Soes Bandit

Junior member

- Messages

- 36

- Likes

- 1

Good Afternoon Guys,

I was wondering if some kind soul could clarify the following for me please?

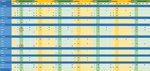

Index Futures – Expire the third Friday of the month in March, June, September and December.

Single Stock Futures – Expire third Friday of every month.

Index Options – Expire the third Friday of every month and weekly on Friday.

Stock Options – Expire Third Friday of every month and weekly on Friday.

Any help would be very much appreciated 🙂

Thank you.

I was wondering if some kind soul could clarify the following for me please?

Index Futures – Expire the third Friday of the month in March, June, September and December.

Single Stock Futures – Expire third Friday of every month.

Index Options – Expire the third Friday of every month and weekly on Friday.

Stock Options – Expire Third Friday of every month and weekly on Friday.

Any help would be very much appreciated 🙂

Thank you.