial gap higher that I've noted in the chart. This gap was significant in two ways: first, in its magnitude, and second in its location. Big gaps (more than 2%) are manifestations of large order imbalances, due to information that prompted market participants to react in a very significant manner. In this example, we might extrapolate that this was a change in perception - from extremely bearish to "maybe the market's discounted all the bad news," therefore increasing the odds of the market moving in the direction of the gap. Moreover, the market opened appreciably higher after nearly a month of unremitting selling pressure.

The size of the gap should also be taken into account when assessing whether to "fade or play". By this I mean that the bigger the gap, the less the likelihood it will be filled that day. Furthermore, large gaps have a high tendency of developing into trending days (chart below).

Since some of these larger gaps are not filled right away, they are said to be "open." Open gaps are very important to identify, because as I stated earlier, they are large order imbalances, and as such, would be considered important areas of support or resistance. Two examples of gaps acting as support and resistance can be found in last week's trading.

The first example (below) is Tuesday's down gap of TF (E-mini Russell 2K). The TF traded higher (faded), initially filling the gap, and subsequently met with stiff resistance at the prior day's closing price, causing it to retreat sharply.

The last example (below) happened on Wednesday, March 25th. The TF had some wild gyrations that day, initially rallying strongly - then reversing down, and finally finding a bottom (support) at the top of the large gap from two days prior.

All in all, gaps are very important as they provide us with important information of overnight order flow and sentiment. Readers should do their own homework, and assess risk carefully before attempting to trade morning gaps, as volatility in the early part of the trading session is usually elevated. Nonetheless, gaps provide tremendous trading opportunities for those that have a well-defined plan and know their probabilities.

Until next time, I hope everyone has a profitable week, month, and year.

Last edited by a moderator: