Volume is a measure of how much of a given financial asset has been traded in a given period of time. It is a very powerful tool but is often overlooked because it is such a simple indicator. Volume information can be found just about anywhere, but few traders or investors know how to use this information to increase their profits and minimize risk.

For every buyer, there needs to be someone who sold them the shares they bought, just as there must be a buyer in order for a seller to get rid of his or her shares. This battle between buyers and sellers for the best price in all different time frames creates movement while longer-term technical and fundamental factors play out. Using volume to analyze stocks (or any financial asset) can bolster profits and also reduce risk.

Basic Guidelines for Using Volume

When analyzing volume, there are guidelines we can use to determine the strength or weakness of a move. As traders, we are more inclined to join strong moves and take no part in moves that show weakness – or we may even watch for an entry in the opposite direction of a weak move. These guidelines do not hold true in all situations, but they are a good general aid in trading decisions.

Volume and Market Interest

A rising market should see rising volume. Buyers require increasing numbers and increasing enthusiasm in order to keep pushing prices higher. Increasing price and decreasing volume show lack of interest, and this is a warning of a potential reversal. This can be hard to wrap your mind around, but the simple fact is that a price drop (or rise) on little volume is not a strong signal. A price drop (or rise) on large volume is a stronger signal that something in the stock has fundamentally changed.

Fig 1 Source: www.freestockcharts.com

A GLD daily chart showing rising price and rising volume

Exhaustion Moves and Volume

In a rising or falling market, we can see exhaustion moves. These are generally sharp moves in price combined with a sharp increase in volume, which signal the potential end of a trend. Participants who waited and are afraid of missing more of the move pile in at market tops, exhausting the number of buyers. At a market bottom, falling prices eventually force out large numbers of traders, resulting in volatility and increased volume. We will see a decrease in volume after the spike in these situations, but how volume continues to play out over the next days, weeks and months can be analyzed using the other volume guidelines.

Fig 2 Source: www.freestockcharts.com

A GLD daily chart showing a volume spike indicating a change of direction.

Bullish Signs

Volume can be very useful in identifying bullish signs. For example, imagine volume increases on a price decline and then the price moves higher, followed by a move back lower. If the price on the move back lower stays higher than the previous low and volume is diminished on the second decline, then this is usually interpreted as a bullish sign.

Fig 3 Source: www.freestockcharts.com

A SPY daily chart showing a lack of selling interest on the second decline.

Volume and Price Reversals

After a long price move higher or lower, if the price begins to range with little price movement and heavy volume, this often indicates a reversal.

Volume and Breakouts vs. False Breakouts

On the initial breakout from a range or other chart pattern, a rise in volume indicates strength in the move. Little change in volume or declining volume on a breakout indicates lack of interest and a higher probability for a false breakout.

Fig 4 Source: www.freestockcharts.com

A QQQQ daily chart showing increasing volume on breakout.

Volume History

Volume should be looked at relative to recent history. Comparing volume today to volume 50 years ago provides irrelevant data. The more recent the data sets, the more relevant they are likely to be.

Volume Indicators

Volume indicators are mathematical formulas that are visually represented in most commonly used charting platforms. Each indicator uses a slightly different formula, and therefore, traders should find the indicator that works best for their particular market approach. Indicators are not required, but they can aid in the trading decision process. There are many volume indicators, and the following provides a sampling of how several of them can be used.

On-Balance Volume (OBV): OBV is a simple but effective indicator. Starting from an arbitrary number, volume is added when the market finishes higher, or volume is subtracted when the market finishes lower. This provides a running total and shows which stocks are being accumulated. It can also show divergences, such as when a price rises but volume is increasing at a slower rate or even beginning to fall. Figure 5 shows that OBV is increasing and confirming the price rise in Apple Inc's share price.

Fig 5 Source: www.freestockcharts.com

An APPL daily chart showing how OBV confirms the price move.

Chaikin Money Flow: Rising prices should be accompanied by rising volume, so this formula focuses on expanding volume when prices finish in the upper or lower portion of their daily range and then provides a value for the corresponding strength. When closes are in the upper portion of the range and volume is expanding, the values will be high; when closes are in the lower portion of the range, values will be negative.

Chaikin money flow can be used as a short-term indicator because it oscillates, but it is more commonly used for seeing divergence. Figure 6 shows how volume was not confirming the continual lower lows (price) in Apple stock. Chaikin money flow showed a divergence that resulted in a move back higher in the stock.

Fig 6 Source: www.freestockcharts.com

An AAPL 10-minute chart showing divergence that indicates a potential reversal.

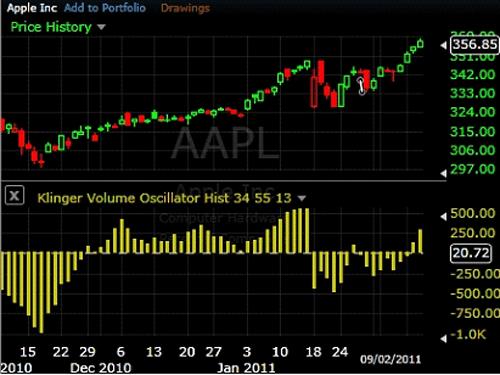

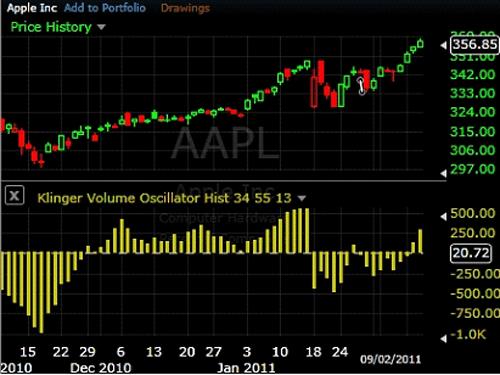

Klinger Volume Oscillator: Fluctuation above and below the zero line can be used to aid other trading signals. The Klinger volume oscillator sums the accumulation (buying) and distribution (selling) volumes for a given time period. In the following figure we see a quite negative number – this is in the midst of an overall uptrend – followed by a rise above the trigger or zero line. The volume indicator stayed positive throughout the price trend. A drop below the trigger level in January 2011 signalled the short-term reversal. The price stabilized, however, and that is why indicators should generally not be used in isolation. Most indicators give more accurate readings when they are used in association with other signals.

Fig 7 Source: www.freestockcharts.com

An APPL daily chart showing how Klinger confirms the uptrend.

In Summary

Volume is an extremely useful tool, and as you can see, there are many ways to use it. There are basic guidelines that can be used to assess market strength or weakness, as well as to check if volume is confirming a price move or signalling a reversal. Indicators can be used to help in the decision process. In short, volume is a not a precise entry and exit tool – however, with the help of indicators, entry and exit signals can be created by looking at price action, volume and a volume indicator.

Cory Mitchell can be contacted at Vantage Point Trading

For every buyer, there needs to be someone who sold them the shares they bought, just as there must be a buyer in order for a seller to get rid of his or her shares. This battle between buyers and sellers for the best price in all different time frames creates movement while longer-term technical and fundamental factors play out. Using volume to analyze stocks (or any financial asset) can bolster profits and also reduce risk.

Basic Guidelines for Using Volume

When analyzing volume, there are guidelines we can use to determine the strength or weakness of a move. As traders, we are more inclined to join strong moves and take no part in moves that show weakness – or we may even watch for an entry in the opposite direction of a weak move. These guidelines do not hold true in all situations, but they are a good general aid in trading decisions.

Volume and Market Interest

A rising market should see rising volume. Buyers require increasing numbers and increasing enthusiasm in order to keep pushing prices higher. Increasing price and decreasing volume show lack of interest, and this is a warning of a potential reversal. This can be hard to wrap your mind around, but the simple fact is that a price drop (or rise) on little volume is not a strong signal. A price drop (or rise) on large volume is a stronger signal that something in the stock has fundamentally changed.

Fig 1 Source: www.freestockcharts.com

A GLD daily chart showing rising price and rising volume

Exhaustion Moves and Volume

In a rising or falling market, we can see exhaustion moves. These are generally sharp moves in price combined with a sharp increase in volume, which signal the potential end of a trend. Participants who waited and are afraid of missing more of the move pile in at market tops, exhausting the number of buyers. At a market bottom, falling prices eventually force out large numbers of traders, resulting in volatility and increased volume. We will see a decrease in volume after the spike in these situations, but how volume continues to play out over the next days, weeks and months can be analyzed using the other volume guidelines.

Fig 2 Source: www.freestockcharts.com

A GLD daily chart showing a volume spike indicating a change of direction.

Bullish Signs

Volume can be very useful in identifying bullish signs. For example, imagine volume increases on a price decline and then the price moves higher, followed by a move back lower. If the price on the move back lower stays higher than the previous low and volume is diminished on the second decline, then this is usually interpreted as a bullish sign.

Fig 3 Source: www.freestockcharts.com

A SPY daily chart showing a lack of selling interest on the second decline.

Volume and Price Reversals

After a long price move higher or lower, if the price begins to range with little price movement and heavy volume, this often indicates a reversal.

Volume and Breakouts vs. False Breakouts

On the initial breakout from a range or other chart pattern, a rise in volume indicates strength in the move. Little change in volume or declining volume on a breakout indicates lack of interest and a higher probability for a false breakout.

Fig 4 Source: www.freestockcharts.com

A QQQQ daily chart showing increasing volume on breakout.

Volume History

Volume should be looked at relative to recent history. Comparing volume today to volume 50 years ago provides irrelevant data. The more recent the data sets, the more relevant they are likely to be.

Volume Indicators

Volume indicators are mathematical formulas that are visually represented in most commonly used charting platforms. Each indicator uses a slightly different formula, and therefore, traders should find the indicator that works best for their particular market approach. Indicators are not required, but they can aid in the trading decision process. There are many volume indicators, and the following provides a sampling of how several of them can be used.

On-Balance Volume (OBV): OBV is a simple but effective indicator. Starting from an arbitrary number, volume is added when the market finishes higher, or volume is subtracted when the market finishes lower. This provides a running total and shows which stocks are being accumulated. It can also show divergences, such as when a price rises but volume is increasing at a slower rate or even beginning to fall. Figure 5 shows that OBV is increasing and confirming the price rise in Apple Inc's share price.

Fig 5 Source: www.freestockcharts.com

An APPL daily chart showing how OBV confirms the price move.

Chaikin Money Flow: Rising prices should be accompanied by rising volume, so this formula focuses on expanding volume when prices finish in the upper or lower portion of their daily range and then provides a value for the corresponding strength. When closes are in the upper portion of the range and volume is expanding, the values will be high; when closes are in the lower portion of the range, values will be negative.

Chaikin money flow can be used as a short-term indicator because it oscillates, but it is more commonly used for seeing divergence. Figure 6 shows how volume was not confirming the continual lower lows (price) in Apple stock. Chaikin money flow showed a divergence that resulted in a move back higher in the stock.

Fig 6 Source: www.freestockcharts.com

An AAPL 10-minute chart showing divergence that indicates a potential reversal.

Klinger Volume Oscillator: Fluctuation above and below the zero line can be used to aid other trading signals. The Klinger volume oscillator sums the accumulation (buying) and distribution (selling) volumes for a given time period. In the following figure we see a quite negative number – this is in the midst of an overall uptrend – followed by a rise above the trigger or zero line. The volume indicator stayed positive throughout the price trend. A drop below the trigger level in January 2011 signalled the short-term reversal. The price stabilized, however, and that is why indicators should generally not be used in isolation. Most indicators give more accurate readings when they are used in association with other signals.

Fig 7 Source: www.freestockcharts.com

An APPL daily chart showing how Klinger confirms the uptrend.

In Summary

Volume is an extremely useful tool, and as you can see, there are many ways to use it. There are basic guidelines that can be used to assess market strength or weakness, as well as to check if volume is confirming a price move or signalling a reversal. Indicators can be used to help in the decision process. In short, volume is a not a precise entry and exit tool – however, with the help of indicators, entry and exit signals can be created by looking at price action, volume and a volume indicator.

Cory Mitchell can be contacted at Vantage Point Trading

Last edited by a moderator: