In previous articles I have discussed swing highs and swing lows and also touched upon a different type of analysis called Gann Theory. This is a popular style of analysis that looks at patterns and repeatable price action based on time. After receiving some emails on the subject, I decided it best to examine Gann Theory a bit further in my articles. I am not going to go into the history of Gann Theory or give a biography of W.D. Gann. Instead, I will discuss some practical applications of some of his theory.

There are three trends applicable to any time frame which you are analyzing: Minor, Intermediate and Major. That also means that there are three types of swing highs and lows that correspond with these trends. Let's examine the definitions of the swing bottoms (lows) and swing tops (highs).

There are three trends applicable to any time frame which you are analyzing: Minor, Intermediate and Major. That also means that there are three types of swing highs and lows that correspond with these trends. Let's examine the definitions of the swing bottoms (lows) and swing tops (highs).

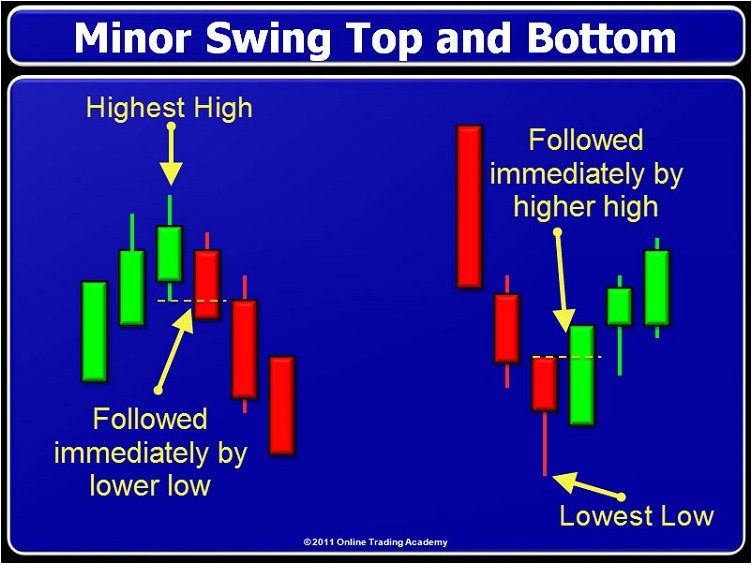

Gann Minor Swings:

A minor bottom is a low price compared to previous lows followed immediately on the next bar or candle by a higher low and a higher high. The minor top is a higher high compared to previous highs in price followed immediately by a lower high with a lower low.

Figure 1

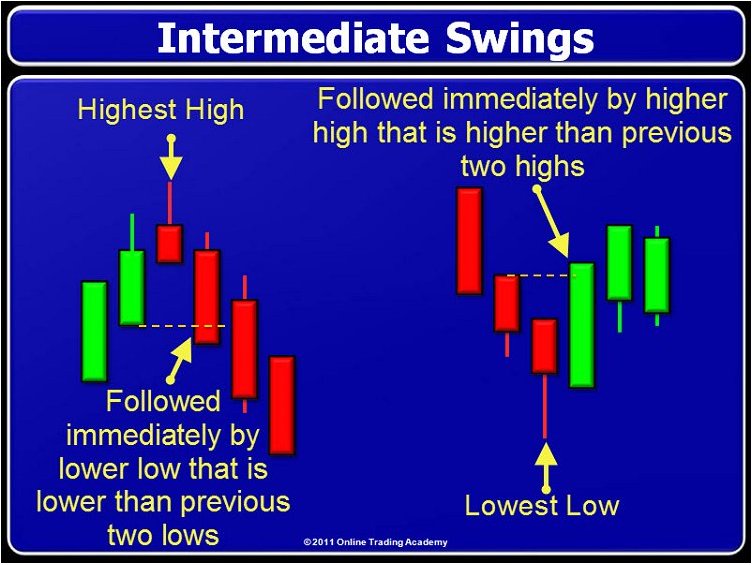

Gann Intermediate Swings:

The intermediate bottom is also a lower low compared to previous lows. However, it differs in that the immediate high that follows must be higher than the previous two bars or candles. The intermediate top is a higher high than previous highs that is immediately followed by a low that is lower than the previous two lows.

Figure 2

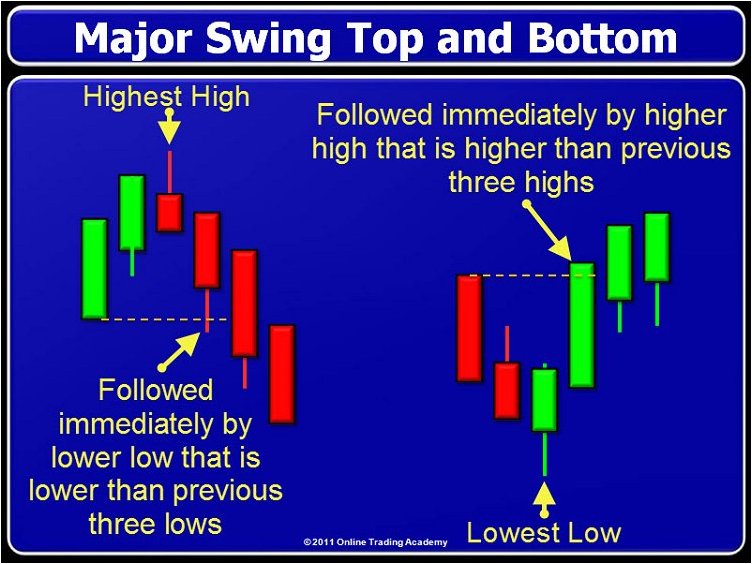

Gann Major Swings:

A major bottom will hold much significance to a trader using Gann Theory for their analysis. A major bottom would be a low price on a bar or candle that is lower than previous lows but is immediately followed by... you guessed it, a high that is higher than the previous three bars or candle highs. The major top is a high that is higher than previous price action followed immediately by a low that is lower than the previous three bars or candles.

Figure 3

Identifying Trend:

If you see price breaking a previous swing top, then you are in an uptrend in the time frame and level (minor, intermediate, or major) that you are trading in. You would continue to trade only in the long direction until you break a previous swing bottom of the same degree. For instance, the following chart of USO opens the day with a minor swing bottom. If we were already in an intermediate uptrend, a trader could use that as an opportunity to trade long intraday until a swing bottom is broken. In fact, they may want to enter or add to longs when a new swing bottom is formed. After the minor swing bottom is broken, a trader should wait for a new intermediate or major swing bottom to form before entering any more long positions.

Figure 4

In Gann trend analysis, a downtrend occurs when price breaks a swing bottom. If price moves downward in a defined uptrend but does not break a swing bottom, it is called a correction and the trader has no need to exit their long. A break of a swing bottom would constitute an exit signal.

The rules would be the same for a downtrend. Once a major downtrend has been established for the time frame you are trading in, you could look to short intermediate or minor swing tops until they are broken.

Now let’s explore trading opportunities using the major, intermediate and minor tops and bottoms. In Gann Theory, there are three trends all working on any time frame at all times. I see many traders inadvertently trading against the trend because they feel they can pick the absolute top or bottom of that trend. Using the three types of tops and bottoms can allow us to create a trading system that should keep us trading on the right side of the trends. This will increase our probability of making high quality, highly profitable trades and in part 2 we will discuss how to progress this further.

The rules would be the same for a downtrend. Once a major downtrend has been established for the time frame you are trading in, you could look to short intermediate or minor swing tops until they are broken.

Now let’s explore trading opportunities using the major, intermediate and minor tops and bottoms. In Gann Theory, there are three trends all working on any time frame at all times. I see many traders inadvertently trading against the trend because they feel they can pick the absolute top or bottom of that trend. Using the three types of tops and bottoms can allow us to create a trading system that should keep us trading on the right side of the trends. This will increase our probability of making high quality, highly profitable trades and in part 2 we will discuss how to progress this further.

Last edited by a moderator: