Nowler

Experienced member

- Messages

- 1,551

- Likes

- 223

Hey folks,

I really appreciate it if some of you would discuss Risk of Ruin, so that i can better understand it.

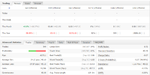

I have attached the RoR of my own live mini account.

* Edited the wording because I implied that in was the one that would discuss it ( I needed you guys to, so I could watch)

I really appreciate it if some of you would discuss Risk of Ruin, so that i can better understand it.

I have attached the RoR of my own live mini account.

* Edited the wording because I implied that in was the one that would discuss it ( I needed you guys to, so I could watch)

Attachments

Last edited: