I have previously alluded to the importance of trading psychology by discussing two types of trading errors: Decision Making Error and Data Error. Some readers have indicated their desire to learn more about it. In this article, I will dive deeper into the topic of option trading and trading psychology.

Trading options and trading psychology are closely interrelated. The goal of this article is to show some of those close connections between the two. Let us start by describing what option trading really is. One of the easiest ways to describe option trading is by simply comparing it to equity trading. Most people are more familiar with equity trading so I will use that as a bench mark. Equity trading involves physically owning a position which represents the ownership of that publicly traded company. With the ownership of the stock certificate, the owner/trader is granted the rights to vote, receive dividends, and to be informed about future stock splits. An owner of an option contract has none of these described privileges. Another way of explaining options versus equities is by using the example from Mother Nature. If we look at any physical object during a sunny day, we would be able to observe a shadow which the observed object is casting on the ground. A stock would be a physical and tangible object where an option contract would be a shadow of the object. With time, the shadow disappears as the day turns into night or with the passage of time, the option arrives to its expiry.

Now, let us move to trading psychology which is important for all traders regardless of the instruments they trade: equities, commodity futures, foreign currency, or options. Many times in my classes I emphasize the fact that trading options involves 60% trading psychology, and only 40% actual option methodology based on the knowledge of various strategies. Many novice option traders do not grasp the importance of having both of these essential elements in place. They tend to give far more emphasis on learning all of the existing exotic advanced options while at the same time, they disregard the need for their own personal growth through Behavioral Finance. By the way, Behavioral Finance and Trading Psychology are virtually synonyms. It is the awareness of their own personal psychology, their own mindset that will help them to become successful traders. Trading is a journey of personal discovery. Option trading simply just accelerates that journey due to the leverage that it has.

A wise option trader learns from his or her losing trades, while the wiser one also learns from the losing trades of others. In the past I have utilized my real option trades in my articles to illustrate some of the option strategies, such as Condors, Spreads, etc. There is no doubt that a lot could be learned from winning trades, yet I must confess that I have learned so much more from my trades that have gone against me. Not only did I learn from those trades a valuable lesson about the stock market but I have also learned a lot about myself and my own psychology. It is so important to have both a sound trading psychology as well as a sound option trading methodology. Both are needed for successful trading, not just one.

In the past decade or so, a ton of trading books have been published and most of them have placed their focus on technical analysis and creation of a bulletproof trading system. Those books do sell well, yet any trader who has been trading for a while knows that trading psychology is just as important as trading methodology. For simplicity's sake, I have created a figure to utilize as my visual aid in this discussion of option trading and trading psychology.

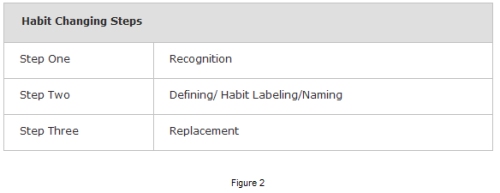

The basic idea conveyed in Figure 1 is that trading performance is composed of two main pillars: trading system and trading psychology. I encourage every reader of this article to investigate the impact of one's own trading performance by looking at both components. By doing such tedious work of first discovering the bad option trading habits, which are always the result of erroneous thinking, and after recognizing them consciously, one moves on to the second stage; the next level. At this level, not only is the trader aware of his or her bad option trading tendencies, but he or she is also able to eradicate them through time. Emphasis in this sentence is on the words "through time" because those bad option trading habits have taken some time to establish themselves. It will also take some time until they are uprooted. Yet, what is more important than mere removal of unwanted habits is its REPLACEMENT. The bad option trading habits have to be replaced with the good ones almost simultaneously because Nature abhors a vacuum. If the bad habit is supposedly eradicated but nothing is placed at its position, then the habit is not gone at all. It is just temporarily concealed under the surface and it is only a matter of time when the old habit will reappear. There are actually three steps that one would need to take in order to replace a habit.

Figure 2 visually presents those three steps. They are: recognize, label it, and then find an appropriate replacement for it. The crucial step is actual recognition, because the moment we recognize that we have a bad habit, we are no longer it. Up to the point of recognition, we were the one with the habit. For instance, an option trade might have a bad habit of Dollar Cost Averaging options that have gone against him or her. Dollar Cost Averaging is a bad habit to have no matter what instrument one is trading; to do it with option premium is even worse because of the leverage that option trading has. Yet, if the trader has done it once in the past when he or she was just learning how options function, and it turned out that it worked out in his or her favor, this single incident tends to carry on with the trader into the next trade and all other future ones. Certainly, an option trader does not intend to get into the mode of Dollar Cost Averaging from the get-go, but as the trade goes bad, the trader switches to that mode almost without being even aware of it. By doing this over and over again, not only is the option trader reinforcing a bad habit but he or she is also limiting the possibilities which exist within option trading, especially if Dollar Cost Averaging is done by using the front month options, for one could be profitable only if the market moves in that single direction. Directional option trading is as close as one could get to equity trading. I have discussed this in greater detail in my article Triple 3-Dimensional Options Are (Yoda's Speech Pattern, Star Wars).

Such a directional option trader might never be able to move on to the next level of option trading - directionless spread trading, for he or she is stuck with this bad habit without ever even being aware of it. It is difficult to get out of the bad habit, but as I mentioned earlier, an existing habit must be replaced by the new one simultaneously. It is possible to "convert" a directional trader into an option spread trader but he must be willing to go through these steps: recognize it, label it, and replace it.

Briefly, let me run through a perfect recovery system. An option trader places a directional trade; after a while it goes against him or her. The trader at this point is already consciously aware of the existing bad habit of Dollar Cost Averaging options, so he or she is already two steps deep into recovery. The trader has recognized it and labeled the "illness." The next step is to replace the urge to add more to the loser, so instead of it, he or she could turn the trade into a spread trade. In this example, spread trading is being used as a replacement strategy.

In conclusion, option trading and trading psychology go hand in hand. Again, I will leave you with the wisdom of the ancients, aphorisms written thousands of years ago, before option trading was event invented. Universal truths never die: "Know thyself." Socrates

Good Trading!

Trading options and trading psychology are closely interrelated. The goal of this article is to show some of those close connections between the two. Let us start by describing what option trading really is. One of the easiest ways to describe option trading is by simply comparing it to equity trading. Most people are more familiar with equity trading so I will use that as a bench mark. Equity trading involves physically owning a position which represents the ownership of that publicly traded company. With the ownership of the stock certificate, the owner/trader is granted the rights to vote, receive dividends, and to be informed about future stock splits. An owner of an option contract has none of these described privileges. Another way of explaining options versus equities is by using the example from Mother Nature. If we look at any physical object during a sunny day, we would be able to observe a shadow which the observed object is casting on the ground. A stock would be a physical and tangible object where an option contract would be a shadow of the object. With time, the shadow disappears as the day turns into night or with the passage of time, the option arrives to its expiry.

Now, let us move to trading psychology which is important for all traders regardless of the instruments they trade: equities, commodity futures, foreign currency, or options. Many times in my classes I emphasize the fact that trading options involves 60% trading psychology, and only 40% actual option methodology based on the knowledge of various strategies. Many novice option traders do not grasp the importance of having both of these essential elements in place. They tend to give far more emphasis on learning all of the existing exotic advanced options while at the same time, they disregard the need for their own personal growth through Behavioral Finance. By the way, Behavioral Finance and Trading Psychology are virtually synonyms. It is the awareness of their own personal psychology, their own mindset that will help them to become successful traders. Trading is a journey of personal discovery. Option trading simply just accelerates that journey due to the leverage that it has.

A wise option trader learns from his or her losing trades, while the wiser one also learns from the losing trades of others. In the past I have utilized my real option trades in my articles to illustrate some of the option strategies, such as Condors, Spreads, etc. There is no doubt that a lot could be learned from winning trades, yet I must confess that I have learned so much more from my trades that have gone against me. Not only did I learn from those trades a valuable lesson about the stock market but I have also learned a lot about myself and my own psychology. It is so important to have both a sound trading psychology as well as a sound option trading methodology. Both are needed for successful trading, not just one.

In the past decade or so, a ton of trading books have been published and most of them have placed their focus on technical analysis and creation of a bulletproof trading system. Those books do sell well, yet any trader who has been trading for a while knows that trading psychology is just as important as trading methodology. For simplicity's sake, I have created a figure to utilize as my visual aid in this discussion of option trading and trading psychology.

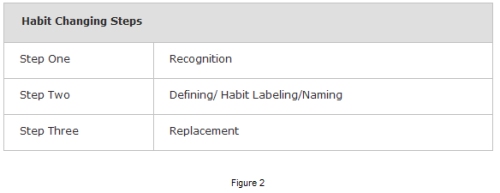

The basic idea conveyed in Figure 1 is that trading performance is composed of two main pillars: trading system and trading psychology. I encourage every reader of this article to investigate the impact of one's own trading performance by looking at both components. By doing such tedious work of first discovering the bad option trading habits, which are always the result of erroneous thinking, and after recognizing them consciously, one moves on to the second stage; the next level. At this level, not only is the trader aware of his or her bad option trading tendencies, but he or she is also able to eradicate them through time. Emphasis in this sentence is on the words "through time" because those bad option trading habits have taken some time to establish themselves. It will also take some time until they are uprooted. Yet, what is more important than mere removal of unwanted habits is its REPLACEMENT. The bad option trading habits have to be replaced with the good ones almost simultaneously because Nature abhors a vacuum. If the bad habit is supposedly eradicated but nothing is placed at its position, then the habit is not gone at all. It is just temporarily concealed under the surface and it is only a matter of time when the old habit will reappear. There are actually three steps that one would need to take in order to replace a habit.

Figure 2 visually presents those three steps. They are: recognize, label it, and then find an appropriate replacement for it. The crucial step is actual recognition, because the moment we recognize that we have a bad habit, we are no longer it. Up to the point of recognition, we were the one with the habit. For instance, an option trade might have a bad habit of Dollar Cost Averaging options that have gone against him or her. Dollar Cost Averaging is a bad habit to have no matter what instrument one is trading; to do it with option premium is even worse because of the leverage that option trading has. Yet, if the trader has done it once in the past when he or she was just learning how options function, and it turned out that it worked out in his or her favor, this single incident tends to carry on with the trader into the next trade and all other future ones. Certainly, an option trader does not intend to get into the mode of Dollar Cost Averaging from the get-go, but as the trade goes bad, the trader switches to that mode almost without being even aware of it. By doing this over and over again, not only is the option trader reinforcing a bad habit but he or she is also limiting the possibilities which exist within option trading, especially if Dollar Cost Averaging is done by using the front month options, for one could be profitable only if the market moves in that single direction. Directional option trading is as close as one could get to equity trading. I have discussed this in greater detail in my article Triple 3-Dimensional Options Are (Yoda's Speech Pattern, Star Wars).

Such a directional option trader might never be able to move on to the next level of option trading - directionless spread trading, for he or she is stuck with this bad habit without ever even being aware of it. It is difficult to get out of the bad habit, but as I mentioned earlier, an existing habit must be replaced by the new one simultaneously. It is possible to "convert" a directional trader into an option spread trader but he must be willing to go through these steps: recognize it, label it, and replace it.

Briefly, let me run through a perfect recovery system. An option trader places a directional trade; after a while it goes against him or her. The trader at this point is already consciously aware of the existing bad habit of Dollar Cost Averaging options, so he or she is already two steps deep into recovery. The trader has recognized it and labeled the "illness." The next step is to replace the urge to add more to the loser, so instead of it, he or she could turn the trade into a spread trade. In this example, spread trading is being used as a replacement strategy.

In conclusion, option trading and trading psychology go hand in hand. Again, I will leave you with the wisdom of the ancients, aphorisms written thousands of years ago, before option trading was event invented. Universal truths never die: "Know thyself." Socrates

Good Trading!

Last edited by a moderator: