The5ersTF

Active member

- Messages

- 229

- Likes

- 5

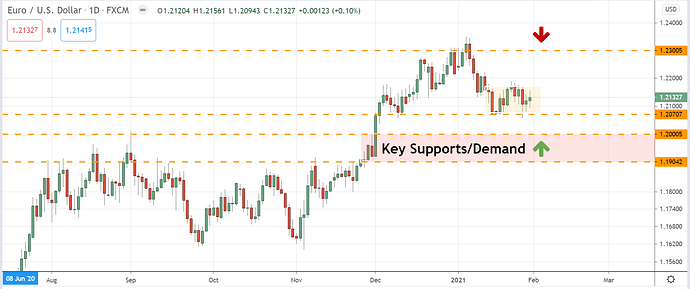

The price has performed a double bottom pattern on the D1 chart,

Also, while the price created the double bottom the MACD created a higher low, which's called MACD divergence.

The combination of double bottom and MACD divergence creates a great setup for buy position.

If the price will break the resistance above I'll look for a buy signal,

If the price will move down toward the demand below I'll buy at the demand,

For both options, the target will be the resistance at the top