Trading financial instruments as a full-time professional trader requires a vast knowledge of the financial industry. Those who are trading the financial markets over a long period of time with consistent profit have probably gone through many difficult stages in their trading career. There are many different types of trading strategy available and professional traders have developed their preferred strategy based on their own personal traits. In this article, we will discuss an excellent trading strategy for use in the forex market. The Fibonacci trading strategy has been used in forex for a long period of time and many experts consider the Fibonacci retracement tools as their favorite. In the eyes of many professionals, the financial market with the help of Fibonacci retracement tools is one of the more advanced ways of making money. It’s true that you may have some difficulty trading currency pairs with this type strategy but if you have a strong basic understanding in forex then you can easily grasp the gist of this approach.

What are Fibonacci retracement tools?

There are many different types of tool available in most trading platforms which helps the trader to perform technical analysis. Markets by their nature are either going up / down or exhibiting sideways movement so when the market is moving upward or downward it will do so with some minor pullbacks. To be precise, you will see some bearish pullback in the market when the market is trending up (and bullish when trending down) and this type of pullback is known as price retracement. Professional traders will attempt to execute their trade in the market after a retracement. Fibonacci is a tool which can help us to identify the end of the retracement in a trending market. This can help a trader to execute high probability trades in the market in favor of the prevailing trend.

Trading using Fibonacci retracement tools

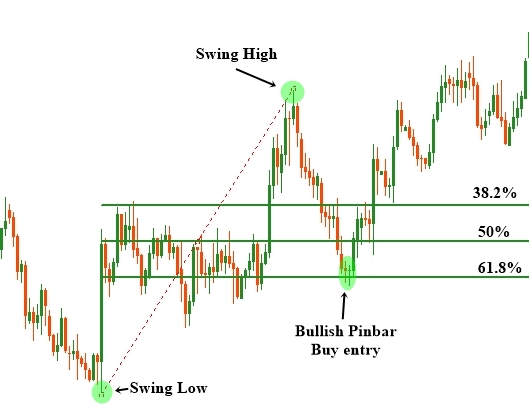

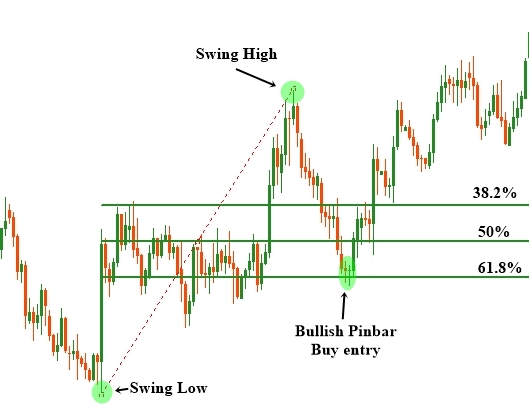

Fig 1 Trading an important Fibonacci retracement level in the market.

Trade setup

In the above figure, a trader uses the Fibonacci retracement tool to identify the potential price reversal point of the currency pair. The most important Fibonacci retracement levels are the 38.2%, 50% and 61.8% Fibonacci retracement level. In an uptrend, these levels act as a strong support level in the market. A trader will draw the Fibonacci levels by using the most significant low and high of the market within the time-frame being traded. In an uptrend, they draw the retracement level from low to high and for the down trend they draw the level from high to low. In the above figure, the trader draws the bullish retracement level by using the most significant low and high of the market. After the retracement level is drawn the trader will wait for a bullish price action signal to execute their trade at the appropriate Fibonacci retracement level. In the above example, a nice bullish pin bar was formed right at the 61.8% Fibonacci retracement and a long trade was entered.

Setting the stop loss and take profit level

There are two ways of setting the stop loss while using Fibonacci retracement tools. If trading at the 50% retracement level or the 38.2% retracement level then you can put your stop loss just below the 61.8% retracement level. An alternative approach could be to use a price action signal as a means to determine a stop loss zone.

It is possible for traders to make significant profits in the market when using a trailing stop loss strategy. In general, (and when not using a trailing stop loss) potential take profit levels are set at the key swing high for the buy order and for the sell order they use the key swing low in the market. However, a more advanced approach would be to close half of a position at the key swing high or low based on the type of order being used. Then keep the remaining half of the position open in the market and use a trailing stop loss feature. The proper use of the trailing stop loss can significantly improve trading performance and help gain much greater reward to risk in the market. Whilst using the trailing stop loss feature, try to ensure that the stop loss is based on major support and resistance levels in the market as opposed to a fixed number of pips.

In Summary

Trading financial instruments with the aid of Fibonacci retracement tools can be highly profitable. Fibonacci retracement can be used to execute trades in the direction of the long term prevailing trend. If you don’t know how to trade with price action signal as a stop loss then it may be better to use wide stop loss while using this trading strategy. Having an understanding of Price Action trading is highly beneficial when combined with Fibonacci and has been shown to be an effective and reliable way of entering and exiting trades.

Andrew Bezen can be contacted at Andrew Bezen.com

What are Fibonacci retracement tools?

There are many different types of tool available in most trading platforms which helps the trader to perform technical analysis. Markets by their nature are either going up / down or exhibiting sideways movement so when the market is moving upward or downward it will do so with some minor pullbacks. To be precise, you will see some bearish pullback in the market when the market is trending up (and bullish when trending down) and this type of pullback is known as price retracement. Professional traders will attempt to execute their trade in the market after a retracement. Fibonacci is a tool which can help us to identify the end of the retracement in a trending market. This can help a trader to execute high probability trades in the market in favor of the prevailing trend.

Trading using Fibonacci retracement tools

Fig 1 Trading an important Fibonacci retracement level in the market.

Trade setup

In the above figure, a trader uses the Fibonacci retracement tool to identify the potential price reversal point of the currency pair. The most important Fibonacci retracement levels are the 38.2%, 50% and 61.8% Fibonacci retracement level. In an uptrend, these levels act as a strong support level in the market. A trader will draw the Fibonacci levels by using the most significant low and high of the market within the time-frame being traded. In an uptrend, they draw the retracement level from low to high and for the down trend they draw the level from high to low. In the above figure, the trader draws the bullish retracement level by using the most significant low and high of the market. After the retracement level is drawn the trader will wait for a bullish price action signal to execute their trade at the appropriate Fibonacci retracement level. In the above example, a nice bullish pin bar was formed right at the 61.8% Fibonacci retracement and a long trade was entered.

Setting the stop loss and take profit level

There are two ways of setting the stop loss while using Fibonacci retracement tools. If trading at the 50% retracement level or the 38.2% retracement level then you can put your stop loss just below the 61.8% retracement level. An alternative approach could be to use a price action signal as a means to determine a stop loss zone.

It is possible for traders to make significant profits in the market when using a trailing stop loss strategy. In general, (and when not using a trailing stop loss) potential take profit levels are set at the key swing high for the buy order and for the sell order they use the key swing low in the market. However, a more advanced approach would be to close half of a position at the key swing high or low based on the type of order being used. Then keep the remaining half of the position open in the market and use a trailing stop loss feature. The proper use of the trailing stop loss can significantly improve trading performance and help gain much greater reward to risk in the market. Whilst using the trailing stop loss feature, try to ensure that the stop loss is based on major support and resistance levels in the market as opposed to a fixed number of pips.

In Summary

Trading financial instruments with the aid of Fibonacci retracement tools can be highly profitable. Fibonacci retracement can be used to execute trades in the direction of the long term prevailing trend. If you don’t know how to trade with price action signal as a stop loss then it may be better to use wide stop loss while using this trading strategy. Having an understanding of Price Action trading is highly beneficial when combined with Fibonacci and has been shown to be an effective and reliable way of entering and exiting trades.

Andrew Bezen can be contacted at Andrew Bezen.com

Last edited by a moderator: