Aston1st

Well-known member

- Messages

- 295

- Likes

- 47

Title should read; "How I turned £3,000 into £20,000 in 6 Weeks"

I had been trading futures & spread betting using various strategies with mixed results. I.e scratching or losing money. As you well know there are as many reasons for losing in trading as there are traders.

Last October 2010, I put around £3,000.00 in a spread betting account and traded the DAX. It was day trading.

1. Where as before I would trade around 20 -30 rts a day I slowed down to between 1 - 10.

2. Started trading at £5.00 then £10.00 , the margin requirements back then were £40.00 for each £1.00 traded, I traded aggressively.

3. At just before and at the Zenith of my trading I was trading £750.00 a tick! Obviously problems getting fills from a bucket shop spread betting account meant that I had to endure 4 ticks spillage!

4. I was using the High and Low of yesterday for my support and resistance levels and pivot points along with point and figure.

5. Initally I was aiming for 10 ticks a day, but often this was too easy to get which meant I traded for some times 20 even 50 ticks.

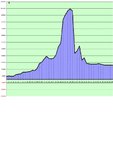

6. The Zenith of my trading account was £118,000 at which point I should have stopped and took all my gains or at least take half.

7. Largest winning day was £35,000 which was on an uneventful day, no real news out so was not too excited about it.

8. Largest losing day was £62,500 Ouch!!!!1

General rule was if no news was coming out, or if the magic charts did not display anything a lotof the interday "big" moves were fake moves and unless they were outside day's I would be cautious in reacting to them.

On the day the DAX was trading aroudn 6750.00 and heading south to the previous day's low, at around 6699 since I was trading at £750.00 a tick I could not take the pain anymore and exited. I then reversed my position on the rationale that if it did take the previous day's low I would reverse again and job 30 ticks! Ala's the price never hit the previous day's low as it was a fake move and it returned to my original position at 6750! at the end of the day.

9. previous to this my target was the DAX to reach 7,000 ( it's that and some all day long nowaday's) which would have given me around £260,000. Syliva from CNBC gave me the idea of reaching for the "Stars" previous to her comments I was trading simply on my own targets and levels. The 250 ticks were 250 ticks too far! Also should have reduced my size.

10. Undeterred from that mega day loss I figured that with £25,000 left in the account I could easily double it in 10 days. Of course I had not figured on the Irish Question that day which is the second big dip on the chart was my worst as I throw my rules out the window. Initially I managed to gain ground only to throw it away.

11. Throughout the trading period I took numerous draw's on the account and spent the money thus my £25,000 profit was frozen at that level as I had no more funds in the Account.

I learnt a number of very valuable lessons during that trading session.

1. It is best to start with a decent size account. Then go for 10 ticks a day or if too easy 10 in the morning and 10 in the afternoon. If you can trade at £100.00 a tick that's over £200,000 a year!

2. Dont' look at the money direct but see the account in terms of numbers of units.

This is so the money doe'snt get in the way of trading how you see the market. Don't try to impose your will on the market, if you have an appointment or your wife gives birth don't try and trade around it or before your appointment trying to tell the market to hurry up and allow you to take your profit!!! :smart:

3. It's possible, to make real money in this game, as an independant or retail trader.

4. When trading, take money out regular, place some of it in :

a; Your reserve trading account that should try to equal your optimum trading account i.e if you start with £10,0000 your reserve should also be built up to £10,000 as you grow so should your reserve.

b; Pay yourself regularly, as paper profits are just that Paper Profits, having £100,000 in my trading account was a great feeling. Not taking the money off the table when I had it is a great regret!

Last but not least, take advice from Oliver Twist's Fagan:

"Only one thing in this world counts, and that's money in the Bank in Large amounts."

Now I have to gather some more capital to trade again. Prop shops won't touch me with a barge pole as VAR is too risky for them and trading period too short.

I had been trading futures & spread betting using various strategies with mixed results. I.e scratching or losing money. As you well know there are as many reasons for losing in trading as there are traders.

Last October 2010, I put around £3,000.00 in a spread betting account and traded the DAX. It was day trading.

1. Where as before I would trade around 20 -30 rts a day I slowed down to between 1 - 10.

2. Started trading at £5.00 then £10.00 , the margin requirements back then were £40.00 for each £1.00 traded, I traded aggressively.

3. At just before and at the Zenith of my trading I was trading £750.00 a tick! Obviously problems getting fills from a bucket shop spread betting account meant that I had to endure 4 ticks spillage!

4. I was using the High and Low of yesterday for my support and resistance levels and pivot points along with point and figure.

5. Initally I was aiming for 10 ticks a day, but often this was too easy to get which meant I traded for some times 20 even 50 ticks.

6. The Zenith of my trading account was £118,000 at which point I should have stopped and took all my gains or at least take half.

7. Largest winning day was £35,000 which was on an uneventful day, no real news out so was not too excited about it.

8. Largest losing day was £62,500 Ouch!!!!1

General rule was if no news was coming out, or if the magic charts did not display anything a lotof the interday "big" moves were fake moves and unless they were outside day's I would be cautious in reacting to them.

On the day the DAX was trading aroudn 6750.00 and heading south to the previous day's low, at around 6699 since I was trading at £750.00 a tick I could not take the pain anymore and exited. I then reversed my position on the rationale that if it did take the previous day's low I would reverse again and job 30 ticks! Ala's the price never hit the previous day's low as it was a fake move and it returned to my original position at 6750! at the end of the day.

9. previous to this my target was the DAX to reach 7,000 ( it's that and some all day long nowaday's) which would have given me around £260,000. Syliva from CNBC gave me the idea of reaching for the "Stars" previous to her comments I was trading simply on my own targets and levels. The 250 ticks were 250 ticks too far! Also should have reduced my size.

10. Undeterred from that mega day loss I figured that with £25,000 left in the account I could easily double it in 10 days. Of course I had not figured on the Irish Question that day which is the second big dip on the chart was my worst as I throw my rules out the window. Initially I managed to gain ground only to throw it away.

11. Throughout the trading period I took numerous draw's on the account and spent the money thus my £25,000 profit was frozen at that level as I had no more funds in the Account.

I learnt a number of very valuable lessons during that trading session.

1. It is best to start with a decent size account. Then go for 10 ticks a day or if too easy 10 in the morning and 10 in the afternoon. If you can trade at £100.00 a tick that's over £200,000 a year!

2. Dont' look at the money direct but see the account in terms of numbers of units.

This is so the money doe'snt get in the way of trading how you see the market. Don't try to impose your will on the market, if you have an appointment or your wife gives birth don't try and trade around it or before your appointment trying to tell the market to hurry up and allow you to take your profit!!! :smart:

3. It's possible, to make real money in this game, as an independant or retail trader.

4. When trading, take money out regular, place some of it in :

a; Your reserve trading account that should try to equal your optimum trading account i.e if you start with £10,0000 your reserve should also be built up to £10,000 as you grow so should your reserve.

b; Pay yourself regularly, as paper profits are just that Paper Profits, having £100,000 in my trading account was a great feeling. Not taking the money off the table when I had it is a great regret!

Last but not least, take advice from Oliver Twist's Fagan:

"Only one thing in this world counts, and that's money in the Bank in Large amounts."

Now I have to gather some more capital to trade again. Prop shops won't touch me with a barge pole as VAR is too risky for them and trading period too short.

Attachments

Last edited by a moderator: