AndersenBands

Well-known member

- Messages

- 462

- Likes

- 0

Yesterday JPY weakened considerably and the ranges that were anticipated to increase did so measurably. AUD also gained notable strength. Here is a visual image of the current short-term momentum ranking of the majors:

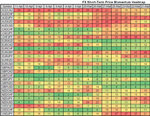

Some of today's observations and ideas include-

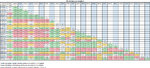

17 of the 28 pairs that we follow had daily ranges in excess of 100% of the typical range, there are few remaining to increase in volatility. However, $AUDNZD and $GBPUSD are two pairs that are likely to experience range expansions relatively soon.

$AUDCAD and $USDJPY 3-day ranges are poised to expand soon as well.

$AUDCHF, $AUDJPY, $AUDUSD, $CHFJPY had short-term momentum turn positive while $GBPCAD and $GBPNZD turned negative.

$CADCHF experienced a long-term momentum reversal up while $USDCAD turned negative.

$EURGBP shows tight daily and 3-day pivot ranges, suggesting a decent move is in the works.

$GBPCHF shows the highest momentum in both short-term and long-term momentum. Similarly, $EURCHF is ranked second for both short-term and long-term momentum.

$AUDUSD and $EURUSD have each confirmed a 3-day pivot reversal up while $USDCHF has confirmed a 3-day pivot reversal down.

Have a great day!

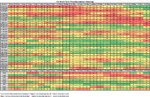

Some of today's observations and ideas include-

17 of the 28 pairs that we follow had daily ranges in excess of 100% of the typical range, there are few remaining to increase in volatility. However, $AUDNZD and $GBPUSD are two pairs that are likely to experience range expansions relatively soon.

$AUDCAD and $USDJPY 3-day ranges are poised to expand soon as well.

$AUDCHF, $AUDJPY, $AUDUSD, $CHFJPY had short-term momentum turn positive while $GBPCAD and $GBPNZD turned negative.

$CADCHF experienced a long-term momentum reversal up while $USDCAD turned negative.

$EURGBP shows tight daily and 3-day pivot ranges, suggesting a decent move is in the works.

$GBPCHF shows the highest momentum in both short-term and long-term momentum. Similarly, $EURCHF is ranked second for both short-term and long-term momentum.

$AUDUSD and $EURUSD have each confirmed a 3-day pivot reversal up while $USDCHF has confirmed a 3-day pivot reversal down.

Have a great day!