Poshtrader

Junior member

- Messages

- 11

- Likes

- 1

“I make plenty of mistakes and I’ll make plenty more mistakes, too. That’s part of the game. You’ve just got to make sure that the right things overcome the wrong ones.” – Warren Buffett

The idea that we learn from our mistakes is an almost absolute truth, especially if we are constantly observant and analytical along with being intuitive. That is why they say that once we have learned a lesson from a mistake, we must avoid making it again. With trading, you have the option to learn from the mistakes of others. Here are the common mistakes every new trader does. And you don’t have to do it. Because you learn it here.

Mistake #1 — Riding without proper training

Learning to ride a bicycle with training wheels or without? The answer is with training wheels.

In this parallel, the training wheels are the demo account, and without is the live account.

Trading in a demo account can sound silly for you, some even argue that trading in a demo account doesn’t bring emotions into the game and so a trader will not be prepared for the difficulties out in the real world. But, here’s the thing: The demo account doesn’t follow the experiences of a real account. Rather, it gives a touch of the things out there in the real world. It makes you understand the correlation between currency pairs or any other trading instruments, the best time to trade and provides you a panel to test your novice strategy. If the strategy gives you a worthy reward, it stacks up to your confidence. When you’re a rookie trader and you see prices swing from your entry, confidence matters most. You need to know when to hold back and when to let go. And trading demo account can aptly do so for you.

Remember, they are training wheels and they make you learn basic riding though it might not prepare you for the rides without them. As a wannabe rider (trader), you got to take it.

Mistake #2 — Over-leveraging

Over-leveraging is a two-edged sword. In a winning-streak, it could be your best friend, but when the trend changes, it becomes the largest foe. Over-leveraging is a terrible way to think you can make more money faster. A lot of traders are misled into this way of thinking and end up losing all their capital in a short time. Some brokers are offering mad amounts of leverage (like 1:1000) that can lead to nothing more than losing your capital to zero. Therefore, one needs to be extremely careful when picking those levels and the brokers that represent them. That’s why diversification among various brokers is probably the best strategy.

Mistake #3— Overtrading profitable trades

When one trade is good, why not make two or even three out of it, it seems logical?

Definitely Not! Trading doesn’t work that way. The market doesn’t give profitable trade setups at your command. Before you realize this mistake, your trading capital would be split. What you lose in a matter of moments, take months or even years to build. Pick the trades wisely and ride the trends.

The key reason traders overtrade is that they either don’t have the patience or don’t understand its importance. The patience is not limited to the development of the trade setup alone.

A master trader has patience in all aspects of trading — the development of trade setups, the patience to take profits, waiting years to develop their trade account. You can’t master patience over-night just for trading.

It demands a shift in your personality. Hunting and fishing are like trade setups, preys are a hard catch. You have to wait for hours to catch it. And these kinds of activities slowly change you as an individual. It instills patience in your character and makes you a better trader.

Mistake #4 — Revenge the losing trades

It is the one mistake that every trader knows that they shouldn’t do, yet no one can help it but do.

The market can be brutal at times. A profitable position can turn into a loss or you can have a series of losses for reasons you can’t understand. It creates a vile chain of emotions you can’t control and you feel the urge to get back what you lost immediately. But the more you try, the more lose. It is because the trades are not supported by logic or strategy rather emotion and desperation. And when you realize the mistake, it may be too late.

The solution is a break from trading, it helps you in many ways. It gives a clear perspective of what went wrong. Never wait to take a break. After all, it’s the only thing that you can control in the market.

Mistake #5 — Ignoring the trend

“The trend is my friend“– another cliche sentence, which will help you to stay on the right side of the market. If you think about trading the way I do, it could be a boring business, but at least one that makes money. I am not interested in fast returns. I am not interested in the most attractive trades that everyone is talking about. I choose to do my analysis. The more boring trade views, the better for me the trade is. Always examine the trend before opening the trade!

Mistake #6 — Trading without stop loss (SL)

This concept is quite popular among some professional traders and they might even recommend it. But it is not going to work for you. Because the resources available at their (professional traders) disposal and your end are quite different.

They tend to have a team of fundamental specialists and a hefty load of money. And so they trade without a stop loss but with solid fundamental backing. Besides, they use various hedging strategies to cover the short-term loss.

As a retail trader, it is better to keep things simple. When a technical setup breaks, it is best to exit positions. It minimizes your loss on the day and lets you trade the next day.

Too tight Stop Loss

Stop-loss (SL) is not the value that you assume you can bear. It is the value the technical structure demands.

Traders frequently make this mistake to manage losses. Except it only rises the amount of losing trades and in turn lowers your accuracy level and confidence in trades.

If you sense, you can’t bear a wide stop, then decrease your trading volume.

Determine the margin value you could manage and then calculate the trade size respectively.

Mistake #7— Trading News

No person can resist the appeal of making easy money. And the news trading presents it. As a rookie trader, you should resist it as it is not the news that matters most. It is the aftermath response of the traders and the sentiment of the community that takes the spotlight.

As an example, suppose the FOMC made a rate cut of 20% which by protocol and understanding should have made the XAUUSD prices to fly. Many retail traders had a serious amount of long orders placed during that day. But the market took them as casualty eventually. Opposite to common understanding, it fell 300 pips and shocked everyone.

Well, the trading community usually has its comments like, “It wasn’t level or higher to the expectations.” The reasons don’t matter because you would get a margin call from your broker before you can say the word ‘why’.

Trading news is more of gambling than trading. Because you can’t read what others have planned for any event featured in the economic calendar.

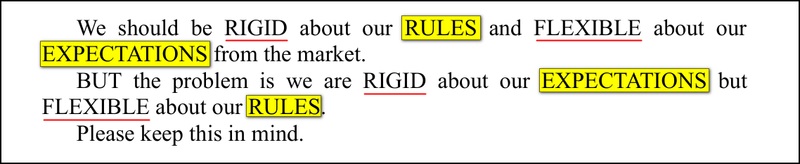

Mistake #8— Trading without a trading plan

When you don’t have a trading plan, you tend to surrender to the moments. And trading gives you those moments often.

It’s all about the system, the trading plan that’s going to bring success and profitability to you.

Pick a strategy or choose an indicator to help you.

Mistake #9— Thinking that price cannot go higher/lower

Even when the price has been in an extended rally for several months, you will always discover traders who week after week tell you that the change is near and they are looking for short entries. Traders would do well to focus on what is obvious and join the trend as long as it is possible.

Crude Oil Futures, April 2020

Mistake #10— Advice from random people

Never make trades based on opinions, tweets, or promises made by other people. “Give a man a fish, and you feed him for a day; show him how to catch fish, and you feed him for a lifetime.”

The Bottom Line

If you have the money to invest and can avoid these rookie mistakes, you could make your investments pay off; and getting a good return on your investments (ROI) could take you closer to your financial goals.

As an individual investor, the best thing you can do to expand your securities for the long term is to realize a reasonable trading strategy that you are comfortable with and willing to stick to.

If you are looking to make a big win by betting your money on your gut feelings, try gambling. Take pride in your trading decisions, and in the long run, your securities will grow and reflect your actions.

The idea that we learn from our mistakes is an almost absolute truth, especially if we are constantly observant and analytical along with being intuitive. That is why they say that once we have learned a lesson from a mistake, we must avoid making it again. With trading, you have the option to learn from the mistakes of others. Here are the common mistakes every new trader does. And you don’t have to do it. Because you learn it here.

Mistake #1 — Riding without proper training

Learning to ride a bicycle with training wheels or without? The answer is with training wheels.

In this parallel, the training wheels are the demo account, and without is the live account.

Trading in a demo account can sound silly for you, some even argue that trading in a demo account doesn’t bring emotions into the game and so a trader will not be prepared for the difficulties out in the real world. But, here’s the thing: The demo account doesn’t follow the experiences of a real account. Rather, it gives a touch of the things out there in the real world. It makes you understand the correlation between currency pairs or any other trading instruments, the best time to trade and provides you a panel to test your novice strategy. If the strategy gives you a worthy reward, it stacks up to your confidence. When you’re a rookie trader and you see prices swing from your entry, confidence matters most. You need to know when to hold back and when to let go. And trading demo account can aptly do so for you.

Remember, they are training wheels and they make you learn basic riding though it might not prepare you for the rides without them. As a wannabe rider (trader), you got to take it.

Mistake #2 — Over-leveraging

Over-leveraging is a two-edged sword. In a winning-streak, it could be your best friend, but when the trend changes, it becomes the largest foe. Over-leveraging is a terrible way to think you can make more money faster. A lot of traders are misled into this way of thinking and end up losing all their capital in a short time. Some brokers are offering mad amounts of leverage (like 1:1000) that can lead to nothing more than losing your capital to zero. Therefore, one needs to be extremely careful when picking those levels and the brokers that represent them. That’s why diversification among various brokers is probably the best strategy.

Mistake #3— Overtrading profitable trades

When one trade is good, why not make two or even three out of it, it seems logical?

Definitely Not! Trading doesn’t work that way. The market doesn’t give profitable trade setups at your command. Before you realize this mistake, your trading capital would be split. What you lose in a matter of moments, take months or even years to build. Pick the trades wisely and ride the trends.

The key reason traders overtrade is that they either don’t have the patience or don’t understand its importance. The patience is not limited to the development of the trade setup alone.

A master trader has patience in all aspects of trading — the development of trade setups, the patience to take profits, waiting years to develop their trade account. You can’t master patience over-night just for trading.

It demands a shift in your personality. Hunting and fishing are like trade setups, preys are a hard catch. You have to wait for hours to catch it. And these kinds of activities slowly change you as an individual. It instills patience in your character and makes you a better trader.

Mistake #4 — Revenge the losing trades

It is the one mistake that every trader knows that they shouldn’t do, yet no one can help it but do.

The market can be brutal at times. A profitable position can turn into a loss or you can have a series of losses for reasons you can’t understand. It creates a vile chain of emotions you can’t control and you feel the urge to get back what you lost immediately. But the more you try, the more lose. It is because the trades are not supported by logic or strategy rather emotion and desperation. And when you realize the mistake, it may be too late.

The solution is a break from trading, it helps you in many ways. It gives a clear perspective of what went wrong. Never wait to take a break. After all, it’s the only thing that you can control in the market.

Mistake #5 — Ignoring the trend

“The trend is my friend“– another cliche sentence, which will help you to stay on the right side of the market. If you think about trading the way I do, it could be a boring business, but at least one that makes money. I am not interested in fast returns. I am not interested in the most attractive trades that everyone is talking about. I choose to do my analysis. The more boring trade views, the better for me the trade is. Always examine the trend before opening the trade!

Mistake #6 — Trading without stop loss (SL)

This concept is quite popular among some professional traders and they might even recommend it. But it is not going to work for you. Because the resources available at their (professional traders) disposal and your end are quite different.

They tend to have a team of fundamental specialists and a hefty load of money. And so they trade without a stop loss but with solid fundamental backing. Besides, they use various hedging strategies to cover the short-term loss.

As a retail trader, it is better to keep things simple. When a technical setup breaks, it is best to exit positions. It minimizes your loss on the day and lets you trade the next day.

Too tight Stop Loss

Stop-loss (SL) is not the value that you assume you can bear. It is the value the technical structure demands.

Traders frequently make this mistake to manage losses. Except it only rises the amount of losing trades and in turn lowers your accuracy level and confidence in trades.

If you sense, you can’t bear a wide stop, then decrease your trading volume.

Determine the margin value you could manage and then calculate the trade size respectively.

Mistake #7— Trading News

No person can resist the appeal of making easy money. And the news trading presents it. As a rookie trader, you should resist it as it is not the news that matters most. It is the aftermath response of the traders and the sentiment of the community that takes the spotlight.

As an example, suppose the FOMC made a rate cut of 20% which by protocol and understanding should have made the XAUUSD prices to fly. Many retail traders had a serious amount of long orders placed during that day. But the market took them as casualty eventually. Opposite to common understanding, it fell 300 pips and shocked everyone.

Well, the trading community usually has its comments like, “It wasn’t level or higher to the expectations.” The reasons don’t matter because you would get a margin call from your broker before you can say the word ‘why’.

Trading news is more of gambling than trading. Because you can’t read what others have planned for any event featured in the economic calendar.

Mistake #8— Trading without a trading plan

When you don’t have a trading plan, you tend to surrender to the moments. And trading gives you those moments often.

It’s all about the system, the trading plan that’s going to bring success and profitability to you.

Pick a strategy or choose an indicator to help you.

Mistake #9— Thinking that price cannot go higher/lower

Even when the price has been in an extended rally for several months, you will always discover traders who week after week tell you that the change is near and they are looking for short entries. Traders would do well to focus on what is obvious and join the trend as long as it is possible.

Crude Oil Futures, April 2020

Mistake #10— Advice from random people

Never make trades based on opinions, tweets, or promises made by other people. “Give a man a fish, and you feed him for a day; show him how to catch fish, and you feed him for a lifetime.”

The Bottom Line

If you have the money to invest and can avoid these rookie mistakes, you could make your investments pay off; and getting a good return on your investments (ROI) could take you closer to your financial goals.

As an individual investor, the best thing you can do to expand your securities for the long term is to realize a reasonable trading strategy that you are comfortable with and willing to stick to.

If you are looking to make a big win by betting your money on your gut feelings, try gambling. Take pride in your trading decisions, and in the long run, your securities will grow and reflect your actions.