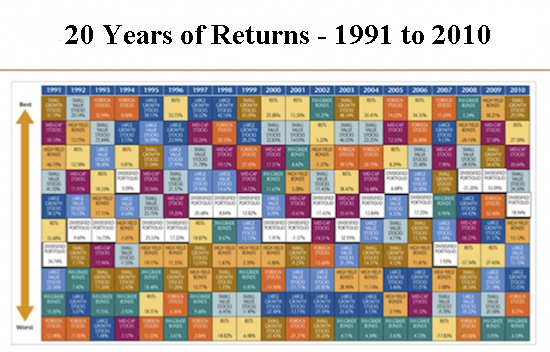

Short-Term Performance

We will start by looking at the diversification chart below, which shows how various asset classes have performed. (The S&P 500 is represented by the category large growth stocks). Notice that over the short-term, during 1995-1999, the large growth stocks category grew approximately 38%, 23%, 36%, 42% and 29% per year. Monetarily, if you had invested $100,000 in 1995, by the end of 1999 you would have had $407,078. Many individual investors reaped such rewards and in 1999 they focused on the previous one, three and five-year time periods, making their performance look stellar, which enhanced their investing conviction and increased their expectation of their future results.

However, the years ahead, 2000-2002, proved to be quite a different story. The $407,000 that was earned during the previous five years would lose $226,000 during the next three years to become just $181,000 by the end of 2002. While this is just one simple example, you can run such analysis over many three to five-year periods which will yield similar results. What this tells us is that paying too much attention to short-term performance can skew your long-term investment strategy, which can lead individual investors to overvalue “trendy” asset classes, therefore increasing their risk and reducing their return.

A Closer Look

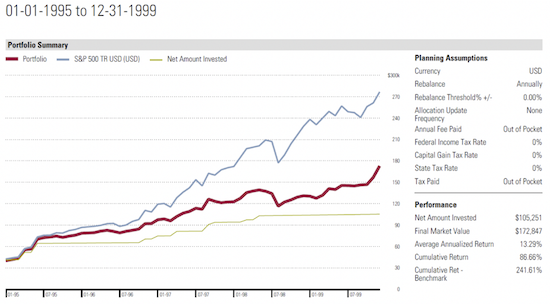

Let’s dig a big deeper into the 1995 to 2002 story to see how choosing a proper time period for performance evaluation can influence results.

Below is a chart of the tremendous short-term performance of the S&P 500 during 1995-1999. The blue is the S&P 500 and the red line is a multiple asset class portfolio consisting of U.S. and foreign equity, U.S. and foreign bonds, commodities, real estate, precious metals and natural resources. As you can see, the S&P outperforms the globally diversified portfolio 241.61% to 86.66%, leading many to claim in 1999 that diversification was no longer necessary. (This same claim is being made today, amidst similar short-term market conditions.)

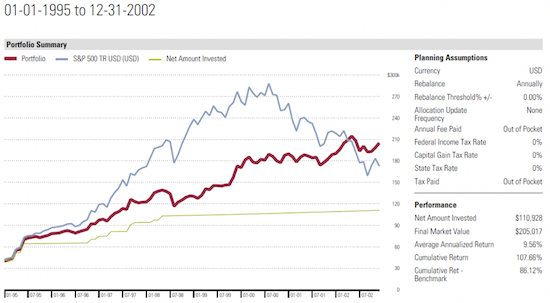

However, long-term investing is not a five-year story, so let’s look at how the two investing styles faired when we add a few more years of data. During 2000-2002, the S&P lost -37.16%, while the globally diversified multiple asset class portfolio actually grew 15.10%. Maybe asset class diversification isn’t dead after all.

Global Diversification

Let’s put all the data points together and see what we get. Over the entire time period, from 1995 to 2002, the globally diversified portfolio outperformed the S&P 500 107.66% to 86.12%. Further, the globally diversified portfolio accomplished this using much less risk and with much less volatility. As you can see, the performance of a portfolio can significantly change when viewed over the proper time period. When individual investors focus on one, three and five-year time periods, they are prone to basing decisions off of incomplete data.

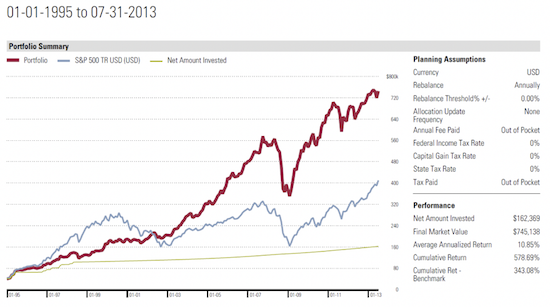

To further illustrate this point, let’s look at how the S&P 500 would have fared against a globally diversified multiple asset class portfolio from 1995 until 2013. The data below teaches us an important lesson. The diversified portfolio returned 578.69% (with much less risk and volatility) while the S&P 500 returned 343.08%. But like today, many investors during the bull markets of 1995-1999 lost their way and traded in a prudent long-term strategy for short-term mania. This caused many individual investors to take on excess risk while simultaneously suffering long-term under-performance.

What’s most fascinating is that you can repeat this study, using just about any set of 15-year data and the results will look very similar. This evidence showcases the wisdom of globally diversified investing and it’s what makes the mindset of the professional portfolio manager much different than that of the individual investor. It’s this mindset that ultimately leads to the success of the long-term approach, even in the face of short-term uncertainties. So the next time you are tempted to analyze your investment strategy using a one, three or five-year approach, be sure that you put those results in their proper context before making any long-term strategic decisions.

James D. Di Virgilio can be contacted at Chacon Diaz & Di Virgilio Wealth Management

Last edited by a moderator: