foroom lluzers

Veteren member

- Messages

- 3,608

- Likes

- 140

Professional trader:Good trading is boring , I have nothing to do all week except wait wait wait patiently , for the righ entry

Professionals understand trading phsychology

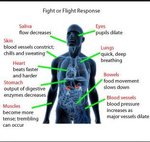

Amateur :Good trading is exciting: being scalped 3 times a day , then taking small profits and large losses getting scalped.Stress is good ,Let's say you're walking down a path and a tiger jumps out at you. Instantly, you perceive a threat and adrenaline is released. The tiger emotions is exciting , you fear ,get attacked by market , then I win .It is more like the exciting chase before the sex.

Amateurs are driven by their emotions , stress ,mistakes and ambitions , they don't understand trading psychology.

http://www.trade2win.com/boards/psychology-risk-money-management/45686-trading-psychology.html

http://www.trade2win.com/boards/first-steps/223070-find-great-mentor.html

http://www.trade2win.com/boards/first-steps/223070-find-great-mentor-6.html#post2893944

Professionals understand trading phsychology

Amateur :Good trading is exciting: being scalped 3 times a day , then taking small profits and large losses getting scalped.Stress is good ,Let's say you're walking down a path and a tiger jumps out at you. Instantly, you perceive a threat and adrenaline is released. The tiger emotions is exciting , you fear ,get attacked by market , then I win .It is more like the exciting chase before the sex.

Amateurs are driven by their emotions , stress ,mistakes and ambitions , they don't understand trading psychology.

http://www.trade2win.com/boards/psychology-risk-money-management/45686-trading-psychology.html

http://www.trade2win.com/boards/first-steps/223070-find-great-mentor.html

http://www.trade2win.com/boards/first-steps/223070-find-great-mentor-6.html#post2893944