Without a doubt, more people follow the price of Gold than any other commodity in the world, and with good reason. Gold, that archaic, barbaric, precious metal men and women have coveted since the dawn of mankind, not only presents wonderful opportunities for making money, it also continues to have a major impact on currencies, interest rates and markets across the globe.

Four factors that influence Gold

While there are many factors that have some impact on this glittery metal the ones that I have found to have the most impact are:

Let's start by looking at the relationship between gold and dollar index , specifically the United States Dollar. What seems to be going on is that Gold can only rally "so far" above the U.S. Dollar before it takes a tumble. It is difficult to see this relationship by looking at charts, but it is quite easy to see when you look at the spread relationship between these markets.

The relationship that I like to look at is arrived by taking the spread between these two markets, on a weekly basis, then compiling a 3 week moving average of the spread and a 21 week moving average of the spread.

In order to see the "push-pull" of the spread, I then subtract the 3 week moving average from the 21 week moving average. Dividing that answer by 100 results in a uniform ratio, thus all points in time can be looked at on a consistent scale.

In doing this I have noticed that when this ratio gets "out of whack" - that is the 3 week spread to the 21 is greater than 30% - a market decline in Gold will shortly exhibit itself. In other words, Gold can become overbought vs. the US Dollar and at that point, large sums of professional money come in to take advantage of this imbalance by selling Gold.

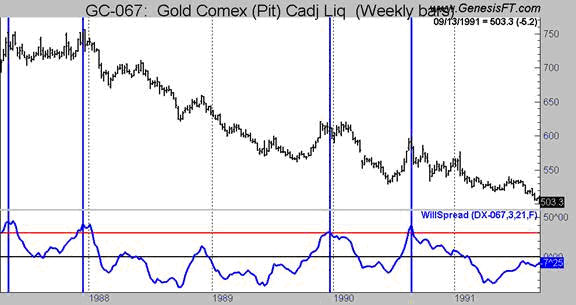

The above chart shows the tremendous impact this spread relationship has had over the last 15 years. Indeed, every time the spread has risen above the upper line you see here Gold has tumbled.

Fundamental Lesson 1: There is a relationship between the US Dollar and Gold

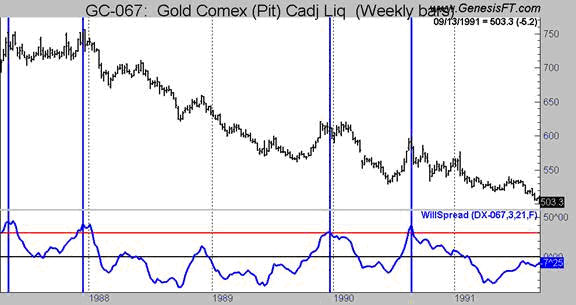

Here is an enlarged view of the late 1980s and early 1990s so you can get a better feel of the importance of this relationship or imbalance between Gold and the U.S. Dollar. This index can be followed or maintained weekly. You may also keep abreast of it, as I do, with the software from Genesis Data Services (gfds.com).

Please note this is not a day-trading or short term swing indicator. It's record is that of calling moves which last for 6 months or longer. What I have developed, crude as it might be, is a way of discerning when Gold is overvalued against the U.S. Dollar. You may also see that most major rallies in this metal, though not all begin with this valuation index in a low level, suggesting owning Gold is better than owning Dollars.

Does Gold have a seasonal pattern?

We usually think of commodities like Corn, Cattle and Wheat or perhaps Cocoa and Coffee as having seasonal influences due to planting, harvesting or breeding cycles. While that is true, it is equally true that the metal markets have shown a specific pattern to rally and decline, usually, but not always, at the same general time periods each year.

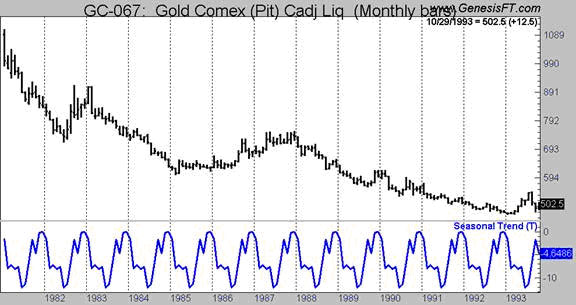

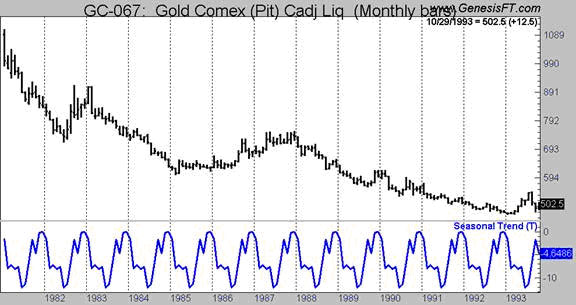

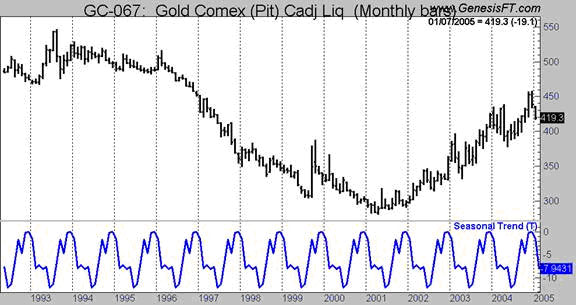

This is not a new idea. In my 1973 book, the first of its kind on identifying seasonal patterns in commodities ("How Seasonal Factors Influence Commodity Prices") I pointed out that Gold had a seasonal influence to rally around July of each year with a top in December. As you look at the long term price of Gold below on a monthly chart, keep in mind that I wrote about the seasonal influence over 30 years ago.

Underneath price you will see that the seasonal pattern (which has been exactly as I identified in 1973) rallies in the middle of the year and declines at the end. That's usually, not always, but usually what Gold does.

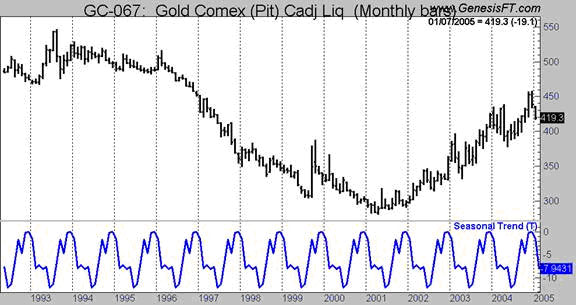

The next chart gives us a view of Gold from 1993 into 2005 where we see the same general rule to be operative; that is if Gold is going to stage a good rally, the chances are high that it will come in the summer while sells come at year end.

This is important information. Virtually all the sizeable declines in AU came around the first of the year; this has not been a good time to be bullish on Gold. It is a sucker play foisted upon the masses by the Gold Bug Camp. The first of the year, when they make their gloom and doom prophecies of famine and pestilence, arguing for higher Gold prices is just not when it happens.

Naturally, every year is not the same. There can, and will be, times Gold slips away from the seasonal influence. There is no perfection in this business of forecasting, but now you know the ideal times to look for rallies and declines in this market.

Fundamental Lesson Two: There is a time to sow and a time to reap Gold. It has strong seasonal influences.

Watching the Commercials

There's not a need for a channel-changer as we watch the Commercials in the Gold market. The Commercials I'm talking about here are a group of traders/investors called "Commercials" by the United States Government. These people are the users and producers of commodities who are so large and influential that they must, by Federal law, report all their buying and selling to the Commodity Futures Trading Commission every week.

These are the biggest, best, brightest and deepest pocket players of commodities in the world. They are the super powers of finance and need to be followed like a hawk. I have been hawk-eyeing this crowd since 1970 and would not take a position in any market without first seeing what they are doing. Now, I'll be the first to admit that there are still problems in using their track record of buying and selling to know what we should do. Yet, on balance, I do not know of any other tool with a better job of calling long term market highs and lows.

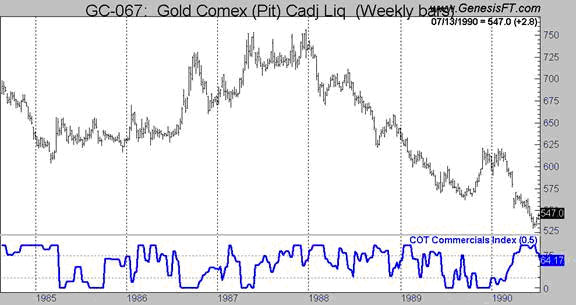

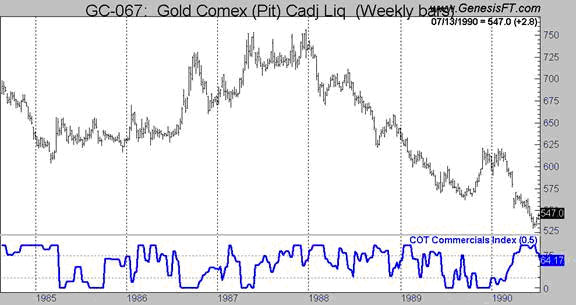

As you can see this chart above stretches all the way back to the price of Gold in 1984 through 1990. In most instances when the index was high - meaning the Commercials were heavy buyers - Gold usually rallied and when low, Gold declined . Is it just that simple? Yes. Sure there are nuances and subtleties to this, but by and large the Commercials do the right thing most of the time. They are an excellent leading indicator of future price action.

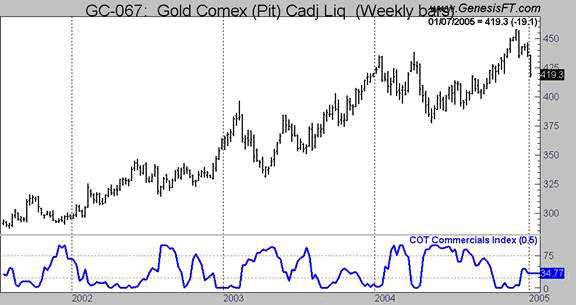

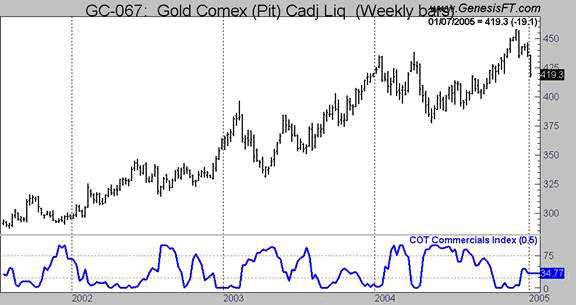

Let's skip forward to 2002-2005 and again look at the same index against the price of Gold and look what we see... déjà vu all over again. When the index is high, Gold rallies and when low, it gets spanked. Is it that simple? Yes!

Fundamental Lesson Three: The future price of gold is heavily influenced by what the Commercials do

2+2=4 (Or How To Trade Gold)

Look at what happened to Gold in late 2004. The Commercials have become heavy sellers and... and... did a bell just go off? I said "late 2004." Isn't that the time when Gold usually declines in phase with its seasonal pattern? Oh, "Gosh, I almost forgot. That sure enough is."

And 2+2+2=Bingo

So, you see how we can combine a seasonal pattern with the Commercials. Now please go back to the valuation model I discussed at the first of this article and see if Gold was over or undervalued at the end of 2004.

Assuming you did that, you will have noticed Gold was overvalued. At the time the seasonals pointed to a decline, and the Commercials were large sellers. What more do you need? Is it that easy? Yes !

Depressions/Recessions and Stockmarket crashes

"Just wait until the market crashes and the economy goes to hell - then Gold will scream and the idiots will pay." I've heard that and similar verses to the point I'm angry. These people are the idiots. They have not studied the past. Gold did not have a rip-roaring bull market in 1929, or in the crash of 1970, or during the largest one month decline in history in 1987. When markets around the world toppled in 2000 with the NASDAQ losing 75% in value, did Gold soar to the moon?

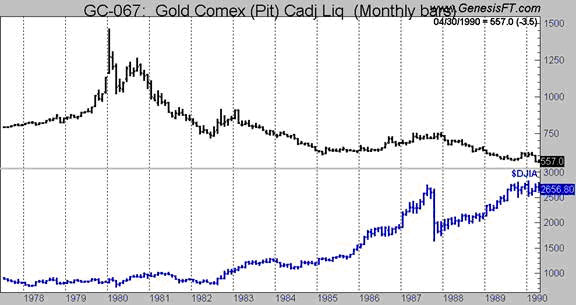

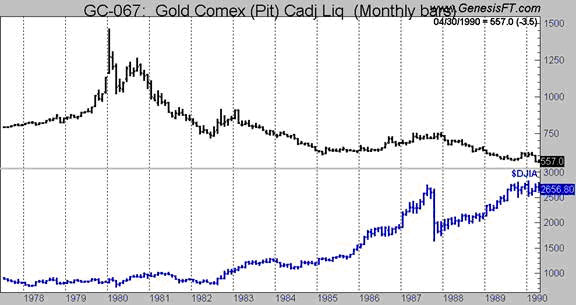

Nope. Gold barely rallied. I rest my case. Stock market crashes and depressions do not put gold higher. To that end, here is a chart of Gold with a chart of the Dow 30 underneath it. Perhaps you can see what I can't. But for the life of me, I do not see any association with large rallies in the Gold market and stock market declines. Go ahead. See for yourself.

Let's look past 1990 and see what happened in the crash of 2000. A crash heard around the world as economies went into a tailspin and unemployment approached 9% throughout Europe.

While stocks plummeted, Gold also declined and then had its best rally from about the start of 2002 to approximately mid-2002. At that same time stocks were rallying! When stocks bottomed in early 2003, guess what? Gold bottomed and rallied in harmony with the stock market rally.

Point Counter-Point: Gold does not rally when stocks or economies collapse

I can almost hear you now saying, "OK smart guy, when does Gold rally based on market forces you have not mentioned earlier"?

My best answer is that when inflation goes berserk, expect Gold to rally. The great Gold bull market of 1979-1980 took place when Jimmy Carter, perhaps the worst President since FDR, was in power. Inflation and interest rates soared. Gold rallies when there is money around, and it is afraid of losing purchasing power. In depressions and recessions there is no money around to buy much of anything, anyway.

Four factors that influence Gold

While there are many factors that have some impact on this glittery metal the ones that I have found to have the most impact are:

- The US Dollar Relationship

- The Seasonal Pattern

- The Commercials

- Stockmarket Crashes/ Depressions

Let's start by looking at the relationship between gold and dollar index , specifically the United States Dollar. What seems to be going on is that Gold can only rally "so far" above the U.S. Dollar before it takes a tumble. It is difficult to see this relationship by looking at charts, but it is quite easy to see when you look at the spread relationship between these markets.

The relationship that I like to look at is arrived by taking the spread between these two markets, on a weekly basis, then compiling a 3 week moving average of the spread and a 21 week moving average of the spread.

In order to see the "push-pull" of the spread, I then subtract the 3 week moving average from the 21 week moving average. Dividing that answer by 100 results in a uniform ratio, thus all points in time can be looked at on a consistent scale.

In doing this I have noticed that when this ratio gets "out of whack" - that is the 3 week spread to the 21 is greater than 30% - a market decline in Gold will shortly exhibit itself. In other words, Gold can become overbought vs. the US Dollar and at that point, large sums of professional money come in to take advantage of this imbalance by selling Gold.

The above chart shows the tremendous impact this spread relationship has had over the last 15 years. Indeed, every time the spread has risen above the upper line you see here Gold has tumbled.

Fundamental Lesson 1: There is a relationship between the US Dollar and Gold

Here is an enlarged view of the late 1980s and early 1990s so you can get a better feel of the importance of this relationship or imbalance between Gold and the U.S. Dollar. This index can be followed or maintained weekly. You may also keep abreast of it, as I do, with the software from Genesis Data Services (gfds.com).

Please note this is not a day-trading or short term swing indicator. It's record is that of calling moves which last for 6 months or longer. What I have developed, crude as it might be, is a way of discerning when Gold is overvalued against the U.S. Dollar. You may also see that most major rallies in this metal, though not all begin with this valuation index in a low level, suggesting owning Gold is better than owning Dollars.

Does Gold have a seasonal pattern?

We usually think of commodities like Corn, Cattle and Wheat or perhaps Cocoa and Coffee as having seasonal influences due to planting, harvesting or breeding cycles. While that is true, it is equally true that the metal markets have shown a specific pattern to rally and decline, usually, but not always, at the same general time periods each year.

This is not a new idea. In my 1973 book, the first of its kind on identifying seasonal patterns in commodities ("How Seasonal Factors Influence Commodity Prices") I pointed out that Gold had a seasonal influence to rally around July of each year with a top in December. As you look at the long term price of Gold below on a monthly chart, keep in mind that I wrote about the seasonal influence over 30 years ago.

Underneath price you will see that the seasonal pattern (which has been exactly as I identified in 1973) rallies in the middle of the year and declines at the end. That's usually, not always, but usually what Gold does.

The next chart gives us a view of Gold from 1993 into 2005 where we see the same general rule to be operative; that is if Gold is going to stage a good rally, the chances are high that it will come in the summer while sells come at year end.

This is important information. Virtually all the sizeable declines in AU came around the first of the year; this has not been a good time to be bullish on Gold. It is a sucker play foisted upon the masses by the Gold Bug Camp. The first of the year, when they make their gloom and doom prophecies of famine and pestilence, arguing for higher Gold prices is just not when it happens.

Naturally, every year is not the same. There can, and will be, times Gold slips away from the seasonal influence. There is no perfection in this business of forecasting, but now you know the ideal times to look for rallies and declines in this market.

Fundamental Lesson Two: There is a time to sow and a time to reap Gold. It has strong seasonal influences.

Watching the Commercials

There's not a need for a channel-changer as we watch the Commercials in the Gold market. The Commercials I'm talking about here are a group of traders/investors called "Commercials" by the United States Government. These people are the users and producers of commodities who are so large and influential that they must, by Federal law, report all their buying and selling to the Commodity Futures Trading Commission every week.

These are the biggest, best, brightest and deepest pocket players of commodities in the world. They are the super powers of finance and need to be followed like a hawk. I have been hawk-eyeing this crowd since 1970 and would not take a position in any market without first seeing what they are doing. Now, I'll be the first to admit that there are still problems in using their track record of buying and selling to know what we should do. Yet, on balance, I do not know of any other tool with a better job of calling long term market highs and lows.

As you can see this chart above stretches all the way back to the price of Gold in 1984 through 1990. In most instances when the index was high - meaning the Commercials were heavy buyers - Gold usually rallied and when low, Gold declined . Is it just that simple? Yes. Sure there are nuances and subtleties to this, but by and large the Commercials do the right thing most of the time. They are an excellent leading indicator of future price action.

Let's skip forward to 2002-2005 and again look at the same index against the price of Gold and look what we see... déjà vu all over again. When the index is high, Gold rallies and when low, it gets spanked. Is it that simple? Yes!

Fundamental Lesson Three: The future price of gold is heavily influenced by what the Commercials do

2+2=4 (Or How To Trade Gold)

Look at what happened to Gold in late 2004. The Commercials have become heavy sellers and... and... did a bell just go off? I said "late 2004." Isn't that the time when Gold usually declines in phase with its seasonal pattern? Oh, "Gosh, I almost forgot. That sure enough is."

And 2+2+2=Bingo

So, you see how we can combine a seasonal pattern with the Commercials. Now please go back to the valuation model I discussed at the first of this article and see if Gold was over or undervalued at the end of 2004.

Assuming you did that, you will have noticed Gold was overvalued. At the time the seasonals pointed to a decline, and the Commercials were large sellers. What more do you need? Is it that easy? Yes !

Depressions/Recessions and Stockmarket crashes

"Just wait until the market crashes and the economy goes to hell - then Gold will scream and the idiots will pay." I've heard that and similar verses to the point I'm angry. These people are the idiots. They have not studied the past. Gold did not have a rip-roaring bull market in 1929, or in the crash of 1970, or during the largest one month decline in history in 1987. When markets around the world toppled in 2000 with the NASDAQ losing 75% in value, did Gold soar to the moon?

Nope. Gold barely rallied. I rest my case. Stock market crashes and depressions do not put gold higher. To that end, here is a chart of Gold with a chart of the Dow 30 underneath it. Perhaps you can see what I can't. But for the life of me, I do not see any association with large rallies in the Gold market and stock market declines. Go ahead. See for yourself.

Let's look past 1990 and see what happened in the crash of 2000. A crash heard around the world as economies went into a tailspin and unemployment approached 9% throughout Europe.

While stocks plummeted, Gold also declined and then had its best rally from about the start of 2002 to approximately mid-2002. At that same time stocks were rallying! When stocks bottomed in early 2003, guess what? Gold bottomed and rallied in harmony with the stock market rally.

Point Counter-Point: Gold does not rally when stocks or economies collapse

I can almost hear you now saying, "OK smart guy, when does Gold rally based on market forces you have not mentioned earlier"?

My best answer is that when inflation goes berserk, expect Gold to rally. The great Gold bull market of 1979-1980 took place when Jimmy Carter, perhaps the worst President since FDR, was in power. Inflation and interest rates soared. Gold rallies when there is money around, and it is afraid of losing purchasing power. In depressions and recessions there is no money around to buy much of anything, anyway.

Last edited by a moderator: