This week I would like to discuss Spread Trading in Commodities. I will write future articles on this topic as it would be near impossible to cover all aspects of this method of trading in one article. This article will be an introductory lesson on Spread Trading in Commodities.

Welcome to Spread Trading

Spread - The purchase of one Futures contract against the sale of another Futures contract of the same or related Commodity.

Spread Trading has been referred to as "Hedge Trading". Remember that Hedging is the method Commercial traders use to help reduce price risk volatility. They may own the physical Commodity and short a Futures contract against it or they may need the Commodity at a later date and buy the Futures contract until time to purchase the Commodity in the cash market. In essence, Spread Trading involves being simultaneously long a position in a Futures contract and short a position in another similar or related Futures contract. To some degree the long position is "hedged" by the short position.

Traders use Spreads to take advantage of seasonal events that happen each year on a regular basis. For example, we can look at the Copper market. Each year around March the building industry starts gearing up for their busy season. They start buying Copper products (electrical wiring, plumbing, flashing for roofs, decorative roofing, etc), this creates excess demand in Copper for the nearby months. This in turn causes prices to rise faster in the front months because the Commodity is needed right now and not later in the year. You could consider buying a front month of Copper and Selling a back month of Copper. As the demand for Copper increases during this time of year, your Spread will widen giving you a profit for the position (as always, please consult your financial advisor before taking this trade). This is just one of the Seasonal events that occur every year. Some others are Heating Oil for winter, Gasoline for driving, meats for barbecue season, etc.

This type of trading is not concerned with absolute price levels of the Commodity you are trading. These traders are concerned with the relative pricing of contracts; speculating on price differentials between the two contracts. By establishing a Spread position instead of an outright Futures position, you are creating a trade that will usually have less risk involved - but not always.

As an example, the trader establishing this position - Long March Corn and Short December Corn - would not be worried about the absolute price levels of Corn, but certainly would be watching the relative difference of March Corn and December Corn. If March Corn gains in value relative to December Corn, then your position will be profitable. If, however, your March Corn decreases in value relative to December, you will have a loss in your position.

In the above example our trader stands to profit if any of the following five situations occur:

Keep in mind that there is some risk in Spread Trading, too. If anything happens to our position other than the five steps above, we stand to lose on the trade.

If we have a bias as to the direction of the market, we can still use spreads. By putting on a Bull spread you anticipate prices to rise faster in the front months than the back months. By putting on a Bear spread, you would be anticipating prices to fall faster in the back months than the front months.

The nice thing about a Bull spread is that most brokers/advisors put their clients in the most liquid (Front months) markets. This adds more buying pressure in the front month causing the spread to widen even more.

Different Types of Spreads

Most all Intra-market Spreads receive the exchange recognized reduced margin rates. Some but not all Inter-commodity Spreads receive this reduced margin. Check with your broker or exchange first before establishing this position to see if it qualifies for discount. The trade can still be done if not recognized but you will pay the full margin on both sides of the position.

Spread Margins

Being that Intra-market spreads are the least risky, they get the best reduced rate on margin reduction. Margin is based on risk/volatility and these spreads have much less margin than any other positions in the Futures industry.

The Inter-commodity Spread involving two different markets carries a higher margin rate due to the risk associated in using two different markets in your spread position. This type of Spread is the most volatile of the spreads. This Spread can actually be more volatile than the outright positions themselves.

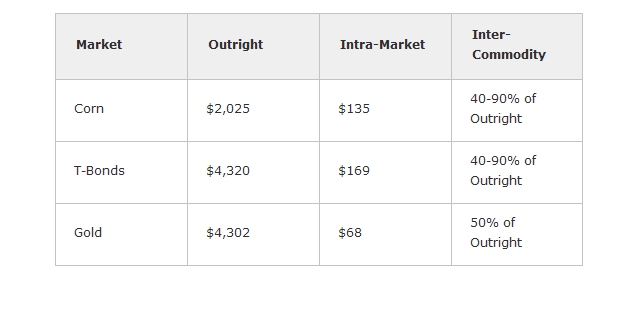

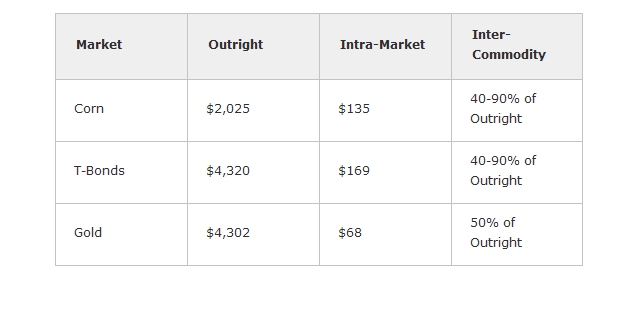

Here are some current examples of margins for Outright positions and Spreads.

As we discussed in previous articles about using margin and your Return on Investment, you can easily see how much less you have to pay out of pocket to get a good return percentage wise.

With Spread trading you give up some reward to gain insurance against an adverse move against you. Perhaps a news report or gap open against an outright Futures position could cost you dearly in slippage. With a Spread you would have a "hedge" to help protect from most of the adverse moves.

Charting Spreads

Spreads can be charted much like any other market. They respond well to Technical Analysis. Whatever your usual charting methods are, you can easily use them with Spreads.

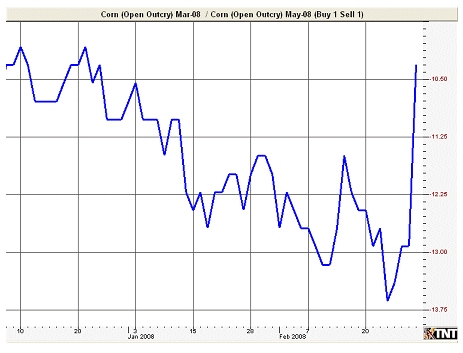

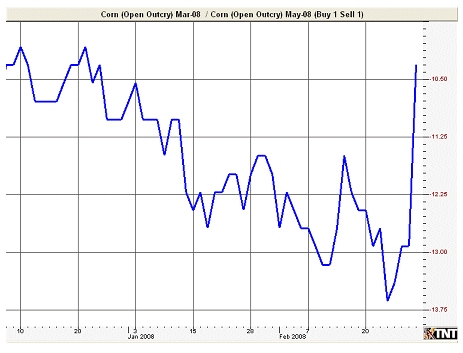

Most Spread charts are based on the close of the day. This creates a "Line" chart instead of your usual Candlestick or bar chart. Here is an example of one:

As you can see this chart has Support/Resistance levels, trend lines can be drawn, indicators can be added, time/price scales are the same as other charts.

Here are some reasons most professional traders use Spreads:

Just because of their hedged nature, spreads generally are less risky than outright futures positions. Since these prices are based on two different but related Commodities, they would have a tendency to move in the same direction together.

Since the margin levels are generally lower for Spreads, traders are able to trade a larger variety of positions increasing diversity. Also, due to the decrease in volatility, spreads allow traders to risk smaller percentages of their account capital.

With a decrease in volatility, traders are able to hold positions for longer-term price moves. With the hedge aspect, the trader is not shaken out by news events or adverse market moves as easily as an outright Futures position. Spreads are also based on Seasonal Factors (another article to follow on that topic). These events occur on a regular cyclical basis and add yet another stabilizing and more predictive market behavior to Spread trading.

These are just some of the highlights of Spread Trading. As I mentioned in the beginning of the article, we could not discuss all the features of this trading style in this issue.

I believe if you do more research on this trading vehicle of Spreading, you will find some very advantageous opportunities and reduced risk. Spread trading can help you sleep at night with open positions.

Welcome to Spread Trading

Spread - The purchase of one Futures contract against the sale of another Futures contract of the same or related Commodity.

Spread Trading has been referred to as "Hedge Trading". Remember that Hedging is the method Commercial traders use to help reduce price risk volatility. They may own the physical Commodity and short a Futures contract against it or they may need the Commodity at a later date and buy the Futures contract until time to purchase the Commodity in the cash market. In essence, Spread Trading involves being simultaneously long a position in a Futures contract and short a position in another similar or related Futures contract. To some degree the long position is "hedged" by the short position.

Traders use Spreads to take advantage of seasonal events that happen each year on a regular basis. For example, we can look at the Copper market. Each year around March the building industry starts gearing up for their busy season. They start buying Copper products (electrical wiring, plumbing, flashing for roofs, decorative roofing, etc), this creates excess demand in Copper for the nearby months. This in turn causes prices to rise faster in the front months because the Commodity is needed right now and not later in the year. You could consider buying a front month of Copper and Selling a back month of Copper. As the demand for Copper increases during this time of year, your Spread will widen giving you a profit for the position (as always, please consult your financial advisor before taking this trade). This is just one of the Seasonal events that occur every year. Some others are Heating Oil for winter, Gasoline for driving, meats for barbecue season, etc.

This type of trading is not concerned with absolute price levels of the Commodity you are trading. These traders are concerned with the relative pricing of contracts; speculating on price differentials between the two contracts. By establishing a Spread position instead of an outright Futures position, you are creating a trade that will usually have less risk involved - but not always.

As an example, the trader establishing this position - Long March Corn and Short December Corn - would not be worried about the absolute price levels of Corn, but certainly would be watching the relative difference of March Corn and December Corn. If March Corn gains in value relative to December Corn, then your position will be profitable. If, however, your March Corn decreases in value relative to December, you will have a loss in your position.

In the above example our trader stands to profit if any of the following five situations occur:

- The long contract rises in price, while the short contract decreases

- The long contract rises in price, more than the short contract

- The long contract rises in price, and the short contract stays at the same price

- The long contract stays the same price, while the short contract's price declines

- The long contract declines in price, less than the short contract

Keep in mind that there is some risk in Spread Trading, too. If anything happens to our position other than the five steps above, we stand to lose on the trade.

If we have a bias as to the direction of the market, we can still use spreads. By putting on a Bull spread you anticipate prices to rise faster in the front months than the back months. By putting on a Bear spread, you would be anticipating prices to fall faster in the back months than the front months.

The nice thing about a Bull spread is that most brokers/advisors put their clients in the most liquid (Front months) markets. This adds more buying pressure in the front month causing the spread to widen even more.

Different Types of Spreads

- Intra-market Spreads - Simultaneous purchase of one delivery month and the sale of another delivery month of the same commodity on the same exchange. Also known as Calendar Spreads.

Example: Buying March Treasury Bonds and Selling June Treasury Bonds traded at the CBOT

- Inter-commodity Spread - Simultaneous purchase of one commodity and delivery month and the sale of another different but related commodity with the same delivery month.

Example: Buying December Silver and Selling December Gold

Most all Intra-market Spreads receive the exchange recognized reduced margin rates. Some but not all Inter-commodity Spreads receive this reduced margin. Check with your broker or exchange first before establishing this position to see if it qualifies for discount. The trade can still be done if not recognized but you will pay the full margin on both sides of the position.

Spread Margins

Being that Intra-market spreads are the least risky, they get the best reduced rate on margin reduction. Margin is based on risk/volatility and these spreads have much less margin than any other positions in the Futures industry.

The Inter-commodity Spread involving two different markets carries a higher margin rate due to the risk associated in using two different markets in your spread position. This type of Spread is the most volatile of the spreads. This Spread can actually be more volatile than the outright positions themselves.

Here are some current examples of margins for Outright positions and Spreads.

As we discussed in previous articles about using margin and your Return on Investment, you can easily see how much less you have to pay out of pocket to get a good return percentage wise.

With Spread trading you give up some reward to gain insurance against an adverse move against you. Perhaps a news report or gap open against an outright Futures position could cost you dearly in slippage. With a Spread you would have a "hedge" to help protect from most of the adverse moves.

Charting Spreads

Spreads can be charted much like any other market. They respond well to Technical Analysis. Whatever your usual charting methods are, you can easily use them with Spreads.

Most Spread charts are based on the close of the day. This creates a "Line" chart instead of your usual Candlestick or bar chart. Here is an example of one:

As you can see this chart has Support/Resistance levels, trend lines can be drawn, indicators can be added, time/price scales are the same as other charts.

Here are some reasons most professional traders use Spreads:

- Lower Risk

- Attractive margin rates

- Increased predictability

Just because of their hedged nature, spreads generally are less risky than outright futures positions. Since these prices are based on two different but related Commodities, they would have a tendency to move in the same direction together.

Since the margin levels are generally lower for Spreads, traders are able to trade a larger variety of positions increasing diversity. Also, due to the decrease in volatility, spreads allow traders to risk smaller percentages of their account capital.

With a decrease in volatility, traders are able to hold positions for longer-term price moves. With the hedge aspect, the trader is not shaken out by news events or adverse market moves as easily as an outright Futures position. Spreads are also based on Seasonal Factors (another article to follow on that topic). These events occur on a regular cyclical basis and add yet another stabilizing and more predictive market behavior to Spread trading.

These are just some of the highlights of Spread Trading. As I mentioned in the beginning of the article, we could not discuss all the features of this trading style in this issue.

I believe if you do more research on this trading vehicle of Spreading, you will find some very advantageous opportunities and reduced risk. Spread trading can help you sleep at night with open positions.

"I have no idea what the market will do, but that is ok and I will play whatever comes my way."

Last edited by a moderator: