EURUSD-Market participants focus shifts to ECB policy. EURUSD breakout again

The results of the first round of French Presidential elections were very much in line with market expectations, EUR spikes. Market participant focuses on ECB meeting this week, the second round of the French election to be held in two weeks time.

Fundamental analysis

Review of the previous data:

• The Ifo Business Climate Index rose to 112.9 points in April from 112.4

• Eurozone Manufacturing PMI 56.8 vs 56.1 forecast

• Eurozone Services PMI 56.2 vs 56.0 forecast

• Germany Manufacturing PMI 58.2 vs 58.1 forecast

• Germany Services PMI 54.7 vs 55.5 forecast

• French Manufacturing PMI 55.1 vs 53.2 forecast

• French Services PMI 57.7 vs 57.2 forecast

• EA annual CPI y/y was 1.5% in March 2017, down from 2.0% in February

• Euro area international trade in goods surplus €17.8 bn in February 2017, €1.7 bn surplus for EU.

Upcoming data:

Thursday, April 27

• Germany prelim CPI m/m basis forecast -0.1% vs 0.2%

Unicredit: The headline inflation rate in April likely accelerated by 0.3pp to 1.9% yoy.

• ECB meeting:

Thursday’s ECB policy meeting is unlikely to be eventful as ECB to keep policy accommodative.

Unicredit- We do not expect new policy announcements, nor do we anticipate any material change of rhetoric.

Unicredit: we think that Thursday’s meeting will be used by the ECB as a “bridge” to the June rendezvous, which promises to be important”.

Deutsche Bank: We do not expect any significant changes at the ECB meeting.

According to Abhishek Singhania at Deutsche Bank, “We do not expect any significant changes at the ECB meeting as the ECB is still waiting for credible evidence for improvement in underlying inflation and is unlikely to want to signal any change in policy stance as yet”.

ABN AMRO: Sticking to its stance for now

According to Nick Kounis and Aline Schuiling at ABN AMRO, We do not expect the ECB to make major changes to its communication at its meeting this week. The first step in the exit process will come with a change in communication in our view in June of this year. The forward guidance will likely become more neutral, dropping the explicit possibility of cutting rates or stepping up QE. We then expect the ECB to set out its plan for tapering in September of this year.

Nomura: We are in line with the consensus in expecting all the ECB’s key policy parameters

to be left unchanged at this week’s ECB meeting on 27 April. No change in the forward guidance may be a small disappointment for the market.

ING: Assuming that Macron does secure the presidency, speculation will increase of a significant tapering announcement to be made at the June 8th ECB meeting.

INSTITUTIONAL FX POSITIONING

Nomura-EUR: Leveraged funds’ net short positioning in EUR rose for the third week (to 48% vs.

45% last week). Max net shorts in the past year reached 75%, which was last seen in August 2016. Asset managers’ net long positioning in EUR remained stable at around 21%.

Technical Analysis

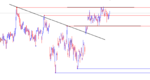

The first round of French election sends the EURUSD to a five-month high.

EURUSD marches to the key breakout zone remains between 1.0950 its top of the rising channel and 1.1000 its 100Wema.

The price is trading above 50Wsma for the first time since November 2016 pause the rally at 20Msma seems at 1.0950.

The price gave an upside breakout through inverse H&S pattern on April 18th again breakout given yesterday (April 25)

The daily RSI approaching overbought zone, indicating round number 1.10 likely to act resistance over near term.

If this week closes above 1.1020/1.1030, rally might extend to 1.1100/1.1120 100Wema, 1.1200/1.1240 Oct 2016 high,1.1300 and 1.1400/1.1430 100.00 weekly fe over the medium term.

Symmetrical triangle breakout gave on the weekly chart, aiming at 1.1300 levels.

Support finds at 1.0900, 1.0820/1.0800 and 1.0700/1.0670

The French election risk was minimized notably, euro remains a buyer on a dip

UBS: forecast 1.15 and 1.20 into end 2017/early 2018

Societe Generale:The bottom in EUR/USD is behind us and the trend has turned.

Nomura: The possible dip after the ECB meeting and inflation data later this week may provide a good opportunity to buy EUR.